Bitcoin: Different cycles to come?

Thu 09 May 2024 ▪

6

min of reading ▪ by

We have faced several cycles since the creation of bitcoin 15 years ago. All these cycles had some similarities that have been repeated over the years. However, there are now several arguments suggesting that the upcoming cycles may impact bitcoin’s behavior differently. This has particularly been the case recently, achieving an ATH before the halving event. We will take a closer look at different reasons explaining the possibility of different cycles.

Bitcoin’s behavior through the halving cycles

The halving cycles have been programmed to occur every 4 years. This process serves to halve the supply. Consequently, regulating the supply over the years helps to reduce the inflation rate of bitcoin. Since its inception, bitcoin’s price tended to increase and achieve an ATH following the halving process. Here is an illustration of this below:

However, this cycle was different because bitcoin achieved an ATH before the halving date:

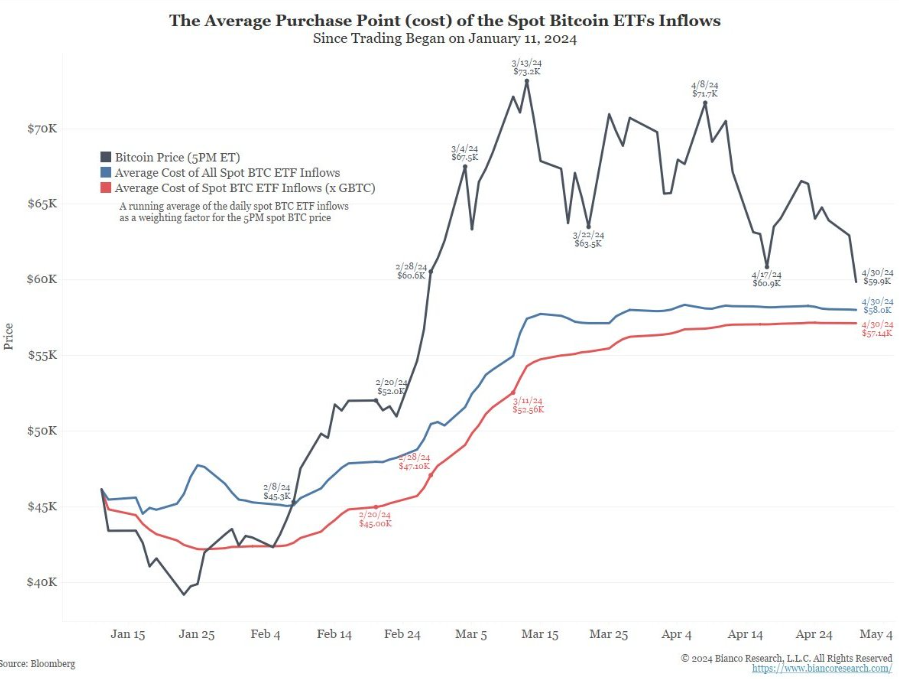

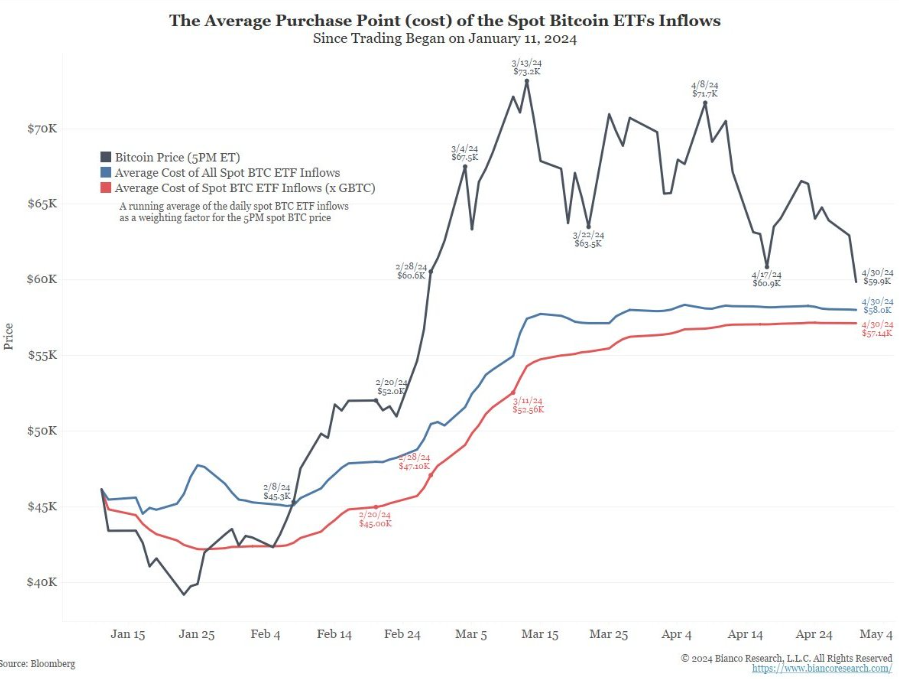

Moreover, it is also notable that the corrections during bitcoin’s rise are quite different. In the past, we were accustomed to more aggressive corrections during the bull run momentum, talking about corrections around 40-50%, whereas this cycle presents drops of 15-25%. This can be explained by an increasingly liquid bitcoin with the greater institutional involvement. Moreover, we can see that the average price on bitcoin ETF inflows at the beginning of the year is around 57K. Therefore, this remains a key level at 22% below the last ATH.

Bitcoin’s cycle and economic cycle

Bitcoin was created in 2009 simultaneously with the implementation of liquidity injections intended to revive the American economy after the financial crisis. For this reason, the creation of bitcoin is also considered a hypothesis of counter-offensive against the FED’s decisions on liquidity injections. The creator or creators of bitcoin probably had a good understanding of economic cycles as well as the functioning of the monetary mass and its impacts. Why? Initially, bitcoin was created at an economic bottom, which is probably not a coincidence in timing. Secondly, its supply is limited (compared to an unlimited monetary supply), and it will be reduced every 4 years to counter inflation.

The 4-year halving cycle is not accidental as it is also close to the average duration of an economic cycle of 5 years. In another context, within an economic cycle, cycles of acceleration (bullrun) and economic growth slowdown (often bear market) last about 18 to 24 months. This means that if we add these two cycles together, it roughly equates to 4 years.

