Aligns with EPS Projections, Declares …

-

Earnings Per Share (EPS): Reported at $0.55, meeting the estimated earnings per share of $0.55.

-

Net Investment Income: Totaled $34.0 million for the quarter, falling short of the previous quarter’s $34.9 million.

-

Net Asset Value (NAV) per Share: Increased to $17.70 from $17.60 at the end of the previous quarter.

-

Revenue: Total investment income for the quarter was $74.5 million, slightly below the $74.9 million from the previous quarter.

-

Dividends: Declared a regular dividend of $0.42 per share and an additional dividend of $0.03 per share for the second quarter of 2024.

-

Portfolio Health: Investments on non-accrual declined quarter-over-quarter, representing 1.0% and 1.7% of the total investment portfolio at amortized cost and fair value, respectively.

-

Investment Activity: Invested $403.1 million in 83 portfolio companies during the quarter, with net investment fundings of $107.1 million after accounting for repayments and sales.

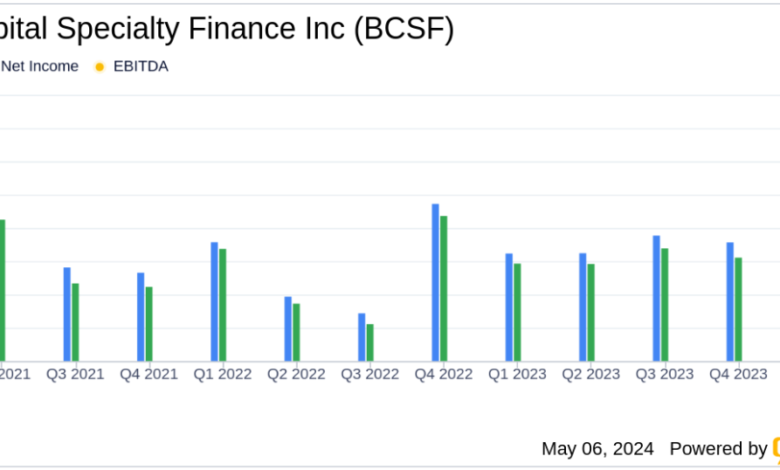

Bain Capital Specialty Finance Inc (NYSE:BCSF) released its 8-K filing on May 6, 2024, announcing its financial results for the first quarter ended March 31, 2024. The company reported earnings per share (EPS) of $0.55, perfectly aligning with analyst estimates, and declared a dividend of $0.42 per share for Q2 2024, with an additional $0.03 per share previously announced. This performance underscores BCSF’s consistent financial management and strategic investment approaches.

Bain Capital Specialty Finance Inc is an externally managed specialty finance company focused on lending to middle-market companies. BCSF aims to generate current income and, to a lesser extent, capital appreciation through direct originations of secured debt and equity investments. The company’s diversified investment portfolio is primarily composed of first lien senior secured loans, evidencing a strong preference for secured assets.

Key Financial Highlights

For Q1 2024, BCSF reported a net investment income (NII) of $34.0 million, or $0.53 per share, slightly below the previous quarter’s $34.9 million, or $0.54 per share. The company’s net asset value (NAV) per share increased to $17.70 from $17.60 at the end of 2023, indicating a gradual enhancement in asset value amidst volatile market conditions.

The total investment portfolio’s fair value stood at $2,406.0 million as of March 31, 2024, spread across 153 portfolio companies in 32 different industries, highlighting BCSF’s broad diversification strategy. Notably, the company’s investments on non-accrual declined quarter-over-quarter, showcasing an improvement in credit quality.

Investment and Portfolio Activity

During the quarter, BCSF was active in the market with $403.1 million invested in 83 portfolio companies, including $238.4 million in seven new companies. This was offset by $296.0 million in principal repayments and sales, resulting in net investment fundings of $107.1 million. The company’s strategic investments and disinvestments reflect its dynamic approach to portfolio management in response to evolving market conditions.

Challenges and Opportunities

Despite a robust start to the year, BCSF faces challenges including increased net debt-to-equity ratio, which stood at 1.09x, up from 1.02x at the end of 2023. This indicates a higher leverage level that could pose risks if not managed effectively. However, the company’s diversified and senior-secured investment approach, combined with a stable credit quality, positions it well to navigate potential market disruptions.

Outlook and Dividend Declaration

Looking ahead, BCSF remains well-positioned to leverage opportunities in the middle-market lending space, supported by a solid balance sheet and strategic investment capabilities. The board’s declaration of a consistent dividend underscores confidence in the company’s stable cash flow generation and financial health.

In conclusion, Bain Capital Specialty Finance Inc’s first-quarter performance demonstrates a strategic balance between risk management and proactive portfolio growth. With aligned EPS and a prudent investment strategy, BCSF is poised to continue delivering value to its shareholders amidst fluctuating market dynamics.

Explore the complete 8-K earnings release (here) from Bain Capital Specialty Finance Inc for further details.

This article first appeared on GuruFocus.

Source link