Pound to Dollar Rate Forecasts Lifted at Goldman Sachs

Image © Adobe Images

“A Sterling reputation” is the title of a new report from Goldman Sachs, in which the company announces an upgrade to its forecasts for the Pound to Dollar exchange rate.

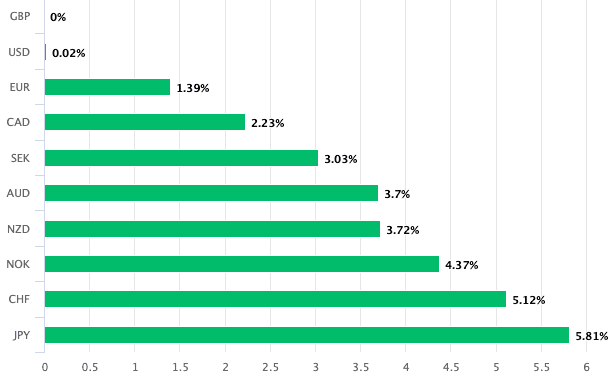

“Sterling has been the best performer in the G10 year-to-date, benefiting from the recent positive cyclical repricing in markets. We still think that GBP has room to run,” says the note.

Analysts at the Wall Street bank say the Pound has benefited amidst slightly looser global financial conditions and better growth pricing. If these conditions persist, gains can extend.

The note comes in the same week the Bank of England delivers its latest policy decision and guidance, and Goldman Sachs strategists say not to expect any major shifts in policy.

Instead, near-term risks to the Pound will come from other central banks:

“With positioning among FX investors concentrated in JPY and CHF, we expect the BoJ and SNB to draw more of the attention than the BoE this week, in addition to the Fed’s new projections. A more hawkish message from the Fed could risk injuring the latest rally in growth pricing, cutting into some of Sterling’s recent outperformance.”

Above: GBP is 2024’s best-performing G10 currency.

Nevertheless, if the current supportive global backdrop persists, Goldman Sachs expects the Pound to remain supported going forward.

With Pound-Dollar now trading around the investment bank’s initial target, it raises its forecasts to 1.30, 1.33 and 1.35 in 3, 6 and 12 months (from 1.28, 1.30 and 1.35 previously).

Source link