Currency Chaos: A Look at the Lira, Argentine Peso, and Ruble

It’s already looking like it could be a dramatic year for the US dollar, and a good time to check in on a few of the major troubled currencies around the world: the Turkish Lira, Argentine Peso, and Russian Ruble.

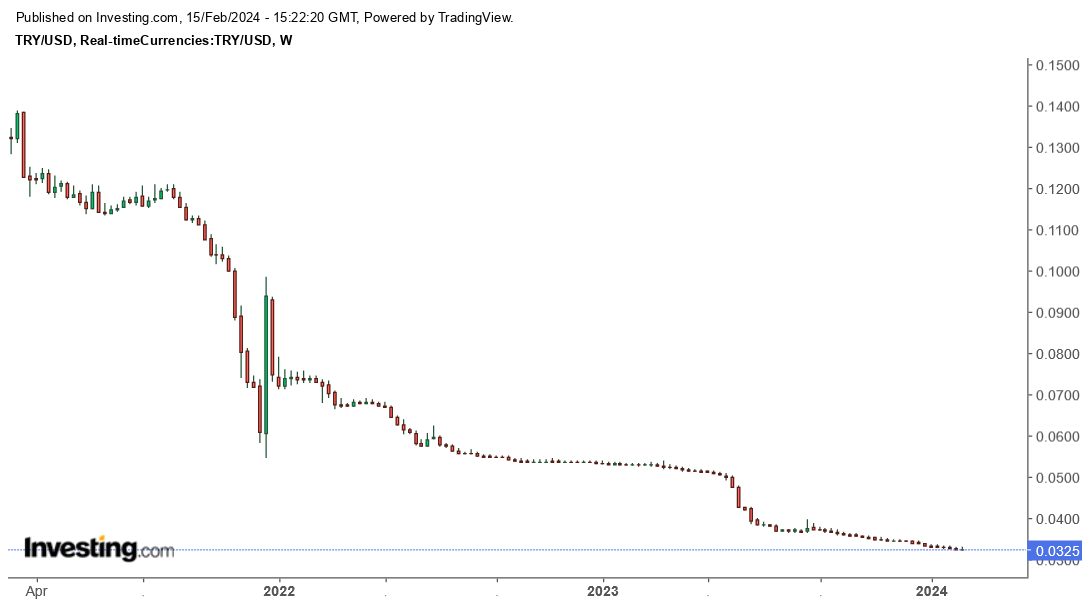

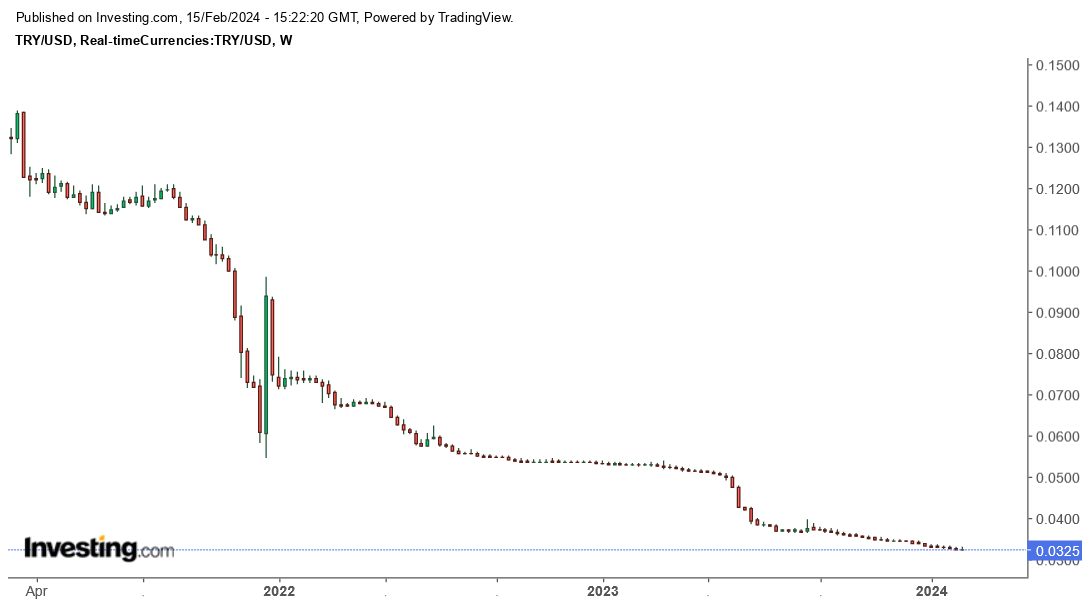

The Lira hit a new low against the US dollar last month, with the Turkish central bank scrambling to contain dramatic double-digit inflation numbers by tightening interest rates.

