S&P 500 falls for 6th day in a row amid weakness in mega-cap tech

-

US stocks were mostly lower on Friday, with the S&P 500 declining for the 6th day in a row.

-

The decline was led by mega-cap tech stocks, with Nvidia plunging as much as 10%.

-

A sharp 23% crash in Super Micro Computer accelerated the decline in tech stocks.

US stocks were mostly lower on Friday, with the S&P 500 falling for the sixth day in a row and experiencing its worst week of performance so far in 2024.

Stocks wavered early Friday as investors assessed Israel’s missile strike against Iran, which was largely seen as symbolic and a potential off-ramp from further conflict.

But the losses in the stock market accelerated after Super Micro Computer announced earnings without preannouncing results, as some on Wall Street seemed to have expected.

Shares of Super Micro Computer crashed 23%, and dragged down AI darling Nvidia by as much as 10%. The Nvidia decline wiped out $183 billion in market valuation. Nvidia supplies its AI chips to Super Micro Computer and counts it as one of its larger customers.

Other tech stocks moving lower Meta Platforms, Amazon, and Netflix, which fell 9% in Friday trades. The company smashed earnings expectations but announced that beginning in 2025 it would stop reporting net subscriber growth.

So far, of the 13% of S&P 500 companies that have reported earnings results, 77% of them have beat profit estimates by a median of 7%, while 55% beat revenue estimates by a median of 3%, according to data from Fundstrat.

Here’s where US indexes stood at the 4:00 p.m. closing bell on Friday:

Here’s what else is going on today:

In commodities, bonds, and crypto:

-

West Texas Intermediate crude oil edged higher by 0.09% to $82.17 a barrel. Brent crude, the international benchmark, rose by 0.16% to $87.25 a barrel.

-

Gold climbed by 0.21% to $2,403.00 per ounce.

-

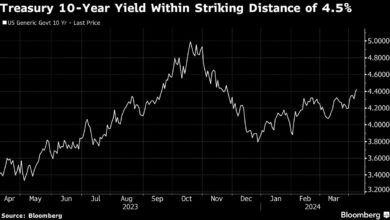

The 10-year Treasury yield was unchanged at 4.62%.

-

Bitcoin edged higher by 1.21% to $64,280.

Read the original article on Business Insider

Source link