Bitcoin Price by 2050 – $52 Million Treasure or Zero-Dollar Trap

HodlX Guest Post Submit Your Post

As we approach the close of the first quarter of the 21st century, the world has witnessed remarkable transformations across nearly every domain.

Among these, the emergence of cryptocurrencies led by Bitcoin has been nothing short of revolutionary. However, as we look forward, the future of Bitcoin remains fiercely contested.

Will it continue its unprecedented ascent to become a pillar of global finance or could it fade into irrelevance?

In this article, we’ll delve into contrasting projections for Bitcoin’s value in 2050, ranging from a mind-boggling $52 million to a total collapse to zero, and explore the factors that shape these divergent forecasts.

Is Bitcoin headed for a $52 million valuation or something more modest

As the world’s first decentralized cryptocurrency, Bitcoin has shaken up the financial landscape.

With its current valuation at $55,862 as of August 6, 2024, Bitcoin continues to thrive as the market increasingly embraces digital assets.

This ongoing growth has led many experts to speculate about its trajectory over the next 25 years.

While some envision Bitcoin reaching extraordinary heights, others foresee a drastic downfall. Let’s first examine the arguments supporting a bullish future for Bitcoin.

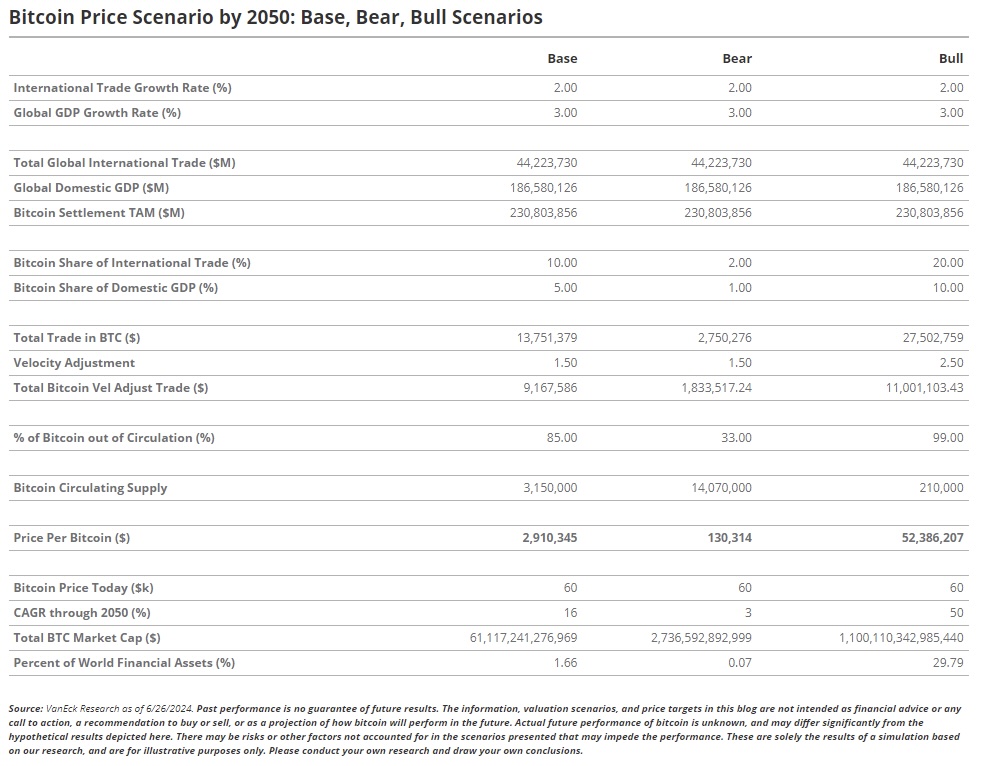

A comprehensive analysis by VanEck’s Digital Assets Research Team projects that Bitcoin’s value could surge to $2.9 million in a base scenario or even reach an astounding $52 million n a bullish scenario by 2050.

But what’s driving these optimistic predictions?

VanEck’s research is rooted in the belief that Bitcoin will evolve into a key global reserve currency.

The firm anticipates that Bitcoin could soon play a central role as an international medium of exchange, particularly with the implementation of new Bitcoin layer two solutions.

They also predict that Bitcoin will facilitate 10% of global trade transactions and five percent of domestic trade by 2050.

Furthermore, VanEck suggests that central banks could hold two-point-five percent of their assets in Bitcoin by then.

Here are some significant factors VanEck highlights that could contribute to Bitcoin’s value surge by 2050.

A transforming international monetary system

A major driver of Bitcoin’s potential rise is a shift in the IMS (International Monetary System).

According to VanEck’s analysis, current trends indicate that economies are gradually distancing themselves from traditional currency reserves.

Today, the IMS is largely dominated by the US dollar, along with the British pound, Japanese yen and euro.

