The Analyst Landscape: 10 Takes On Blackstone Mortgage Trust

During the last three months, 10 analysts shared their evaluations of Blackstone Mortgage Trust (NYSE:BXMT), revealing diverse outlooks from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 8 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 1 | 4 | 0 | 0 |

| 2M Ago | 0 | 0 | 2 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

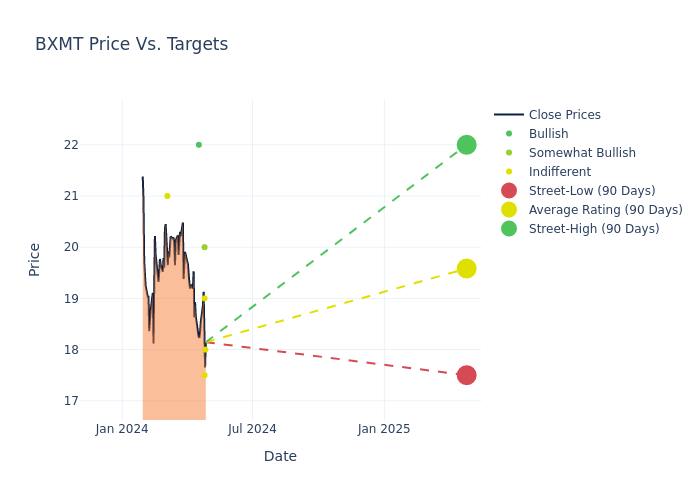

Analysts’ evaluations of 12-month price targets offer additional insights, showcasing an average target of $19.85, with a high estimate of $22.00 and a low estimate of $17.50. A negative shift in sentiment is evident as analysts have decreased the average price target by 6.15%.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of Blackstone Mortgage Trust among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jade Rahmani | Keefe, Bruyette & Woods | Lowers | Market Perform | $18.00 | $20.50 |

| Richard Shane | JP Morgan | Lowers | Neutral | $17.50 | $18.50 |

| Douglas Harter | UBS | Lowers | Neutral | $19.00 | $21.00 |

| Donald Fandetti | Wells Fargo | Lowers | Overweight | $20.00 | $22.00 |

| Sarah Barcomb | BTIG | Lowers | Buy | $22.00 | $24.00 |

| Jade Rahmani | Keefe, Bruyette & Woods | Lowers | Market Perform | $20.50 | $21.00 |

| Richard Shane | JP Morgan | Lowers | Neutral | $18.50 | $19.00 |

| Douglas Harter | UBS | Lowers | Neutral | $21.00 | $21.50 |

| Eric Dray | B of A Securities | Lowers | Neutral | $21.00 | $22.00 |

| Jade Rahmani | Keefe, Bruyette & Woods | Lowers | Market Perform | $21.00 | $22.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they ‘Maintain’, ‘Raise’ or ‘Lower’ their stance, it reflects their response to recent developments related to Blackstone Mortgage Trust. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from ‘Outperform’ to ‘Underperform’. These ratings reflect expectations for the relative performance of Blackstone Mortgage Trust compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Blackstone Mortgage Trust’s stock. This examination reveals shifts in analysts’ expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Blackstone Mortgage Trust’s market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Blackstone Mortgage Trust analyst ratings.

Unveiling the Story Behind Blackstone Mortgage Trust

Blackstone Mortgage Trust Inc is a real estate finance company primarily involved in the origination and purchase of senior loans collateralized by commercial properties in North America, Europe, and Australia. The vast majority of the company’s asset portfolio is comprised of floating rate loans secured by priority mortgages. These mortgages are mainly derived from office, hotel, and manufactured housing properties. A significant percentage of the collateralized real estate properties are located in New York, California, and the United Kingdom. Blackstone Mortgage Trust is managed by a subsidiary of The Blackstone Group and benefits from the market data provided by its parent company. Nearly all of Blackstone Mortgage Trust’s revenue is generated in the form of interest income.

Blackstone Mortgage Trust’s Economic Impact: An Analysis

Market Capitalization Highlights: Above the industry average, the company’s market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Decline in Revenue: Over the 3 months period, Blackstone Mortgage Trust faced challenges, resulting in a decline of approximately -18.25% in revenue growth as of 31 March, 2024. This signifies a reduction in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Net Margin: Blackstone Mortgage Trust’s net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of -86.97%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Blackstone Mortgage Trust’s ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -2.91%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): The company’s ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -0.52%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Blackstone Mortgage Trust’s debt-to-equity ratio surpasses industry norms, standing at 4.55. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Analyst Ratings: Simplified

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Source link