The UK economy suffers from low levels of investment? That’s just not true says Deutsche Bank

If you ask economists what the biggest problem facing the UK economy has been over the past few decades, most would say low levels of investment.

Investment in new technologies is crucial for stimulating productivity growth, but the UK economy has the lowest level of investment compared to GDP in the G7.

Perhaps unsurprisingly, the UK’s productivity growth has been more sluggish than that of its rivals.

However, economists at Deutsche Bank have questioned this narrative. “Weak UK investment was not a reason for sluggish UK growth these last few years,” Sanjay Raja, chief UK economist at Deutsche Bank said in a note.

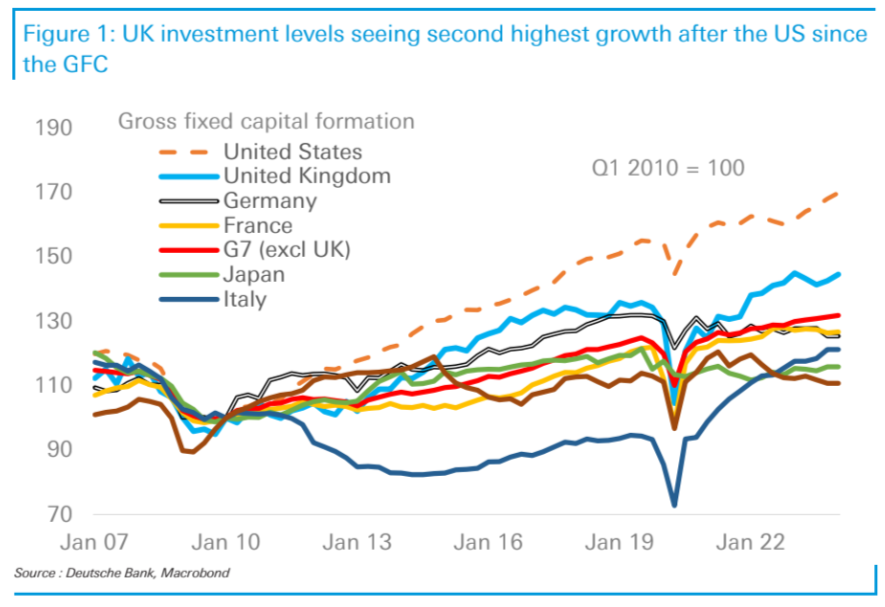

They point out that aggregate investment growth since the financial crisis is second only to the US among G7 economies.

Although levels of investment in the UK economy stagnated in the aftermath of Brexit, things have improved since the pandemic. In recent years it has been running comfortably above its pre-pandemic level, growing 5.5 per cent in 2023.

Deutsche Bank pointed to a number of different factors which could be behind the recent resurgence in investment.

Capital investment may be relatively more attractive for firms when the cost of labour has gone up so much in response to inflation.

Re-industrialisation, where firms reshore their operations often for geopolitical reasons, has also been a boon for business investment. A recent survey noted that nearly 60 per cent of UK manufacturers have engaged in reshoring their supply chains over the last year or so.

Another key driver of investment in the UK economy has been government policy. After reversing the cut to corporation tax, the government introduced a ‘super-deduction’ on capital expenditure to try and encourage business investment. This came to an end in April 2023.

In the Autumn Statement last year, Jeremy Hunt eschewed potentially more attention-grabbing tax cuts in favour of the full expensing policy.

Full expensing essentially allows businesses to write off the cost of investment against a range of qualifying equipment. Hunt has committed to expanding the policy further when the fiscal position allows.

Source link