Here’s why everyone’s betting on the US dollar

Investors entered the year predicting that the US dollar would fall. Instead, it’s gained more than 4% against all major developed and emerging-market counterparts, according to a Bloomberg currency index. And that strength is mainly down to three things.

First, the US economy has been surprisingly resilient. It grew by a respectable 2.5% in 2023, despite expectations for a downturn, and the International Monetary Fund forecasts that it’ll grow by 2.7% this year – more than double the rate of any other G7 country. That “US exceptionalism” is boosting demand for the country’s financial assets and, in turn, the dollar.

Second, America’s inflation problem is proving to be quite stubborn, coming in hotter than expected in the past few months. That’s pushing traders to scale back their bets for interest rate cuts by the Federal Reserve, boosting the dollar. After all, higher-for-longer interest rates only increase the greenback’s appeal among international savers and investors.

Third, geopolitical tensions – especially in the Middle East and Ukraine – have been rising, and that’s pushing investors to safe-haven assets like gold and (you guessed it) the dollar.

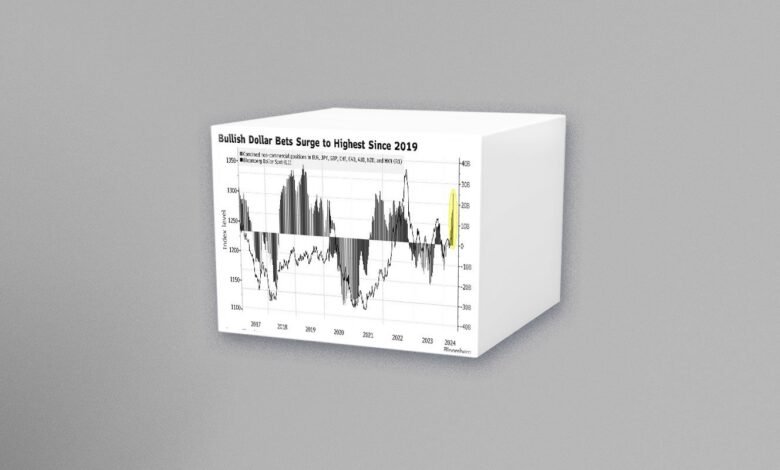

Traders seem to think the greenback has further room to appreciate: they’re amassing huge dollar-bullish positions in the futures market, staking bearish claims against other major currencies. Their combined net positions are currently the highest since 2019 – a stark contrast to the start of the year when they were betting that the dollar would fall. Time will tell if that change of heart ends up being correct.

Traders’ combined net positions on the dollar against eight other major currencies in the futures market are at their highest since 2019. Source: Bloomberg.

Source link