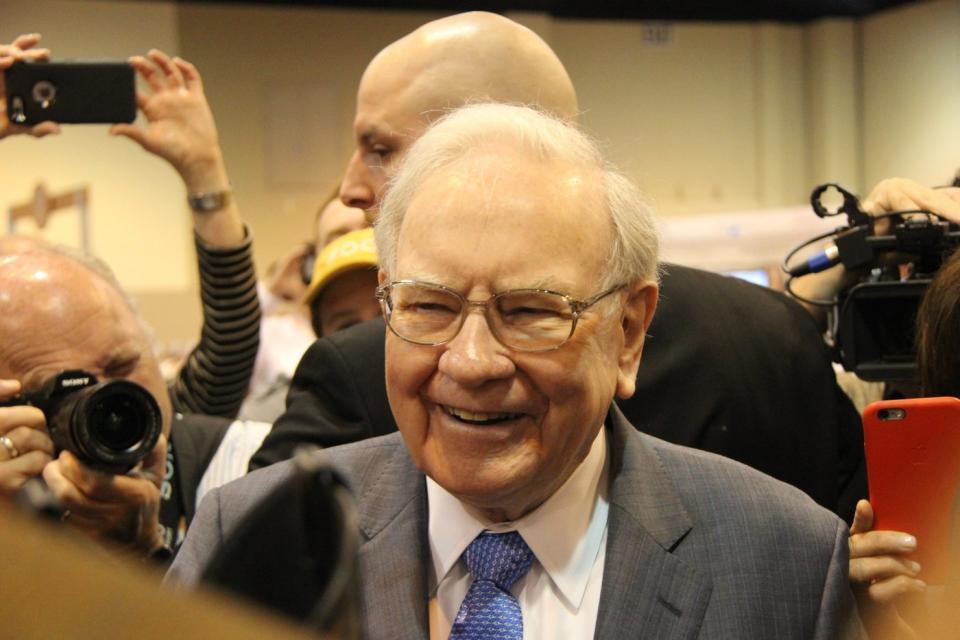

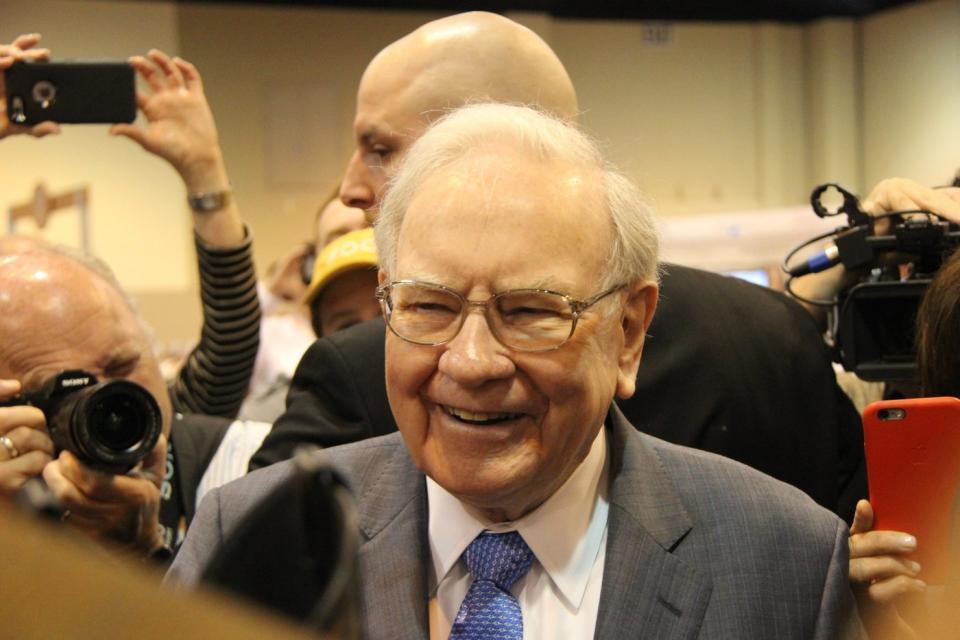

40.2% of Warren Buffett’s $362 Billion Portfolio Is Invested in 2 Artificial Intelligence (AI) Stocks

Warren Buffett was born in 1930, and he bought his first stock at age 11. By 1965, he was running his own investment company called Berkshire Hathaway, which he still leads today.

Buffett has steered Berkshire to a total return of 4,384,748% over the last 58 years, which would have been enough to turn a $1,000 investment into more than $43.8 million. The same investment in the S&P 500 index over the same period would be worth just $312,230.

Berkshire’s incredible run of success stems from a simple strategy. Buffett likes to own companies with steady growth, sound profitability, and strong management teams. He especially likes companies returning money to shareholders through dividends and stock buybacks. One thing he has never done is chase the latest stock market trend, whether it be the internet, cloud computing, or now, artificial intelligence (AI).

