Will a longer-term mortgage jeopardise your retirement?

As pensions minister, Liberal Democrat politician Steve Webb — now, rightly, Sir Steve Webb — was an undoubted force for good. And in private life, post-Parliament, he’s continued the good work.

Now a partner at pensions consultancy Lane Clark & Peacock (LCP), he submitted a Freedom of Information request after spotting some interesting figures about mortgages in a recent Bank of England report covering the fourth quarter of 2023.

Basically, reported the Bank, people were taking out long-term mortgages that ran on past their state retirement age.

Was this a growing trend, though? Sir Steve asked the Bank for prior-year figures to be prepared on the same basis, for 2022 and 2021.

35 years old, with a 35-year mortgage

And as a recent LCP press release highlights, the answer was a resounding ‘yes’: it is a growing trend.

In fact, reports LCP, among those in the 30-39 age bracket, over the past two years there’s been a 29% increase in the uptake of mortgages that run on past retirement age.

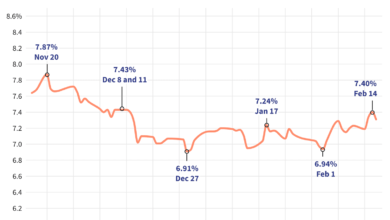

This perhaps shouldn’t be surprising: there’s the cost-of-living crisis, sky-high interest rates, sky-high house prices, inflation that exceeds many people’s pay rises — need I go on?

And so, predictably, people — particular young people — are taking out longer-term mortgages in order to get on the property ladder by spreading their mortgage costs over a longer period, thus keeping their monthly payments down.

Where once 25-year mortgages were the norm, we’re now seeing sizeable numbers of 30-year, 35-year, and even 40-year mortgages.

Gambling with retirement

Now, Sir Steve — rightly — worries about the impact of this on people’s retirement.

“The huge number of mortgages which run past state pension age is shocking. The challenge of getting on the housing ladder is forcing large numbers of young home buyers to gamble with their retirement prospects by taking on ultra-long mortgages. Serious questions need to be asked of mortgage lenders as to whether this lending is really in the borrower’s best interests”.

Well, yes. But preventing mortgage providers from offering long-term mortgages won’t be popular, particularly in a rental environment which is also expensive, as well as capricious.

Rightly or wrongly, I suspect that longer-term mortgages are here to stay.

Parallel investing to build a mortgage-paying lump sum

Now, what is all this to do with investing, you ask?

Simple — especially if you’re a younger person with a longer-term mortgage, or you’re considering a longer-term mortgage, or are the parent or friend of someone in one of those two positions.

Sir Steve, I believe, is right when he says that people are gambling with their retirements. In retirement, you shouldn’t be worried about paying your mortgage, or being forced to downsize. And you want to be actually in retirement, rather than working part-time — not because you want to, but because you have to, in order to pay the mortgage.

The solution, I believe, lies with investment: investing regularly, every month, in a stock market portfolio designed to make sure that you can pay the mortgage off on retirement — or ideally, pay it off well before.

And better still, as I’ve noted before, carrying out that investment in tax-sheltered vehicles such as ISAs and Self-Invested Personal Pensions (SIPPs), where capital gains and accumulated dividends are free of tax.

Meaning that every penny of gain can go towards the mortgage.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Flexibility is your friend

Now, you might well be thinking: why go to all the faff of investing ‘on the side’? If you can afford to invest, why not just go for a shorter mortgage period, and pay higher monthly payments?

The answer: because people want to leave themselves with ‘wriggle room’, both to enjoy a little of life, and to allow for some ups and downs in their finances. While you have to pay the monthly mortgage, you can vary the amount of your monthly investments as circumstances suit.

And of course, adding to your investments is also a good way of dealing with any windfalls such as bonuses.

In short, in many ways it’s the best of both worlds: low monthly mortgage payments, but flexible monthly investments designed to remove the element of gambling from your retirement, and hopefully holding open the door to even paying that mortgage off early.

Source link