President Erdogan has referred to interest rate hikes as the “mother of all evil,” but has been forced to do an about-face. Turkey is a living example of the lose-lose realities of having a central authority that pulls the levers on a currency according to their whims. With inflation hitting almost 65% in January, Ankara has few options other than to raise the cost of borrowing.

Turkish Lira/USD

But even if rate hikes have the intended effect of bringing inflation down, it leaves Ankara with no choice but to eventually swing back in the other direction when inflation cools and they want to stimulate borrowing again. In the best case, central banks are trapped in an eternal cycle of booms and busts of their own making. Eventually, the currency is destroyed. But unlike the USD, the Lira doesn’t have the benefit of being a global reserve currency protected by petrodollar supremacy and US military might.

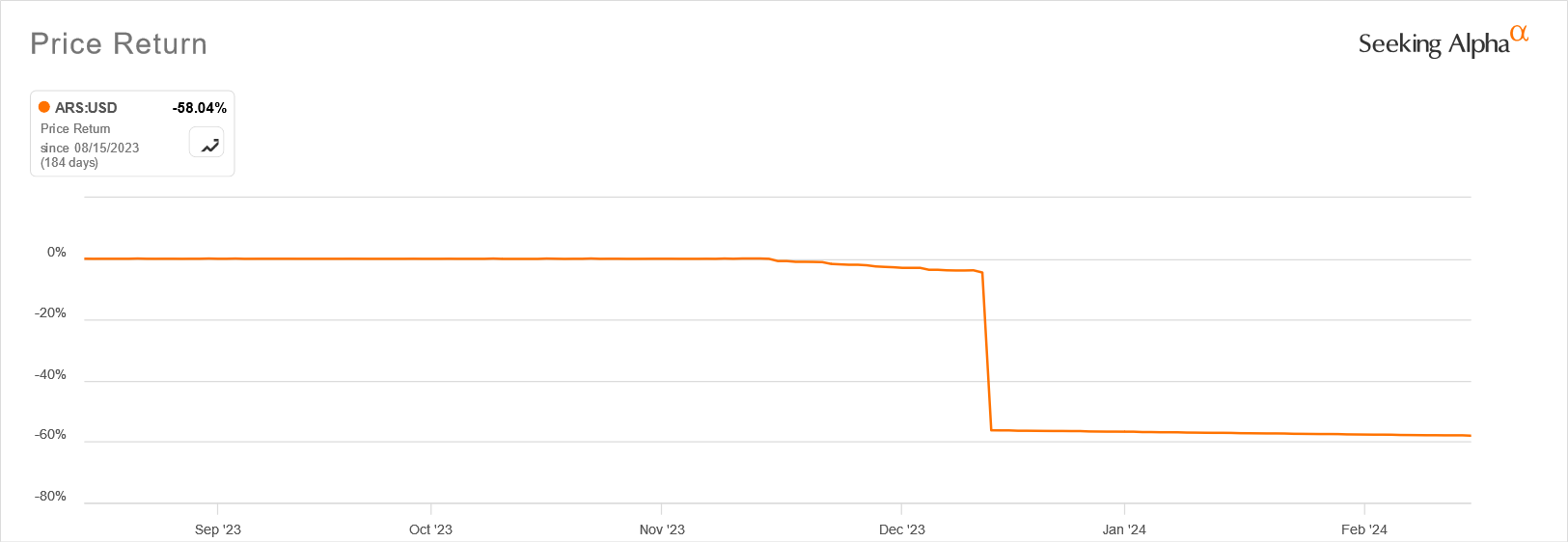

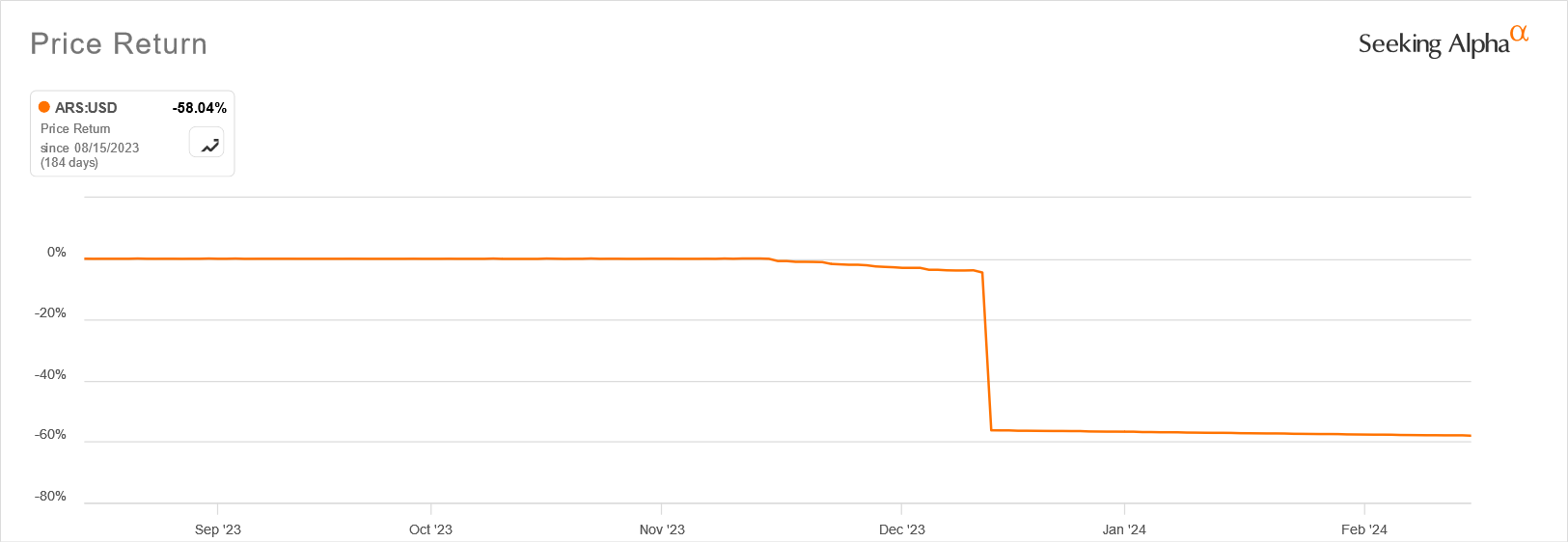

Speaking of evil, all eyes are on Argentina’s new “Anarcho-Capitalist” president Javier Milei, who painted his campaign with colorful diatribes against the wickedness of central planning. He repeatedly promised to “burn down” the Central Bank of Argentina and dollarize the economy amid an inflationary crisis, but has since softened many of his stances and become more pragmatic as the legality and political viability of his proposals have been challenged.

Of course, runaway inflation can’t be cooled overnight, regardless of the methods. Milei has urged Argentines to give him 24 months to bring it meaningfully down, and rather than racing to “dynamite” the central bank as promised, he now says it will be shut down “sooner or later.”

Milei appointed Deutsche Bank alumnus Santiago Bausili as the new central bank chief, a far more middle-of-the-road conservative than Milei’s anarcho-capitalist label. Of course, there would be severe economic and political consequences for shutting down the bank haphazardly, so a dose of post-election pragmatism is no surprise.

As for the peso, Milei and Economy Minister Luis Caputo are slashing spending and devaluing the currency by at least 50%, hoping to boost exports. The peso has been down since Milei has taken office but still has a way to go before reaching the 50% mark.

