Bitcoin drops below $60,000 as ETFs see outflows and on-chain metrics show negative trend

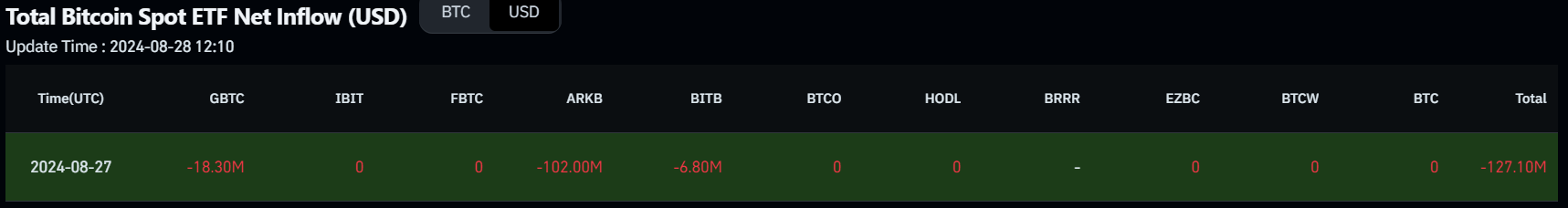

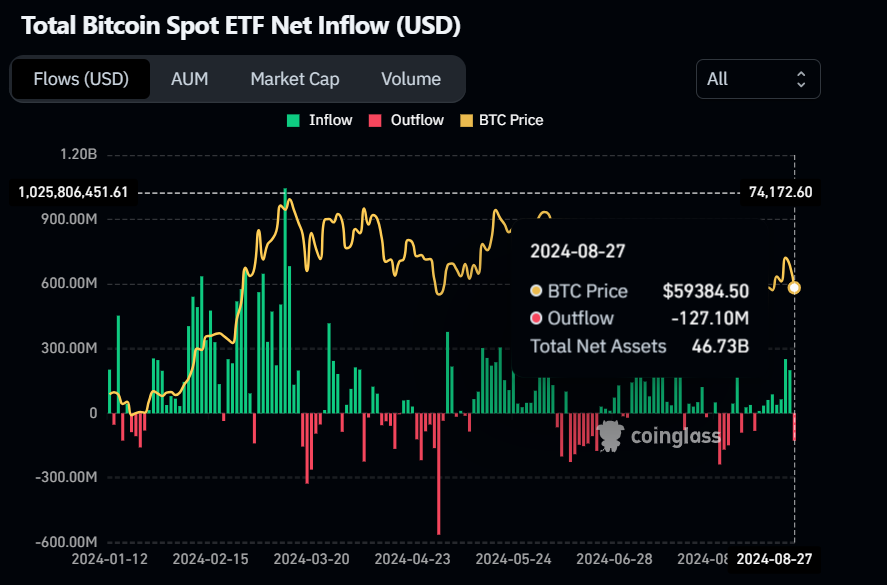

- U.S. spot Bitcoin ETFs recorded outflows of $127.1 million on Tuesday.

- Nasdaq files with the SEC to list and trade Bitcoin Index Options.

- On-chain data shows long liquidations and a higher percentage of shorts, signaling a continuation of the bearish trend.

Bitcoin (BTC) edges up slightly on Wednesday after dropping by 7.5% at the start of the week following the markets’ broad risk-off tone. Nasdaq has filed with the U.S. Securities and Exchange Commission (SEC) to list and trade Nasdaq Bitcoin Index Options (XBTX), a positive development for BTC, but on-chain metrics project a negative outlook as evidenced by a higher percentage of shorts, while US spot Bitcoin ETFs posted outflows on Tuesday.

Daily digest market movers: Nasdaq seeks SEC approval to launch Bitcoin Index Options

- Nasdaq (NDAQ) announced on Tuesday that it has filed with the US Securities and Exchange Commission (SEC) to list and trade Nasdaq Bitcoin Index Options (XBTX). Nasdaq, a global technology company specializing in exchange and financial technology services, has partnered with C.F. Benchmarks, a leading regulated cryptocurrency index provider, to enhance the integration of digital assets into traditional financial markets.

The Nasdaq Bitcoin Index Options are designed to help institutional and retail investors manage their positions and hedge investments in the cryptocurrency markets. Subject to regulatory approval, these options will track Bitcoin prices using the CME CF Bitcoin Real-Time Index (BRTI). The product enhances market maturity and liquidity by offering European-style exercise and cash settlement.

- On Tuesday, Coinglass’s U.S. spot Bitcoin ETFs data shows an outflow of $127.1 million. This was the first day of outflows after eight days of inflows, the longest streak of gains since mid-July. As a result, BTC declined by 5.4% on Tuesday and, if this trend continues, Bitcoin price could decline further as ETFs’ net flow data is crucial for understanding market dynamics and investor sentiment. The combined Bitcoin reserves held by the 11 U.S. spot Bitcoin ETFs stand at $46.73 billion.

