Dominance wars: Bitcoin vs. others, and what this means for ALTs

Bitcoin’s recent market behavior has left many traders scratching their heads wondering how feelings of euphoria could turn into a ghost town so quickly. After a dramatic 12% single-day increase last Thursday, Bitcoin has been steadily grinding lower, struggling below the daily TBO Cloud. The unexpected surge last Thursday gave the crypto market a quick dose of hopium, but unfortunately it didn’t include the much needed volume to sustain and continue last week’s significant move.

Volume last Thursday was surprisingly weak compared to the panic-driven dump we saw on the 5th of August, a clear sign that last Thursday’s pump was artificial at best (and likely a squeeze for late-comers shorting the market). This disparity between price action and volume is a major signal that all traders and investors should learn to recognize; while price tells the story, volume determines the twists and turns. In short, the price of Bitcoin increased significantly, but the amount of trading activity did not match this rise, indicating a discrepancy between the market’s enthusiasm and actual investment.

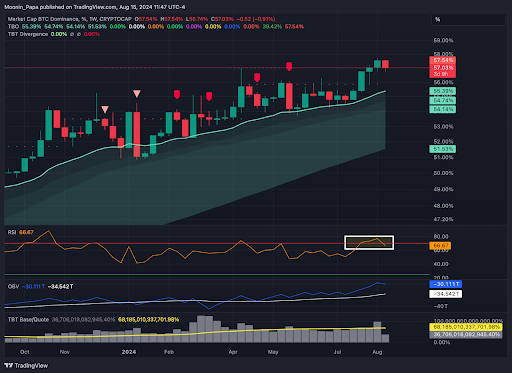

When we take a closer look at various technical indicators, we can get a deeper understanding of the current market dynamics:

– Bearish Signals: The TBT Divergence

– RSI and OBV Indicators: The Relative Strength Index (RSI) did not hit a new low recently, suggesting a potential test of overhead resistance soon, which could push it back into overbought territory—a bullish sign. Conversely, the On-balance Volume (OBV) indicator showed a bullish crossover, giving yet another bullish signal for Bitcoin to continue pushing higher.

– Historical Context: It’s important to remember that August and September are historically bearish months, yet the market is showing signs of bullish momentum building. While these bullish signals are exciting, it’s important to stay grounded and not get too excited until Bitcoin pushes above $72,000.

Despite these mixed signals, the broader market landscape reveals critical insights. BTC Dominance remains high, indicating that Bitcoin still takes up a significant share of the market capitalization. This has a large influence on altcoin movements, particularly those paired with Bitcoin.

For traders, the current market conditions offer both challenges and opportunities. The expectation of an exciting Q4 for Bitcoin and ALTs means that there is a lot of upcoming promise that requires patience and preparation. I am personally working on exiting all open BTC-paired trades in profit before Bitcoin potentially moves toward the $72,000 mark to prevent drawdown on my trading portfolio. My goal is to accumulate Bitcoin during the next month and a half so that I am well positioned to enjoy BTC’s rise to $72k and beyond later this year.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Source link