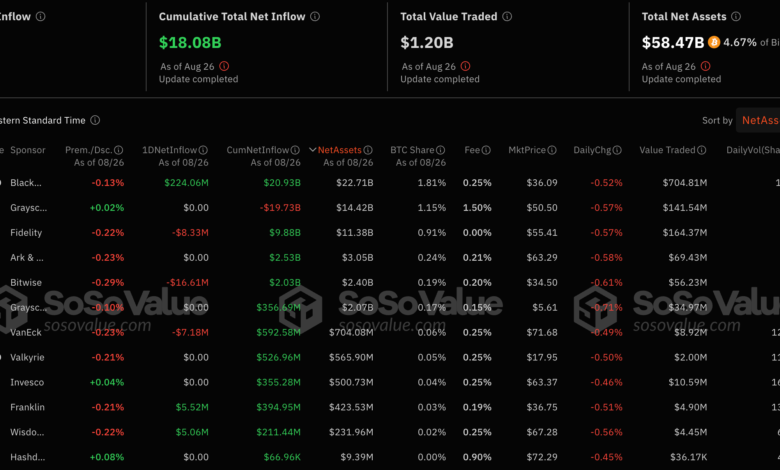

BlackRock and Grayscale own 2.96% of Bitcoin circulating supply amid $202 million net inflow

US-based Bitcoin ETFs saw a net inflow of $202.6 million on Aug. 26, according to SoSo Value data.

| Ticker | Sponsor | Prem./Dsc. | Aug. 26 Inflow | Net Inflow | BTC Share | Value Traded |

|---|---|---|---|---|---|---|

| IBIT | BlackRock | -0.13% | $224.06M | $20.93B | 1.81% | $704.81M |

| GBTC | Grayscale | +0.02% | $0.00 | -$19.73B | 1.15% | $141.54M |

| FBTC | Fidelity | -0.22% | -$8.33M | $9.88B | 0.91% | $164.37M |

| ARKB | Ark | -0.23% | $0.00 | $2.53B | 0.24% | $69.43M |

| BITB | Bitwise | -0.29% | -$16.61M | $2.03B | 0.19% | $56.23M |

| BTC | Grayscale | -0.10% | $0.00 | $356.69M | 0.17% | $34.97M |

| HODL | VanEck | -0.23% | -$7.18M | $592.58M | 0.06% | $8.92M |

| BRRR | Valkyrie | -0.21% | $0.00 | $526.96M | 0.05% | $2.00M |

| BTCO | Invesco | +0.04% | $0.00 | $355.28M | 0.04% | $10.59M |

| EZBC | Franklin | -0.21% | $5.52M | $394.95M | 0.03% | $4.90M |

| BTCW | WisdomTree | -0.22% | $5.06M | $211.44M | 0.02% | $4.45M |

Starting with IBIT, managed by BlackRock, this ETF experienced a substantial net inflow of $224.06 million on Aug. 26. This inflow adds to its already impressive cumulative net inflow, which now stands at $20.93 billion. The fund trades at a slight discount of 0.13% relative to its net asset value (NAV), holding a 1.81% share of Bitcoin. With a trading volume of $704.81 million, IBIT continues demonstrating its dominance in the Bitcoin ETF market, reflecting strong investor confidence and significant capital commitment.

On the other hand, GBTC, offered by Grayscale, showed no change in its net inflow on Aug. 26, maintaining a neutral stance. However, the fund has experienced substantial outflows over time, evidenced by its cumulative net inflow of -$19.73 billion. Despite this, GBTC trades at a slight premium of 0.02% and holds a 1.15% share of Bitcoin. Its trading volume on this day was $141.54 million, indicating continued interest in the fund despite its prolonged outflows.

FBTC, Fidelity’s Bitcoin ETF, saw a net outflow of $8.33 million on Aug. 26, slightly reducing its cumulative net inflow, now at $9.88 billion. The ETF trades at a 0.22% discount to its NAV and holds a 0.91% share of Bitcoin. Despite the outflow, the fund remains active in the market with a trading volume of $164.37 million, showcasing its resilience and continued relevance among investors.

The ARKB ETF, from Ark’s 21Shares, recorded no net inflow or outflow on Aug. 26, keeping its cumulative net inflow steady at $2.53 billion. The ETF trades at a 0.23% discount relative to its NAV and holds a relatively modest 0.24% share of Bitcoin. With a trading volume of $69.43 million, ARKB continues to maintain its position in the market with stable, if not spectacular, activity.

Finally, BITB, managed by Bitwise, experienced a net outflow of $16.61 million on Aug. 26. Nevertheless, its cumulative net inflow remains positive at $2.03 billion. The ETF trades at a 0.29% discount to its NAV and holds a 0.19% share of Bitcoin. The trading volume for BITB was $56.23 million, reflecting a lower level of market activity compared to some of the other ETFs.

In summary, IBIT (BlackRock) leads the pack with the highest daily and cumulative net inflows, reflecting strong investor confidence. Notably, BlackRock and Grayscale own a combined 2.96% of the Bitcoin circulating supply.

Source link