This Nation Is Legally Allowed to Confiscate Your Bitcoin

UK authorities have recently approved secondary legislation aimed at enhancing their ability to confiscate cryptocurrency assets, including Bitcoin, involved in criminal activities legally.

This development stems from the passage of the Economic Crime and Corporate Transparency Bill last year, which empowered authorities to freeze and seize crypto assets suspected of facilitating crimes like money laundering and drug trafficking.

UK Government Can Legally Confiscate Bitcoin

Effective April 26, a new law will grant UK law enforcement the authority to freeze digital assets for up to 90 days without requiring a court order if there’s suspicion of criminal involvement. This measure aims to disrupt illicit financing, preventing the movement or concealment of assets.

Indeed, the forthcoming rule builds upon the foundation of the Economic Crime and Corporate Transparency Act of 2023. It amplifies law enforcement’s capability to confiscate and immobilize specific crypto assets associated with criminal offenses. These include money laundering, drug trafficking, and terrorism.

Although UK authorities have previously seized crypto assets occasionally, the new legislation is poised to expedite these procedures. Recently, the UK Metropolitan Police confiscated over £1.4 billion worth of Bitcoin, following an investment scam in China.

Read more: The State of Crypto Regulation in the United Kingdom

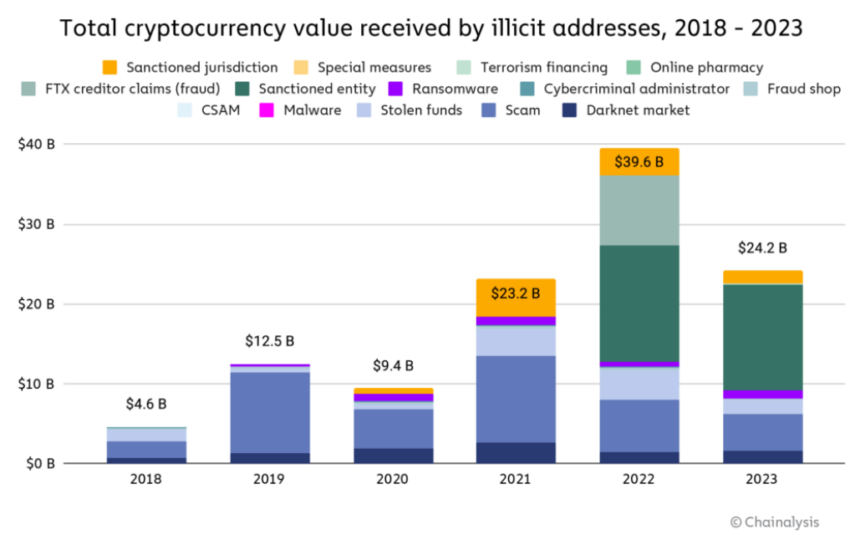

This proactive stance by UK authorities reflects a broader global trend towards heightened interest in crypto asset seizure. Notably, the United States Government has seized billions in digital assets allegedly linked to diverse criminal activities, including terrorism and other illicit activities.

The activation of these provisions marks a pivotal moment in UK crypto regulation. Stakeholders foresee these changes as pivotal in curbing criminal activities and protecting lawful asset holders.

Besides that, the legislation will bolster law enforcement’s capacity to combat crimes, with far-reaching implications for the crypto sector. Meanwhile, the heightened regulatory oversight and asset seizure potential highlight the critical need for compliance and due diligence among individuals and businesses in the crypto space.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Source link