Bitcoin (BTC) Comes Close to ATH of $69K, Leaving $550 Million in Liquidations

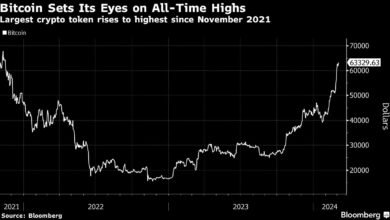

It has been another eventful day in the world of crypto, with Bitcoin (BTC) almost reaching its previous peak of approximately $69,000 (per CoinGecko’s data).

The asset’s price has been gradually climbing in the last several months, but the real bull run seems to have begun last month. In fact, BTC’s rally in February represented the longest monthly green candle in its 15-year-old history.

At the start of March, the primary cryptocurrency consolidated at around $61,000-$62,000 for a few days before taking off once again on March 4. It jumped to as high as $68,700 before slightly retracing to its current level of $67,700.

The altcoins have recorded impressive gains, too, adding to the overall bullishness in the sector. Ethereum (ETH) ascended to a two-year high of over $3,700, while the popular meme coins Dogecoin (DOGE) and Shiba Inu (SHIB) are up 18% and 80% on a daily scale, respectively.

The massive green wave in the industry has resulted in millions of dollars of liquidations. According to CoinGlass, the amount for the past 24 hours equals $550 million, with 60% of the sum being short positions.

BTC trades comprised most of the total figure, while ETH followed second with $91 million. DOGE and SHIB have also collectively accounted for around $60 million in short positions.

Bitcoin’s surge to its historic peak comes more than a month before the halving, which will reduce the rate at which new BTC are mined. As a result, miners will start receiving 3.125 BTC (instead of 6.25 BTC) for validating new blocks on the blockchain.

Historically, the halving has been followed by a bull run for the leading digital asset and a market boom, meaning the rally might be far from over.

Source link