With that said, many of the stocks owned by Berkshire have turned their attention to the AI revolution. Two of them account for a combined 40.2% of the conglomerate’s $362 billion portfolio of publicly traded stocks and securities today.

1. Amazon: 0.5% of Berkshire Hathaway’s portfolio

E-commerce was Amazon‘s (NASDAQ: AMZN) primary business when it was founded in 1994, but the company has since expanded into cloud computing, streaming, digital advertising, and AI. Berkshire didn’t buy Amazon stock until 2019, and Buffett has often expressed regret for not recognizing the opportunity sooner. Today, Amazon’s $1.9 trillion valuation makes it the world’s fifth-largest company.

Amazon Web Services (AWS) is the largest provider of cloud services by revenue globally. It offers hundreds of solutions to help businesses thrive in the digital age, and it has also become a distribution platform for many of Amazon’s AI initiatives. CEO Andy Jassy wants to dominate the three core layers of AI: infrastructure (chips and data centers), large language models (LLMs), and customer-facing AI applications.

Like most cloud providers, AWS offers customers infrastructure powered by Nvidia‘s industry-leading graphics chips (GPUs), which were designed for processing AI workloads. However, it has also designed its own chips, and Jassy says there is strong demand for its latest Trainium 2 hardware because of its attractive pricing and performance.

AWS also continues to expand its Bedrock platform, which is home to a growing number of ready-made LLMs. Building an LLM requires substantial amounts of data and financial resources, so using an existing model can accelerate the development of AI applications. Amazon built its own family of models called Titan, but AWS customers can also access models from leading start-ups like Anthropic, in which Amazon recently invested $4 billion.

To cover the third and final layer, Amazon recently launched an AI virtual assistant called Q. It’s capable of analyzing the internal data of any business to provide useful insights, and it can also write, test, and debug computer code to speed up the release of new software. It’s the ultimate productivity tool for AWS customers.

Amazon generated $574 billion in total revenue last year, which was more than any of its tech peers in the trillion-dollar club. However, while the company has been profitable over the last three quarters, it has historically generated consistent losses because it favored investing heavily in growth. Combined with the absence of a dividend or buyback program, it doesn’t tick many of Buffett’s usual boxes.

That could explain why Amazon stock represents just 0.5% of Berkshire’s portfolio. However, the conglomerate might wish it owned a larger stake in the coming years as the AI opportunity unfolds.

2. Apple: 39.7% of Berkshire Hathaway’s portfolio

Buffett certainly hasn’t shown much hesitation when buying Apple (NASDAQ: AAPL) stock. Berkshire first invested in the iPhone maker in 2016, and it has spent around $38 billion accumulating shares since then. Thanks to a significant increase in stock price, Berkshire’s stake in Apple is currently worth a whopping $143.5 billion, even after discounting the recent sale of 13% of the conglomerate’s position.

The iPhone is Apple’s flagship product, but it has an entire portfolio of hardware successes, including the iPad, Watch, Mac computers, and iPhone accessories like the AirPods. Apple also has a growing number of services, which include Apple Music, Apple News, Apple TV, and iCloud, to name just a few. These services are typically subscription-based and carry much higher profit margins than Apple’s hardware products, so they are frequently a point of focus for investors.

Apple didn’t become a $2.8 trillion company by standing still, and while it has been less vocal about its AI aspirations than other tech giants, it could make a significant dent on the emerging industry. There was an early clue inside the latest iPhone 15 Pro. It’s fitted with a new Apple-designed A17 Pro chip, which enhances the smartphone’s ability to process AI workloads, like those underpinning the Siri voice assistant and autocorrect keyboard function.

In March, rumors began to fly that Apple was in partnership talks with leading developers of AI chatbots like Alphabet (Google) and OpenAI. These applications could help Apple’s customers rapidly craft content, from emails to images, on their devices. They could also become virtual assistants capable of everything from answering complex questions to offering gift suggestions.

If history is any guide, Apple could charge those companies billions of dollars to have their AI chatbots installed on its 2.2 billion active devices worldwide. After all, Apple already charges Alphabet around $18 billion per year to set Google as the default search engine on its Safari browser — a similar fee for Alphabet’s Gemini chatbot would not be surprising. More will likely be revealed about Apple’s AI plans at the Worldwide Developers Conference in June.

Notably, Apple meets most of Buffett’s criteria. It delivers steady revenue growth in most years, it’s highly profitable, and its CEO Tim Cook regularly receives Buffett’s praise. Plus, Apple pays a regular dividend, and it just announced a new stock buyback program worth $110 billion, which is the largest in corporate history.

So why did Berkshire recently sell 13% of its position in Apple? Buffett says it was for tax reasons (he speculates that corporate taxes could rise in the future), but he assured investors Apple would likely remain Berkshire’s largest position at the end of 2024.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $543,758!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, and Nvidia. The Motley Fool has a disclosure policy.

40.2% of Warren Buffett’s $362 Billion Portfolio Is Invested in 2 Artificial Intelligence (AI) Stocks was originally published by The Motley Fool

Source link