Bitcoin below $71,000 – Is it time to buy or sell BTC now?

- At press time, Bitcoin was trading at around $69,000

- Open Interest figures were around $36 billion, despite BTC’s price decline

Following several days of uptrends, Bitcoin’s recent ascent above $71,000 sparked optimism among certain traders. However, its subsequent dip below $70,000 elicited mixed sentiments, with buying and selling sentiment both displaying comparable figures.

A weak bull trend?

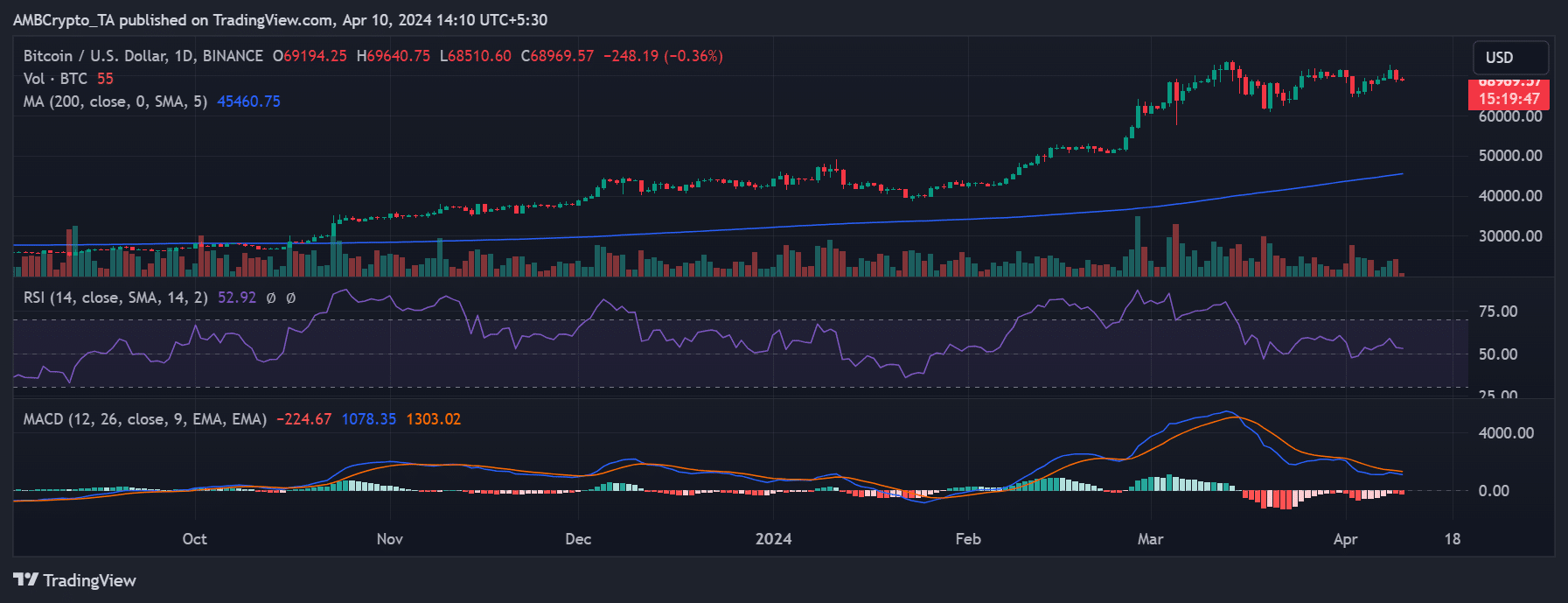

Bitcoin registered a significant setback on 9 April, deviating from the expected price trend with a decline of nearly 3% on the charts. Analysis of the daily timeframe price chart revealed a drop to around $69,217 by the end of the trading session, down from its starting point above $71,000.

This decline outweighed the previous day’s gains of over 2.7%.

At the time of writing, this downtrend persisted, albeit marginally. The Relative Strength Index (RSI) line appeared almost flat too, hovering slightly above the neutral line. This position suggested that Bitcoin was still in a bullish uptrend, but it was a weak one.

Buy or sell?

