Biden proposes relief for homebuyers. Here’s what to know.

President Joe Biden declared triumph on bread-and-butter issues in his State of the Union address, describing the U.S. economy as “the strongest in the world.”

Still, he said, conditions must improve for middle-class Americans, pointing for instance to high costs in the housing market that remains resistant to a cooldown elsewhere in the economy.

Biden proposed a pair of tax credits for current and prospective homeowners meant to ease affordability and stimulate the housing market.

“If inflation keeps coming down, mortgage rates will come down as well,” Biden said. “But I’m not waiting.”

Biden proposed a $5,000 tax credit for first-time homebuyers to put toward their mortgage, which he said amounts to an estimated $400 per month.

In addition, the White House has put forward a $10,000 tax credit for families who sell their starter homes. In theory, the measure will facilitate activity in the housing market, since many homebuyers have clung to their current low-rate mortgages rather than take on a new home at much higher rates.

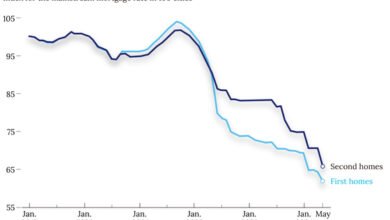

The average interest rate for a 30-year fixed mortgage has soared to 6.88%, rebounding after a steady decline at the end of last year, according to a report from Freddie Mac on Thursday.

Looking back further, that figure has skyrocketed from an average 30-year fixed mortgage rate of 3.76% prior to when the Fed began raising interest rates in March 2022, data shows.

In response to ABC News’ request for comment, a White House official said the administration believes the tax credits can make a substantial difference for homebuyers when coupled with a proposal that would increase the supply of homes.

Economists who spoke to ABC News cheered the effort to thaw the frozen housing market but warned that the tax incentives may not be enough for homebuyers to overcome the cost of high home prices and mortgage rates.

“I’m very bullish on this first-time homebuyers credit because this will help partially offset the higher interest rates that we’re facing,” Bruce Sacerdote, an economics professor at Dartmouth University, told ABC News.

“The more home ownership, the better,” Sacerdote added. “It ends up being a great investment for families.”

Steve Allen, an economist at North Carolina State University’s Poole College of Management, agreed. “Here’s an eternal truth in economics about taxes: Tax more of it, you get less of it. And tax less of it, you get more of it,” Allen said.

Some economists cautioned, however, that the tax credit for first-time homebuyers may not be large enough to alter the approach of those who stand to receive the benefit.

“I’m worried that this could be too small to make a real difference,” Andrew Levin, an economics professor at Dartmouth College and a former Fed economist, told ABC News.

Julia Fonseca, a finance professor at the University of Illinois at Urbana-Champaign, voiced similar concern in a post on X about the potential insufficiency of the $10,000 tax credit for families selling their starter homes.

If the families choose to pursue the tax credit and sell their homes, Fonseca said, they will likely encounter major challenges finding a new home, because the sluggish market has made so few homeowners willing to sell.

Plus, since mortgages have risen sharply, homeowners will need greater incentive to trade in the relatively low mortgage rates on their current homes for higher rates on a new one, Fonseca said.

The average borrower would need to receive roughly $50,000 to make up for the disparity in mortgage payments, she added.

“The maximum tax credit of $10k is small relative to this amount, so it might not be enough to incentivize even one seller to sell, let alone two,” Fonseca said.