Embracing Bitcoin for Retirement: Michael Saylor Says YES!

6h33 ▪

3

min of reading ▪ by

The dance has now begun in earnest for American pension funds and Bitcoin! While the first institutions are beginning to invest in the recent Bitcoin ETFs, Michael Saylor, president of MicroStrategy, has just launched a new prediction. According to the Bitcoin oracle, institutional adoption will soon spread to all thousands of American pension funds.

Bitcoin: The Prophecy of Widespread Adoption

“There are thousands of pension funds in the United States that manage approximately $27 trillion in assets. They will all need Bitcoin.” The words are out, as visionary as ever in the mouth of Michael Saylor. While the first institutions were just beginning to venture into Bitcoin, he now predicts widespread adoption on a very large scale.

His reasoning is once again infallible. Pension funds, guardians of a portion of American households’ assets, will not be able to eternally ignore the inflation-hedging virtues and store of value that Bitcoin offers in the face of the erosion of fiat currencies.

But BTC would also represent for these investors a tremendous opportunity to ride the wave of digital disruption and innovation, or risk being left behind. Hence the need, according to Saylor, to massively integrate the crypto asset into their portfolios.

Eloquent Beginnings

While the generalization of such a massive institutional adoption may still seem a very ambitious prophecy, recent developments in Bitcoin ETFs lend credibility to Saylor’s oracles.

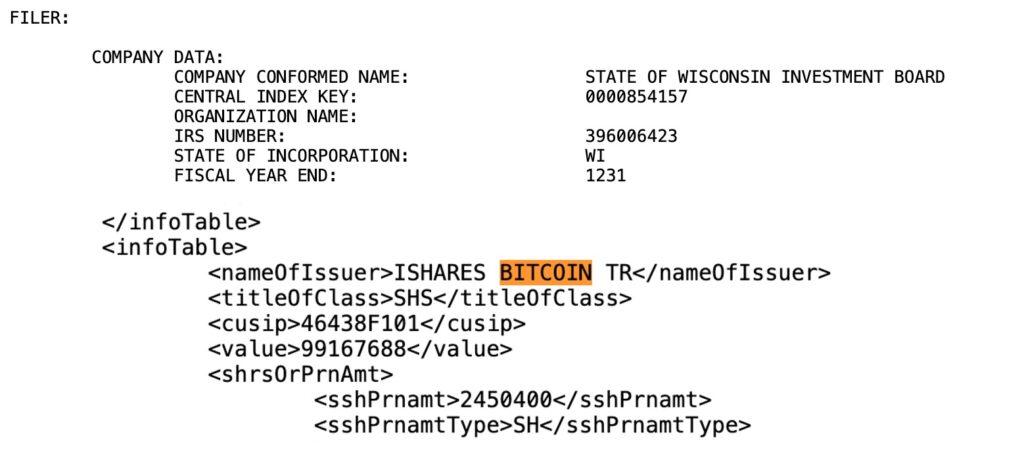

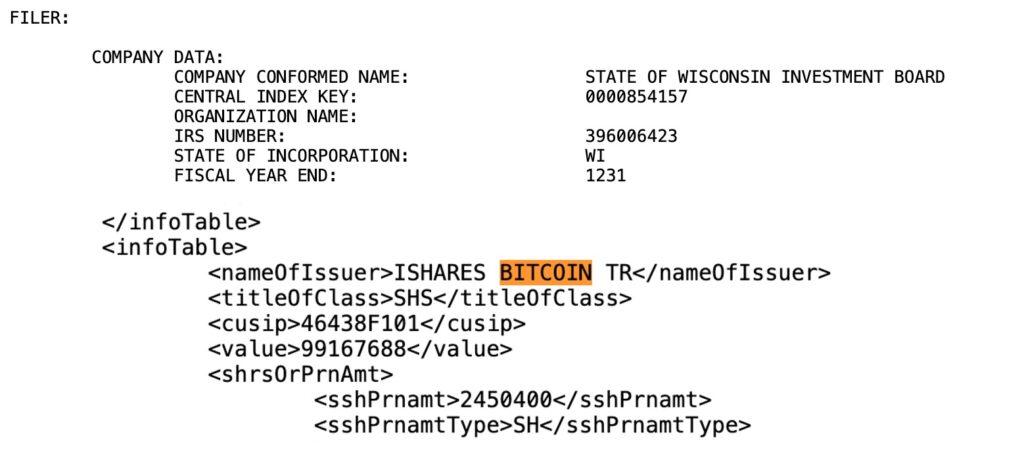

Indeed, in recent weeks we have seen the first pension funds of renown take the plunge and invest millions in these exchange-traded instruments. The Wisconsin SWIB public pension manager has invested $99 million in BlackRock’s Bitcoin ETF. Other giants like JPMorgan and Wells Fargo are also reported to have taken positions.

The first crack in the wall of institutional skepticism toward Bitcoin. But these initiatives, symbolic as they may be, could well be just the precursors of a much more massive movement.

As the first institutional steps into Bitcoin materialize, the influential Michael Saylor sees even farther and larger. Pension funds that integrate BTC? A dizzying prospect when you know the potential tentacular liquidity of these investor behemoths.

Maximize your Cointribune experience with our ‘Read to Earn’ program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

Click here to join ‘Read to Earn’ and turn your passion for crypto into rewards!

Le monde évolue et l’adaptation est la meilleure arme pour survivre dans cet univers ondoyant. Community manager crypto à la base, je m’intéresse à tout ce qui touche de près ou de loin à la blockchain et ses dérivés. Dans l’optique de partager mon expérience et de faire connaître un domaine qui me passionne, rien de mieux que de rédiger des articles informatifs et décontractés à la fois.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.