A country’s currency is used in global trade based on its share of the world’s GDP (gross domestic product), which in turn strengthens the financial infrastructure built around that currency.

For decades, this system has remained stable, but cracks are beginning to show. VanEck’s research notes that the US dollar’s share in cross-border payments has hovered around 61% for the past 45 years.

However, the euro and yen have seen significant declines.

The euro’s share of global payments has dropped from 22% in the mid-2000s to 14.5% by the end of 2023. Its presence in central bank reserves has also decreased from 25.3% in the late 2000s to 19.75% in 2023.

The Japanese yen has fared even worse, with its share of global payments falling from 12% in the mid-1990s to under five percent in 2023, while its central bank reserves have shrunk from six-point-two percent to just over five percent in the same period.

These shifts suggest that reliance on the ‘principle four currencies’ the US dollar, yen, euro and pound is waning globally.

VanEck posits that this diminishing dependence opens the door for Bitcoin to fill the gap in the years ahead.

De-dollarization and the emergence of a new IMS

VanEck’s analysis also highlights a significant shift tied to de-dollarization.

Although the US dollar remains a dominant global reserve currency, many nations are gradually moving away from it a trend known as de-dollarization.

Several factors are driving this transition, including the following.

- The US dollar becoming increasingly expensive for emerging economies

- Changes in oil demand and trade relations with the Gulf countries

- Geopolitical events the most critical being the Russia-Ukraine conflict

This gradual distancing from the US dollar is paving the way for a new IMS. According to VanEck’s research, the Chinese Yuan Renminbi) has seen its value double over the past year.

Countries such as Saudi Arabia, Brazil and Russia are increasingly using RMB for international trade in place of the US dollar.

Moreover, emerging economies are favoring local currencies over the US dollar. For instance, India is now purchasing oil using INR (Indian Rupees) and settling trade with Malaysia in INR.

Disruption in traditional international currency reserves

The transition away from the traditional IMS has disrupted global currency reserves. VanEck projects that by 2050, there will be a rise in bilateral trade agreements and a more significant role for the Chinese RMB.

Additionally, emerging market currencies could account for three percent to seven-point-five percent of central bank reserves over the next 25 years.

As reliance on dominant reserve currencies diminishes, VanEck foresees Bitcoin’s share of global reserves climbing to two-point-five percent.

The firm also predicts Bitcoin’s role in international and domestic trade will increase, capturing 10% and five percent of market share, respectively.

Bitcoin emerging as a new reserve currency

In this evolving IMS, Bitcoin is likely to emerge as a new reserve currency for global economies.

VanEck asserts that most emerging markets lack the stability or influence to achieve reserve currency status.

While some countries may lean on China and other emerging powers, those wary of suboptimal reserve options might turn to Bitcoin.

VanEck identifies several advantages that Bitcoin offers as a reserve currency, including the following.

- Unchallenged monetary policy

- Neutrality

- Adequate property rights

- A lack of government bias

Bitcoin’s decentralized, neutral structure allows for transparent, software-driven algorithms rather than politically influenced decision-making, making it an attractive option for reserve status.

Valuing Bitcoin in 2050

VanEck’s Bitcoin valuation model for 2050 is based on three key factors Bitcoin’s velocity, the GDP of trade (both domestic and international) settled in BTC and the actively circulating Bitcoin supply.

Their analysis assumes Bitcoin will become integral to the global financial system, taking market share from the traditional ‘principle four’ currencies that currently dominate global reserves.

The research starts with the world’s GDP in 2023 and projected growth rates, factoring in a 20% decline in the market share of the existing major currencies.

It also includes an increase in Bitcoin’s role in global trade, as discussed earlier, which includes five percent of domestic and 10% of international transactions.

The valuation further incorporates predictions that central banks will hold two-point-five percent of their assets in Bitcoin by 2050, with 85% of Bitcoin removed from circulation due to its store-of-value appeal.

Assuming a Bitcoin velocity similar to the US average VanEck’s analysis concludes that Bitcoin’s base value could reach $2.9 million by 2050, representing one-point-six percent of the world’s financial assets.

While the bearish scenario pegs Bitcoin’s value at $130,314, the bullish outlook sees it skyrocketing to an eye-watering $52 million per coin.

Could the price of Bitcoin really go to zero

While forecasts like VanEck’s paint a picture of Bitcoin reaching extraordinary heights, there’s a strong counter-narrative from prominent voices who predict the exact opposite Bitcoin crashing to zero.

Despite the enthusiasm around crypto, influential figures like Jim Rogers and Charlie Munger are openly skeptical, dismissing Bitcoin’s long-term viability.

Jim Rogers he skeptical investor

Jim Rogers, a renowned investor and global finance authority, is notably pessimistic about the future of cryptocurrencies.

At the India Today Conclave, he expressed his doubts, stating that he doesn’t believe cryptocurrencies, including Bitcoin, have lasting value.

