Nasdaq rolls out first Bitcoin index: What it means for BTC’s future

- New Bitcoin trading products on the verge of launch.

- Bitcoin index and futures to increase Bitcoin trading liquidity.

Nasdaq and CME Group are making significant strides in expanding Bitcoin trading options, a move that could have profound implications for the future of Bitcoin [BTC]. Nasdaq is leading the effort with its first-ever BTC index.

The company has filed with the US SEC to list and facilitate trading of Nasdaq Bitcoin Index Options (XBTX). If approved, this will provide a secure and regulated platform for trading Bitcoin options as John Black, Head of Index Options at Nasdaq stated:

“We’re creating a place for investors to confidently put their money into this innovative asset class.”

CME Group, the world’s largest futures exchange, also launched a smaller Bitcoin futures contract aimed at retail investors. This initiative is part of the market’s evolution to attract a broader audience.

By making futures contracts more accessible, CME Group is expected to bring new liquidity and increased attention to Bitcoin trading, potentially driving BTC prices higher in future.

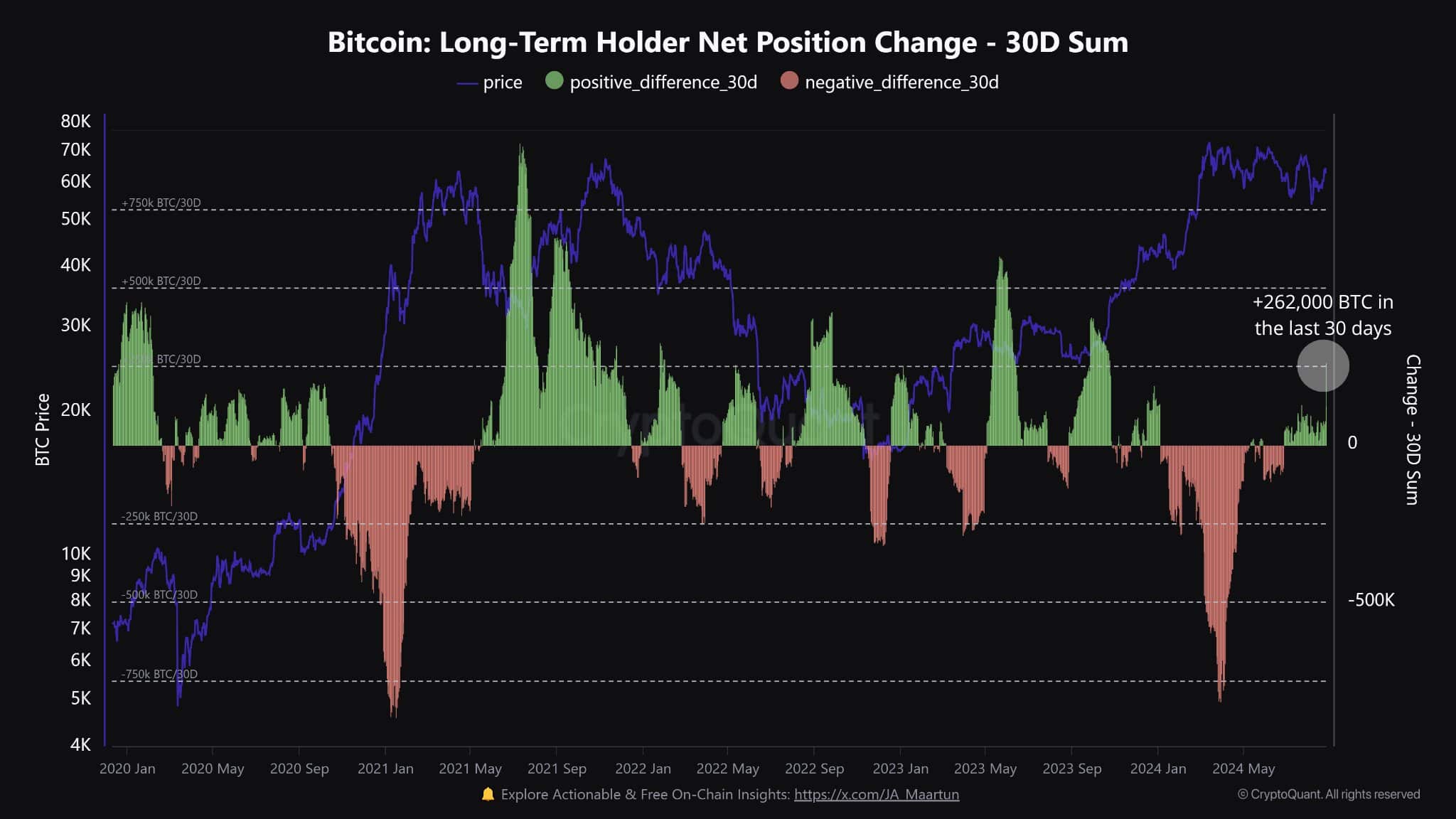

Supporting the long-term bullish outlook for Bitcoin, the supply held by long-term holders has increased by 262,000 BTC in the past 30 days, now controlling 14.82 million BTC, which is 75% of the total supply.

