Bitcoin Witnesses Epic 7,023% Imbalance in Bulls’ Liquidations

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

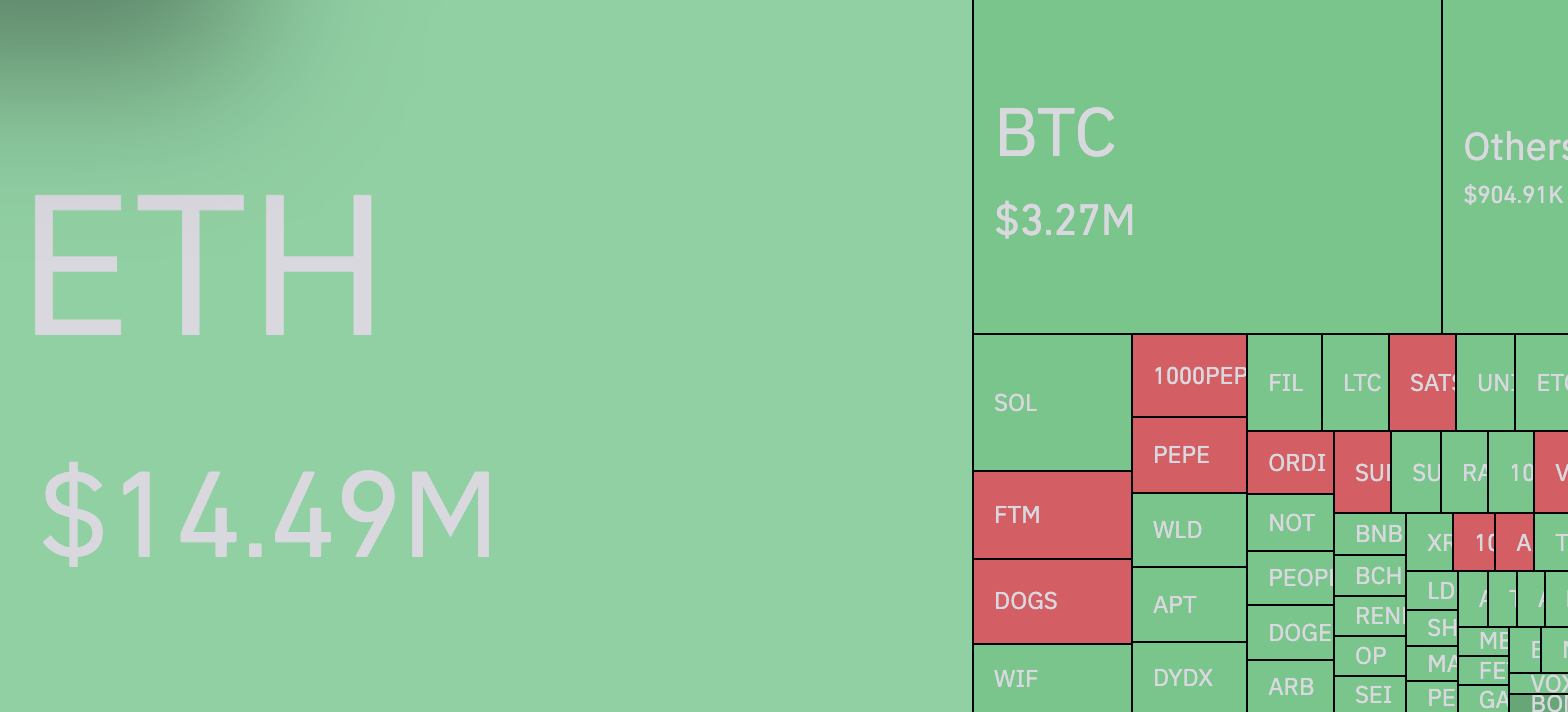

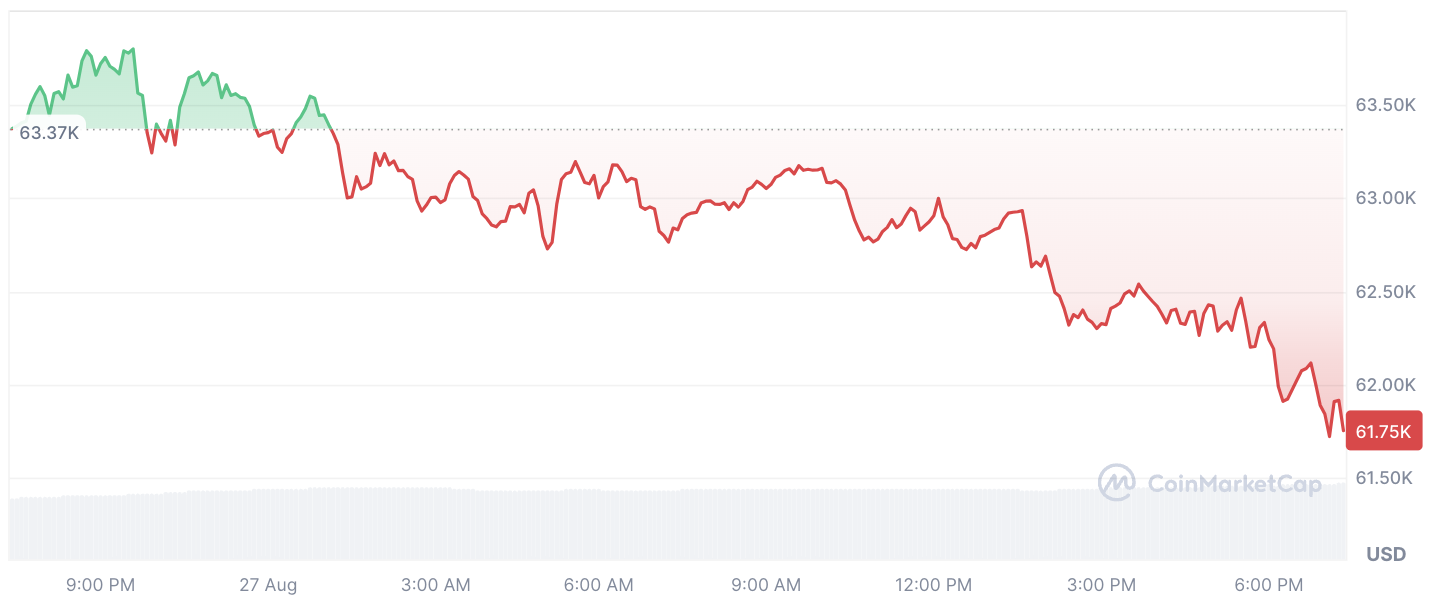

The Bitcoin (BTC) market has seen a lot of liquidations recently, and bullish traders have been hit the hardest. CoinGlass says that over $3 million worth of long positions were liquidated in just one hour, while short liquidations totaled just $51,000. This huge imbalance of 7,023% shows that the market is bearish.

The price of Bitcoin fell 0.6% over the same period, which contributed to the liquidation spree.This drop comes on the heels of a 3.7% drop since the beginning of the week, which is adding to the pain for bullish traders.

As is often the case, those who were late to the game or did not manage their risk effectively ended up paying a heavy price. The major liquidations make us wonder if the market is just making a normal correction, or if this is the end of Bitcoin’s recent rally.

One thing is for sure: despite the recent volatility, Bitcoin is still a big deal for investors and traders. The financial markets are still paying attention to this cryptocurrency, so it is likely to remain a volatile asset.

There are opportunities and risks for those willing to participate. While some may be less excited about recent liquidations, others may see this as a chance to buy Bitcoin at a potentially discounted price.

It is important to note that leveraged trading carries significant risks, so traders should be careful and think about their risk tolerance before entering into such positions.

Source link