He argues that real, tangible commodities like sugar and rice have more inherent value than digital assets.

Rogers said,

“I have more confidence in real things that people can use than in Bitcoin.”

He predicted that Bitcoin could eventually “disappear and go to zero.”

Rogers favors traditional safe-haven assets like gold and silver, arguing that while people understand these physical stores of value, they remain largely unfamiliar with and distrustful of Bitcoin.

When asked about his own crypto investments, he bluntly stated that he holds none.

Charlie Munger n outspoken critic

Another staunch critic is Charlie Munger, vice chairman of Berkshire Hathaway.

Known for his sharp, no-nonsense views, Munger has repeatedly slammed Bitcoin, labeling it “stupid” and “evil” during Berkshire Hathaway’s annual meeting.

He, along with CEO Warren Buffet, warned that Bitcoin undermines established financial systems like the Federal Reserve and national currencies.

Munger is unequivocal in his prediction Bitcoin’s value will likely hit zero.

Munger’s concerns are rooted not just in financial logic but also in broader social impacts. He believes Bitcoin fuels speculative bubbles and promotes a “tribal” mindset among investors, leading to irrational behavior.

A more nuanced critique conomic and regulatory risks

Beyond these prominent voices, there are additional reasons why Bitcoin’s value could potentially collapse. One significant concern is regulatory intervention.

As governments around the world grapple with how to control or integrate cryptocurrencies into their financial systems, stringent regulations could severely impact Bitcoin’s adoption and market value.

For instance, if major economies impose strict restrictions on cryptocurrency trading or mining, demand could plummet.

CBDCs (central bank digital currencies)

As more countries experiment with their own digital currencies, Bitcoin could face obsolescence in certain markets where government-backed alternatives are preferred.

Additionally, Bitcoin’s extreme price volatility and scalability issues continue to be barriers to mainstream adoption.

If these challenges aren’t resolved, it’s possible that trust in Bitcoin could erode over time.

$52 million versus zero dollars here does the truth lie

The debate between Bitcoin reaching astronomical values like $52 million or plummeting to zero highlights the deep uncertainty surrounding the future of this digital asset.

The truth likely lies somewhere in between these extreme scenarios. Bitcoin has proven resilient over the past decade, surviving multiple crashes and regulatory crackdowns.

However, it’s important to remember that Bitcoin’s price is heavily driven by speculation and investor sentiment, making it inherently volatile and unpredictable.

VanEck’s bullish projection assumes a near-perfect scenario where Bitcoin captures a significant share of global financial assets but this is far from guaranteed.

To put this into perspective, if Bitcoin were to reach $52 million per coin, its market cap would balloon to a staggering $1.1 quadrillion far surpassing the total value of the world’s leading companies and financial systems.

Such growth would require unprecedented levels of global adoption and trust in Bitcoin, a feat that seems improbable given the current market dynamics.

On the flip side, while Bitcoin’s critics foresee a collapse, it’s worth noting that similar doomsday predictions have been made since its inception yet Bitcoin remains a major player in the financial landscape.

The likelihood of Bitcoin going to zero, while not impossible, is mitigated by its growing institutional adoption, technological innovations and the establishment of its role as ‘digital gold’ among certain investor groups.

To be realistic, let us compare this claim with the value of Nvidia, Microsoft and Apple the three most valuable companies currently in the global market.

In 2024, the total market capitalization of these three companies is a little over $3 trillion.

Let us focus on Apple. The company is going strong and is bound to grow in the years to come. According to a forecast by CoinCodex, the Apple stock may reach $2,383 by 2050, gaining 1,211%.

This stock price will push Apple’s value to $61 trillion in 2050 roughly 20 times what it is today.

Now, if we compare this with the prediction of BTC reaching $1,100 trillion by 2050, something doesn’t feel right.

It does not seem likely for Bitcoin to surpass one of the highest-valued companies in the world by such a big margin.

Having said that, while such predictions are unlikely, they are not impossible. As an investor, you should always keep yourself informed and prepared for the unexpected.

The world has seen a plethora of miracles no stats predicted.

The bottom line tay rational and informed

The world of cryptocurrencies is fraught with hype, fear and uncertainty. Rather than getting swept up in sensational predictions, investors should approach Bitcoin with a balanced perspective.

Both the ultra-bullish and ultra-bearish scenarios are speculative and should be taken with caution.

Making informed, rational decisions based on thorough research and professional advice is key especially when dealing with an asset as unpredictable as Bitcoin.

As always, the best strategy is to diversify your investments, assess your risk tolerance and avoid making decisions based solely on extreme market narratives.

Cryptocurrencies can offer significant returns, but they can also lead to significant losses. Be mindful of the risks and exercise caution when navigating this volatile market.

Rahul Ka is a business consultant and a tech aficionado decoding the digital frontier one innovation at a time, from blockchain breakthroughs to tech startups.

Follow Us on Twitter Facebook Telegram