Pound to New Zealand Dollar Week Ahead Forecast: Still Holding the Line

Image © Adobe Stock

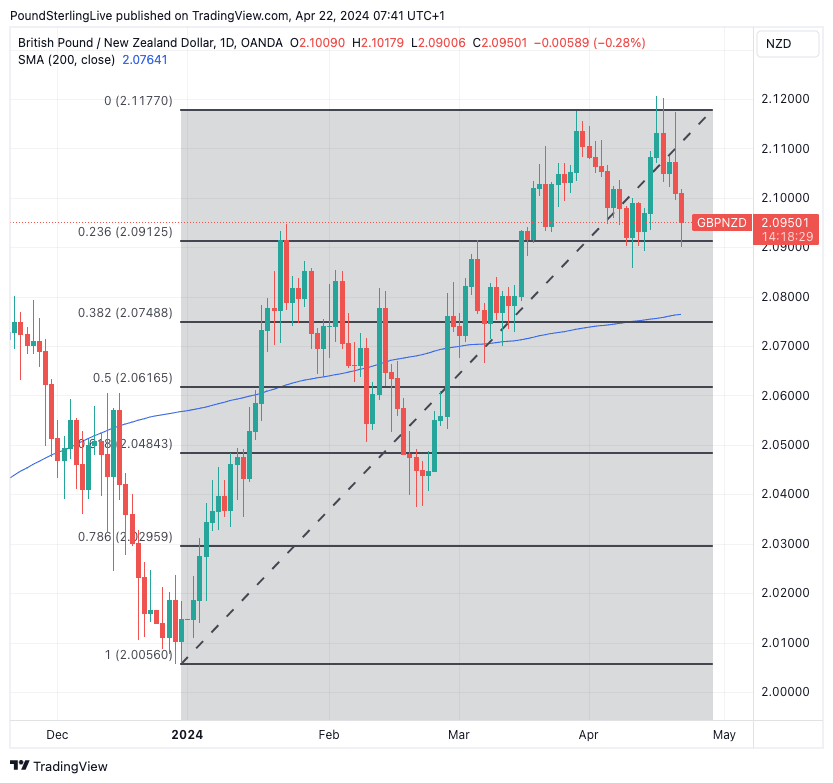

The Pound is near its April lows against the New Zealand Dollar following Friday’s selloff, but we look for support to kick in again.

The general trend in the Pound to New Zealand Dollar exchange rate (GBP/NZD) remains positive on account of the pair remaining above the 200-day moving average, currently located at 2.0764.

We have turned bearish on a number of other GBP exchange rate pairs on account of recent breaches below the 200 DMA, but for GBP/NZD we note this flip from upside to downside is still some 200 pips away.

The pair meanwhile found support early on Monday when it rebounded off the 23.6% Fibonacci retracement of 2024’s rally:

Above: GBP/NZD at daily intervals with the 200 DMA and Fibonacci retracement levels indicated.

This level – at 2.0912 – forms the focus of our near-term technical deliberations regarding this exchange rate: should it hold, a return to the 2024 high at 2.12 is likely. However, a break below here in the coming days will invite a test of the 38.2% retracement level, located near the 200 DMA at 2.0750.

Given the confluence of these levels, we would imagine they will offer significant support against further GBP/NZD weakness.

Sterling is under pressure across the board courtesy of a jump in expectations for a mid-year interest rate cut at the Bank of England following Friday’s speech from Bank of England MPC member Dave Ramsden.

In a speech delivered in Washington, Ramsden expressed confidence inflation in the UK is falling to where it needs to be and that risks to the inflation forecast are now tilted to the downside. It appears Ramsden is now part of a rump of MPC members who are ready to cut UK interest rates.

If last week’s repricing of UK rate expectations extends over the coming days, look for GBP/NZD to trade with a heavy tone.

The Pound could prove volatile on Tuesday as the PMI survey for April is released. This is the most timely of the major UK economic data releases and will give a steer as to how strong the first quarter’s economic recovery was.

The number to watch belongs to the services PMI, where consensus looks for a reading of 53. Anything below this could extend the recent sombre tone in Pound Sterling.

“The flash services PMI likely eased to 52.5 in April,” cautions an economic preview note from UniCredit. “The pick-up in 1Q24, which was presumably related to the improvement in real incomes, is likely to prove short-lived as the labour market is now clearly weakening.”

External forces will be important for the New Zealand dollar. Keep an eye on Australia’s inflation numbers, due for release Tuesday; any undershoot here could spill over into NZD trade, as markets would increase the likelihood that future New Zealand inflation prints could also undershoot.

The global picture will also likely weigh on NZD in the coming days. “Fed repricing and tolerance towards a weaker yuan are two headwinds,” says Kenneth Broux, a strategist at Société Générale.

We saw last week the Australian and New Zealand Dollars came under pressure after Chinese authorities let the Renminbi unexpectedly weaken, confirming downside risks associated with any further weakness in the Chinese currency.

“The bias for CNY depreciation is now much stronger,” says Mitul Kotecha, a strategist at Barclays.

“We consider the PBoC’s fixing of the yuan reference point above the 7.10 psychological barrier on the day of its 1Q GDP data release to be a clear signal that it is ready to ease the grip on the currency and prepared to allow further weakness in the yuan,” says Broux.

Also weighing on the pro-cyclical NZ Dollar is the rise in global interest rates associated with rising U.S. bond yields. This has come about as markets slash expectations for interest rate cuts at the U.S. Federal Reserve in 2024 on account of strong U.S. growth and inflation.

We would, however, judge that the recent repricing has run its course, and with a quieter U.S. economic calendar on hand this week, the prospect for global markets and the Kiwi Dollar to recover has increased.

For now, though, we will consider rebounds to be short-lived. Markets will only become more confident that the Fed will cut rates in 2024 if upcoming inflation prints start to surprise the downside.

This means we must wait for next month’s U.S. data docket to land.

Source link