Banks expected to reveal lower profits amid mortgage rate price war

Britain’s top banks are expected to reveal lower profits this week as mortgage rates start to creep down.

Lloyds Banking Group, which incorporates the Halifax brand and is the UK’s largest mortgage lender, and NatWest will report their half-year results on Thursday and Friday respectively.

Meanwhile Santander will also update investors on Wednesday.

Lloyds is expected to report a pre-tax profit of £3.2bn for the first six months of the year, which would be about a fifth lower than the £3.9bn half-year profit it generated this time last year.

The bank was among one of the lenders that reported bumper profits, with its income boosted by higher interest rates which allow banks to charge more for loans.

But earnings started to retreat from 2023 highs at the start of this year as competition in the mortgage and savings market heated up.

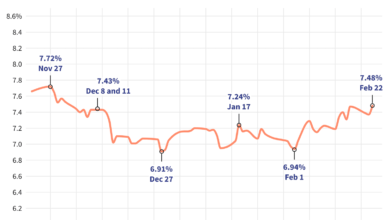

Mortgage rates have been reduced continually by all major lenders over the past few weeks while savings rates remain competitive and far above the current inflation figure of two per cent.

NatWest lowered their rates by up to 0.23 per cent last Friday, following Santander, Virgin Money and Clydesdale Bank.

The average two year fixed mortgage is 5.88 per cent while the average five year is 5.47 per cent, according to the latest data from Moneyfacts.

Investors will be looking to see whether the level of lending remained subdued in recent months, as buyers continue to hold out for borrowing costs to come down.

Gary Greenwood, a research analyst for Shore Capital Markets, said the outlook is “perhaps more encouraging given improving UK economic sentiment and especially if base rates begin to fall” in the second half of the year.

This is likely to drive a pick-up in demand for loans, he said.

UK interest rates currently stand at 5.25 per cent, which they have been held at since August last year.

Current predictions suggest they will remain at this level at the next Bank of England meeting in early August and will come down later in the year.

Meanwhile, NatWest is expected to report an operating pre-tax profit of £2.6bn for the six months to June, £1bn lower than the £3.6bn recorded this time last year.

The banking group said in April it had seen consumer confidence start to improve, and reported an increase in both savings and current account balances since the end of 2023.

Mr Greenwood suggested that this trend could have slowed in recent months, with fewer people moving money into long-term savings accounts after a spike in transfers last year.

Source link