Avoid Costly Currency Conversion Scams in Europe, Warns The Points Guy

Travelers heading to Europe are being cautioned about a prevalent credit card scam that could significantly inflate their expenses. Brian Kelly, the travel aficionado behind The Points Guy, recently shed light on the “dynamic currency conversion” (DCC) tactic, a deceptive practice that poses an unnecessary financial burden on unsuspecting tourists.

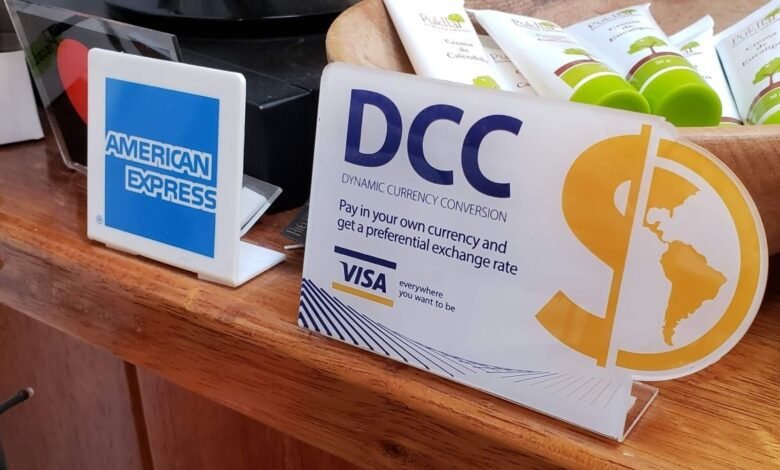

Understanding Dynamic Currency Conversion

At its core, DCC offers travelers the “convenience” of paying for purchases in their home currency instead of the local currency, such as Euros. This might seem like a helpful service at first glance, especially for those wary of dealing with exchange rates. However, Kelly’s experiences reveal a different story. During a trip across Europe, he encountered numerous instances where merchants provided the option to pay in US dollars, only to discover that this choice came with a hidden markup. For example, a transaction that should have cost him $416 ended up being quoted at $437 under DCC. By opting to pay in the local currency and letting his US credit card handle the conversion, Kelly saved $20 on a single purchase.

But the issue doesn’t stop at retail transactions. XE.com, recommended by Kelly for accurate, real-time exchange rates, illustrates the potential savings when avoiding DCC at ATMs, which also employ aggressive tactics to encourage travelers to opt for the seemingly simpler US dollar conversion.

The Wider Implications of DCC

Although DCC has been around since the 1990s, its implications are increasingly relevant in today’s globalized world. The European Consumer Organisation and Visa have both issued warnings against this misleading practice. The former describes DCC as fundamentally a scam, emphasizing that consumers almost always end up paying more than necessary. Visa advises travelers to decline DCC offers if they feel pressured or if the transaction lacks transparency, noting that choosing between local currency and DCC should not affect one’s ability to make purchases or withdraw cash.

The persistence of DCC as a widespread issue underscores a larger problem within international travel and commerce: the exploitation of uninformed consumers. Despite the availability of resources and advice from experts like Kelly, many travelers still fall victim to these costly conversions, often out of convenience or confusion.

Protecting Yourself from Currency Conversion Scams

So, how can travelers protect their wallets from these predatory practices? The first step is awareness. Understanding that DCC is an optional service â and a costly one at that â empowers consumers to make informed decisions. Always opt to pay in the local currency and allow your bank to handle the conversion, as this typically results in the best available exchange rate. Additionally, travelers should familiarize themselves with the conversion rates before making transactions, using reliable sources like XE.com for the most accurate information.

For those planning a trip to Europe or any foreign destination, taking the time to research and prepare for potential financial pitfalls like DCC can make all the difference. By staying informed and vigilant, travelers can ensure that their adventures are memorable for the right reasons, without unnecessary financial strain.