Despite recent market downturns, this strong long-term holding indicates continued confidence in Bitcoin’s future.

Bitcoin ETFs daily & weekly net-flow

Moreover, the Bitcoin ETF market has seen positive net flows recently, with daily BTC ETF net flows reaching +3,179 BTC (approximately $195.65 million) and weekly net flows at +9,909 BTC.

This trend suggests that the introduction of Nasdaq’s Bitcoin index and CME Group’s Bitcoin futures could further enhance these inflows, supporting a higher BTC price in the long term.

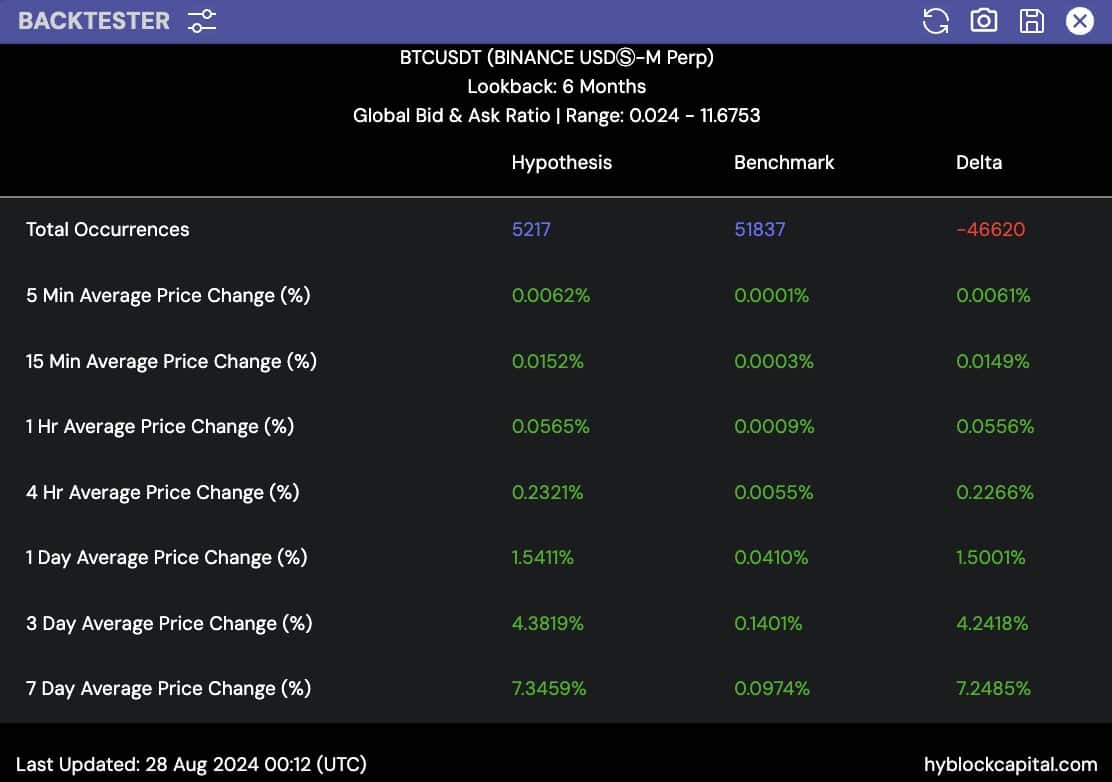

What does the global bid ask ratio say?

Another positive indicator is the Global Bid-Ask Ratio (GBAR), which has flipped positive, outperforming average BTC price action across multiple timeframes.

This trend, combined with the upcoming Nasdaq Bitcoin index and CME Group futures, suggests that Bitcoin trading liquidity is on an upward trajectory.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Stablecoin supply

Finally, the amount of stablecoin supply has been steadily increasing, reaching an all-time high in 2024.

This influx of funds, particularly into Binance, correlates with a rise in the Taker Buy/Sell Ratio for stablecoins on the platform, which could drive BTC prices higher as trading activities increase with the launch of these new Bitcoin products.

Source link