Bullish Trend Set for Pause

Image © Adobe Images

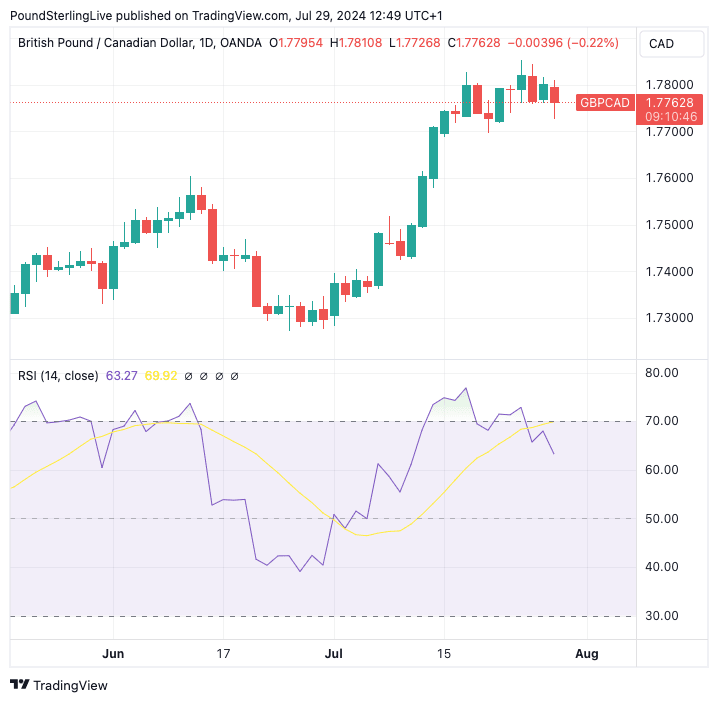

The Pound to Canadian Dollar exchange rate retains a constructive setup, but the coming week could see some of the recent moves retraced as investors account for a potential Bank of England interest rate rise on Thursday.

Markets see a rate hike as 58% likely, up from around 40% just one week ago.

The rise in expectations has coincided with a stalling in GBP/CAD’s uptrend, which topped out at 1.7852 last Wednesday.

We expect the pullback to deepen should the Bank proceed with a cut, but we would expect weakness to ultimately be relatively limited in scope as the Bank will likely caution that future cuts aren’t guaranteed.

A cut, alongside no clear commitment to cut interest rates any further, would be interpreted as a ‘hawkish’ cut that can allow GBP/CAD to restart its uptrend in the coming days and weeks.

“GBPCAD retains a bullish undertone,” says Shaun Osborne, Chief FX Strategist at Scotiabank. “The weekly chart highlights the GBP’s progress over the past few months, leaving spot within reach of the 1.79/1.80 area—last seen in 2020/21.”

Osborne says short-, medium- and long-term trend momentum signals are leaning bullish and the GBP’s progress through trend resistance (off those 2020 and 2021 highs) suggests more progress is likely in the pound in the medium term.

Track GBP/CAD with your custom alerts; find out more here

“It also suggests that scope for short-term counter-trend corrections is limited to the 1.7350/1.7450 range,” he says.

From a tactical perspective, Osborne thinks minor dips in the cross look like a buy.

“Weakness below the 1.73 area (support defined by former trend resistance sits at 1.7290 currently) would signal more significant downside movement, however,” he adds.

Source link