The aforementioned decline in Bitcoin’s price has sparked great discussion about whether to buy or sell the asset. In fact, Social dominance and volume on Santiment indicated a relatively balanced debate between these positions. Consider this – An analysis of social volume showed around 164 mentions of buy sentiment, compared to 125 mentions of sell sentiment.

Furthermore, an examination of social dominance revealed that the buy sentiment was around 4.9%, while the sell sentiment was around 3.7%. Additionally, at the time of writing, “Bitcoin halving” ranked as the second-highest trending word. These metrics suggest that despite the price decline, traders remain largely focused on the potential impact of the upcoming halving event.

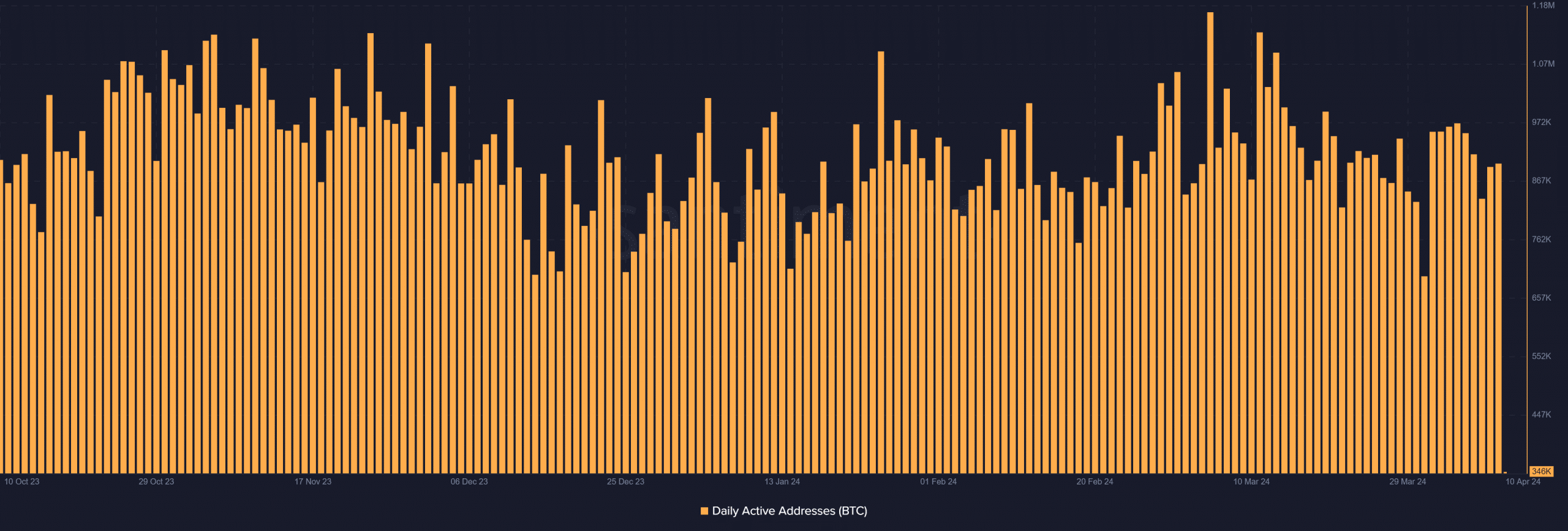

Minimal activity in active addresses

An analysis of Bitcoin‘s daily active addresses revealed a slight increase over the past four days too, with the same hovering around the 800,000 threshold. Between 7 and 8 April, active addresses rose from around 835,000 to over 892,000, with a further hike to over 898,000 by 9 April.

On the contrary, the 7-day active addresses chart highlighted a recent decline. From 7 to 10 April, active addresses decreased from over 4.9 million to approximately 4.7 million. These metrics suggest that while a notable number of active wallets exist, many participants may be adopting a wait-and-see approach.

– Read Bitcoin (BTC) Price Prediction 2024-25

At press time, Bitcoin’s Open Interest had fallen too. Data from Coinglass revealed that Open Interest stood at approximately $36.89 billion, down from $37.84 billion on 9 April. What can be inferred here? Well, despite figures for the same falling, a considerable amount of capital is still entering the market. Bitcoin’s short-term price action is unlikely to make a dent here either.

Source link