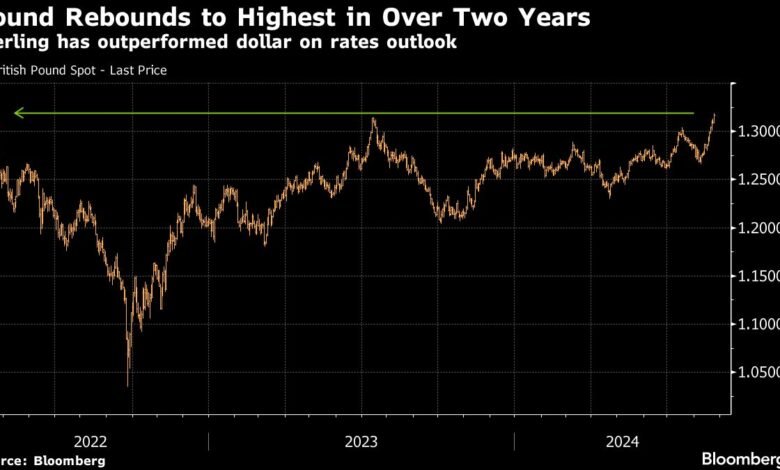

Pound Rises to Strongest in Over Two Years Against the US Dollar

(Bloomberg) — Sterling climbed to the strongest level in over two years, adding to a world-beating rally fueled by bets the Bank of England will ease monetary policy less than the Federal Reserve.

Most Read from Bloomberg

The pound on Friday rose more than 1% to $1.3230, the highest level since March 2022. The latest gains came amid broad dollar weakness after Federal Reserve Chair Jerome Powell said the time has come for the US central bank to cut its key rate, bolstering the view that the outlook for the two economies would continue to diverge.

“We think there is room for the pound to garner further support in the weeks ahead,” said Dominic Bunning head of G-10 FX strategy at Nomura.

The BOE lowered interest rates in a tight decision in August, yet the outlook for further cuts has since been muddied by the underlying resilience of the UK economy. While the risks of persistent inflation appear to be receding it is “too early to declare victory,” Governor Andrew Bailey said, according to a text of his speech that will be delivered later.

Money-market traders are pricing in less than two quarter-point rate cuts by the BOE in 2024, compared with about a full percentage point of easing from the Fed. Sterling pared some of its gains to trade 0.9% stronger as of 4:42 p.m. in London, putting it on track for its largest jump since December.

Turnaround Story

It’s a remarkable turnaround for the UK currency, which in the latter half of 2022 tumbled to a record low amid a chaotic rout in the nation’s bond market.

The rebound has attracted inflows from hedge funds, asset managers and other speculative market players, who pushed their net long position to an all-time high in mid-July, according to CFTC data going back to 1999.

While that positioning has since flipped short in recent weeks, it’s an added reason for the currency to rally, Bunning said.

“The relative resilience in the data suggest that back-to-back cuts are highly unlikely,” he added, pointing to stronger than expected UK PMI data. On Aug. 22, private sector companies in the UK reported their strongest growth in four months.

In the US, meanwhile, data released Aug. 21 on job growth showed the labor market was probably far less robust than previously reported, keeping pressure on the Fed to cut interest rates in September.

“The pound is the go-to currency to express a short-US dollar investment view right now,” said Neil Jones, a managing director at TJM Europe.

(Updates with market reaction and Bailey’s prepared remarks from the second paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link