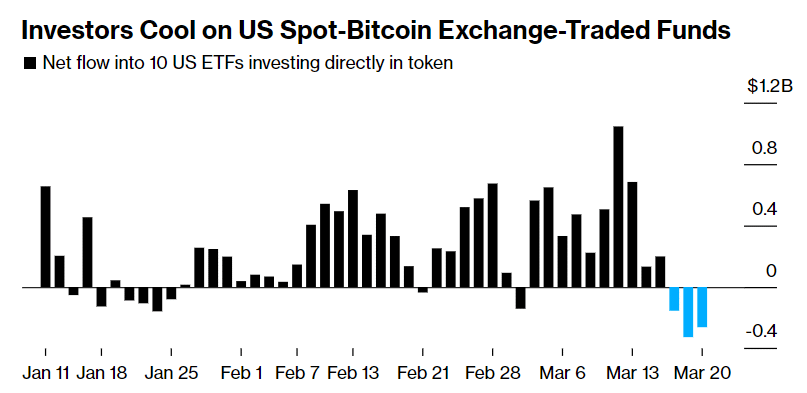

Bitcoin ETFs see record $742m in outflows over 3 days

Spot Bitcoin ETFs experienced their largest three-day withdrawal since their launch in January.

The trend marked a significant shift from the high demand propelling Bitcoin to its all-time high. Between Monday and Wednesday, these ETFs saw a withdrawal of $742 million, indicating substantial outflows from the Grayscale Bitcoin Trust alongside a decrease in new investments in competing funds by significant firms such as BlackRock and Fidelity Investments.

Despite this, according to Bloomberg data, the ETFs have attracted $11.4 billion in net investments since inception, making them among the most successful ETF launches. The Grayscale Bitcoin Trust, now an ETF, reported $13.3 billion in outflows.

While global stocks and gold continued to rise, Bitcoin’s rally cooled as the market digested the ETF outflow data. However, Bitcoin’s value surged over 5% today, fueled by the Federal Reserve’s indications of potential interest rate cuts, which lifted various asset classes.

The stock price of Bitcoin-related companies has also seen notable gains today after a week-long decline. MicroStrategy, the largest holder of BTC, saw its share price increase by 15% today. Stocks from leading BTC mining companies like Marathon Digital and Riot Platforms also recovered slightly today following Bitcoin’s recovery.

Source link