Digital Realty, CloudHQ and Scaleaway Announced Investments in the French Data Center Industry in 2023

French Data Center Market

Dublin, April 24, 2024 (GLOBE NEWSWIRE) — The “France Data Center Market – Investment Analysis & Growth Opportunity 2024-2029” report has been added to ResearchAndMarkets.com’s offering.

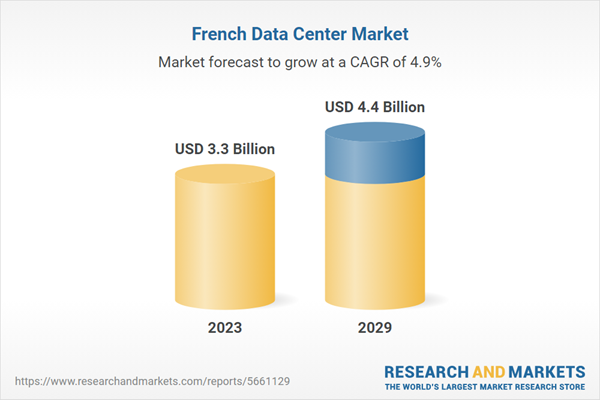

The French data center market by investment is expected to grow at a CAGR of 4.93% from 2023-2029, from USD 3.3 Billion in 2023 to reach USD 4.4 Billion in 2029.

France is leading in digital product leadership in Europe, ahead of Germany and the UK. Nearly half of French businesses believe that the shift to digital products will significantly impact how they manage their products. In addition, around 40% of French companies are using data insights to shape their product roadmap, putting them at the forefront of this approach.

France has emerged as a leading advocate for renewable energy within Western Europe, leveraging abundant resources like hydroelectricity, nuclear power, wind energy, and solar photovoltaic power. The government and data center operators have secured substantial environmentally friendly energy.

Submarine cables play an important role in connecting data centers across different regions, and they are essential for boosting connectivity in a particular country or region. There are currently around 24 active submarine cables and four upcoming cables in France. The rise in these cables attracts data center investments in the France data center market.

The French government is making significant investments in advancing its economic digitalization. One key initiative involves a substantial €20 billion investment in expanding high-speed broadband coverage to ensure connectivity for every household in France over the next decade. An extra €150 million is allocated for research and development within the ‘Investments into the Future’ project, focusing on security and cloud computing.

District heating efficiently distributes surplus heat generated by industrial facilities to fulfill the heating needs of nearby residential and commercial areas. For more than a decade, the practice of using waste heat from data centers to support district heating has been in operation.

REPORT COVERAGE

This report analyses the France data center market share. It elaboratively analyses the existing and upcoming facilities and investments in IT, electrical, mechanical infrastructure, general construction, and tier standards. It discusses market sizing and investment estimation for different segments.

The segmentation includes:

-

IT Infrastructure

-

Servers

-

Storage Systems

-

Network Infrastructure

-

Electrical Infrastructure

-

UPS Systems

-

Generators

-

Switches & Switchgears

-

PDUs

-

Other Electrical Infrastructure

-

Mechanical Infrastructure

-

Cooling Systems

-

Rack Cabinets

-

Other Mechanical Infrastructure

-

Cooling Systems

-

CRAC and CRAH

-

Chillers

-

Cooling Towers, Condensers and Dry Coolers

-

Economizers & Evaporative Coolers

-

Other Cooling Units

-

General Construction

-

Core & Shell Development

-

Installation & Commissioning Services

-

Building & Engineering Design

-

Fire Detection & Suppression Systems

-

Physical Security

-

Data Center Infrastructure Management (DCIM)

-

Tier Standard

-

Tier I & Tier II

-

Tier III

-

Tier IV

-

Geography

-

Paris

-

Other Cities

VENDOR LANDSCAPE

-

Some key colocation investors in the France data center market are CyrusOne, Colt Data Centre Services, Data4, Digital Realty, DTiX, Euclyde Data Centers, Equinix, Orange Business Services, and others.

-

In 2023, the France data center market witnessed investment announcements from Digital Realty, CloudHQ, Scaleaway, and others.

-

Telecom operators such as Orange and others have played an essential role in connectivity nationwide.

-

Local enterprises’ migration of on-premises infrastructure to cloud/colocation will play a vital role in colocation revenue growth.

IT Infrastructure Providers

Data Center Construction Contractors & Sub-Contractors

Support Infrastructure Providers

Data Center Investors

New Entrants

-

CloudHQ

-

Nation Data Center

-

Stratosfair

-

Yondr

EXISTING VS. UPCOMING DATA CENTERS

KEY QUESTIONS ANSWERED

-

How big is the France data center market?

-

What is the growth rate of the France data center market?

-

How many MW of power capacity will be added across France from 2024 to 2029?

-

How many existing and upcoming data center facilities exist in France?

-

What factors are driving France data center market?

-

Who are the new entrants in France data center market?

Key Attributes:

|

Report Attribute |

Details |

|

No. of Pages |

128 |

|

Forecast Period |

2023 – 2029 |

|

Estimated Market Value (USD) in 2023 |

$3.3 Billion |

|

Forecasted Market Value (USD) by 2029 |

$4.4 Billion |

|

Compound Annual Growth Rate |

4.9% |

|

Regions Covered |

France |

For more information about this report visit https://www.researchandmarkets.com/r/76npwh

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Source link