Bitcoin Spot ETF Net Inflow chart

- Mi Primer Bitcoin, an educational Bitcoin nonprofit organization founded in El Salvador, is at risk of running out of funds, according to a Twitter post by its founder John Dennehy. El Salvador is the first country to have adopted Bitcoin as legal tender and the country’s government has been gradually increasing its Bitcoin holdings.

“We are in danger of running out of funding before some longer-term funding kicks in at the end of the year. If nothing changes, we will run out of money in September,” he said.

“We’ve been working tirelessly to cultivate funding sources that best allow us to remain truly independent and ensure long-term sustainability, but we need a bridge for a couple of months to get there,” Dennehy concluded.

- According to DL News, the French authorities’ arrest of Telegram founder Pavel Durov last Saturday may have been bad news for the crypto community.

“For years, crypto founders, devs, investors, and all manner of users have flocked to the platform and formed groups to communicate, collaborate, and help grow their ventures. Durov’s arrest suggests European authorities are intensifying their push to hold software developers responsible for the activity that takes place on their platforms,” DL said.

The arrest of Durov may have created FUD (Fear, Uncertainty, Doubt) among the crypto community, potentially contributing to the recent crypto market sell-off and the decline in Bitcoin’s price.

When French authorities detained Telegram founder Pavel Durov this week, it spelled bad news for the crypto community.

For years, crypto founders, devs, investors, and all manner of users have flocked to the platform and formed groups to communicate, collaborate, and help grow…

— DL News (@DLNewsInfo) August 28, 2024

Additionally, famous personalities in the crypto space have raised concerns about Durov’s arrest. Among them is Paolo Ardoino, CEO of Tether, one of the largest companies in the cryptocurrency industry, and Tesla CEO Elon Musk, who posted the hashtag #FreePavel on his social media platform X.

The arrest of Pavel Durov for enabling free speech communications through Telegram is very concerning.

If we, as a society, lose the battle to defend freedom of speech and communication, nothing else won’t matter, dark ages will be our future.

— Paolo Ardoino (@paoloardoino) August 26, 2024

- Lookonchain data shows that on Tuesday, as Bitcoin’s price declined more than 7%, 87,405 traders were liquidated for $318.46 million. Among them, a whale was liquidated for $12.67 million on an ETH/BTC long position, and another one was liquidated for $12.6M on a $BTC long position. If BTC declines further, more traders could be wiped out of the market.

The price of $BTC dropped by ~7% and $ETH dropped by ~10%!

87,405 traders were liquidated for $318.46M in the past 24 hours.

A whale was liquidated for $12.67M on an ETH/BTC long position.

Another whale was liquidated for $12.6M on a $BTC long position.… pic.twitter.com/9aObwOYjKv

— Lookonchain (@lookonchain) August 28, 2024

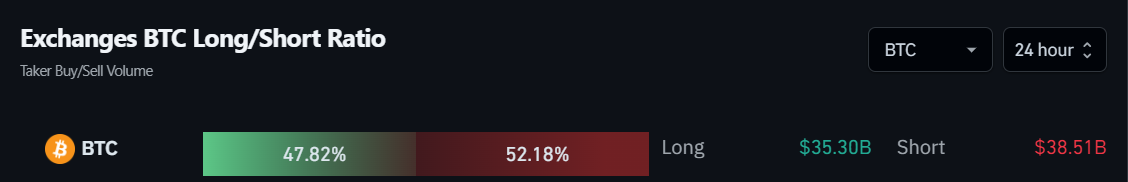

- Coinglass’s long-to-short ratio on exchanges shows BTC’s long-to-short ratio at 52.18%. This ratio reflects bearish sentiment in the market, as there is a higher percentage of shorts than longs. This suggests that more traders anticipate the decline in Bitcoin’s price.

Bitcoin long-to-short ratio chart

Technical analysis: BTC is poised for down leg

Bitcoin price was rejected around the daily resistance level at $65,379 on Sunday, declining by 7.5% in the next two days. On Wednesday, it recovers slightly by 1% at $60,071 at the time of writing.

If BTC continues to decline and closes below the $58,783 level, it could decline further by 4.5% to retest its daily support at $56,002.

The Relative Strength Index (RSI) on the daily chart has slipped below its neutral level of 50, and the Awesome Oscillator (AO) is on its way to close below its neutral level of zero. When both indicators trade below their neutral levels, it suggests a weak momentum and an impending bearish trend.

BTC/USDT daily chart

However, if Bitcoin’s price finds support around $58,783 and closes above it, the bearish thesis will be invalidated, and BTC could rally 11% to revisit its daily resistance level at $65,379.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.