As these are averages, the cycles can sometimes be shorter or longer. As a result, this leads to the possibility of irregularities within a 4-year cycle. When we talk about irregularities, it could mean having an ATH before a halving, for example.

The institutionalization of bitcoin, an important factor for the upcoming cycles

This year’s highlight is certainly the approval of bitcoin spot ETFs. This event has contributed to bitcoin’s credibility and democratization. Beyond that, ETFs allow for the simplified integration of bitcoin into portfolios as they have now become centralized products. The strong demand can be observed by the inflows into ETFs at the start of the year.

As a result, this event has been an important catalyst for bitcoin achieving an ATH before the halving event.

Performances increasingly less substantial with each cycle

The performance will be lower since bitcoin’s capitalization is higher. This follows the same principle in traditional markets: a small capitalization tends to be more volatile in both directions compared to a large capitalization. Regarding bitcoin, we can see that it’s not only the supply that is halved every 4 years, but there is also an impact on the performance. Here’s a comparison of bitcoin’s performance after each halving in previous years:

The following chart highlights the different halvings. We can see that until 2020, the curve’s progression was rather vertical. Then, it begins to flatten more and more from 2024 onwards.

This is also the case for bitcoin’s performance as it has shifted from a vertical mode to a more horizontal one. And in terms of volatility, corrections are less aggressive since the movements are more horizontal.

Past performance is not indicative of future results, and this is particularly true for bitcoin. Overall, bitcoin remains structurally bullish in the long term. However, it remains that bitcoin’s growth is expected to increasingly resemble more traditional performance over the coming years. This is explained both by the institutionalization of bitcoin (more volume) and the structure of bitcoin itself with the halving process. Finally, the criticisms made about bitcoin’s volatility should diminish over time.

Maximize your Cointribune experience with our ‘Read to Earn’ program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

Après avoir travaillé pendant 7 ans dans une banque canadienne dont 5 ans dans une équipe de gestion de portefeuille comme analyste, j’ai quitté mes fonctions afin de me consacrer pleinement aux marchés financiers.

Mon but ici, est de démocratiser l’information des marchés financiers auprès de l’audience Cointribune sur différents aspects, notamment l’analyse macro, l’analyse technique, l’analyse intermarchés…

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.