Argentine Peso/USD Before and After Milei Took Office

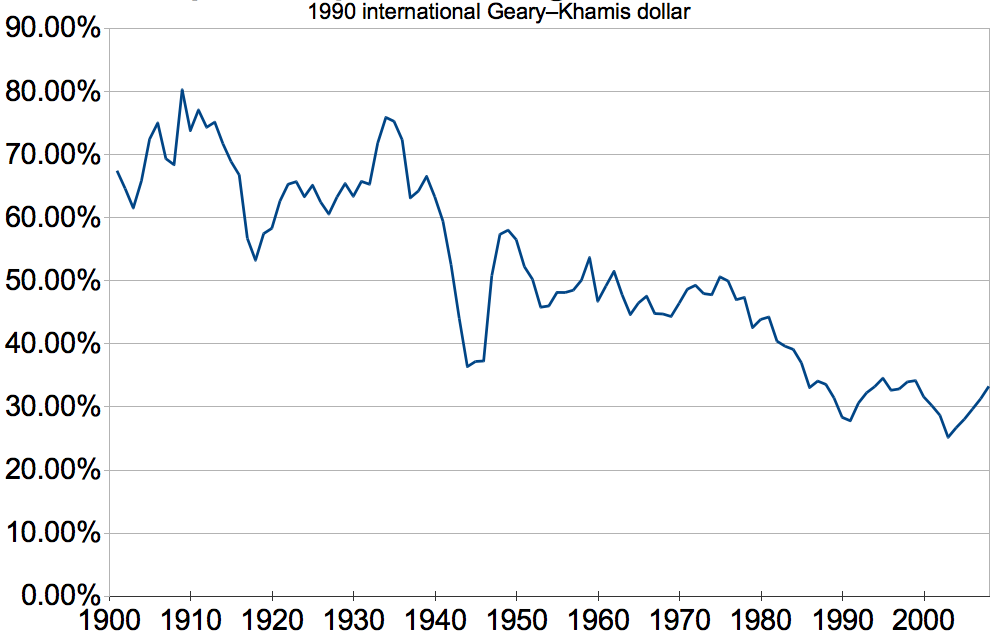

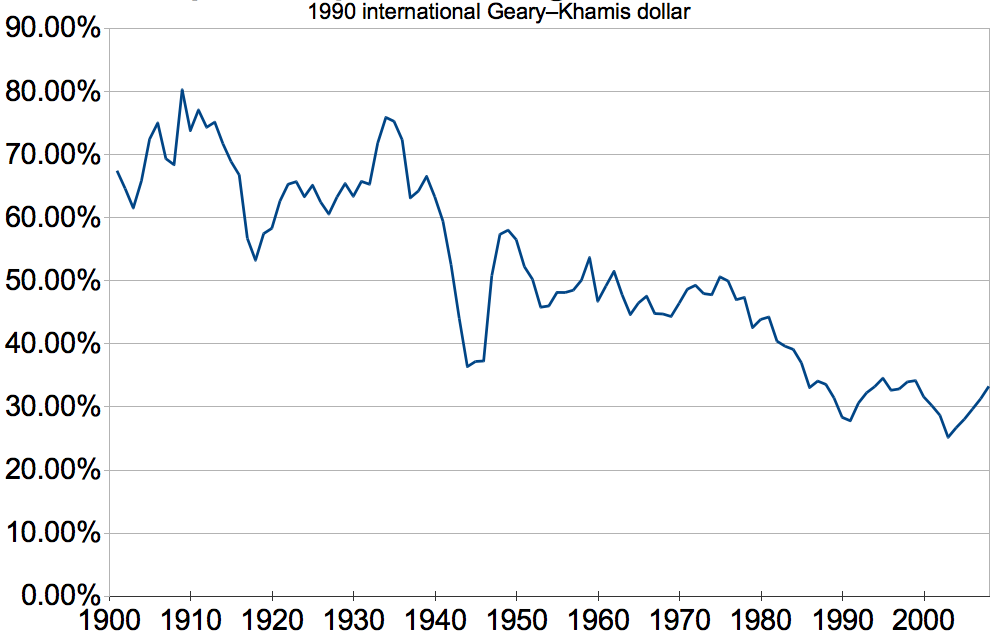

For Milei’s part, the administration acknowledges that shorter-term pain is bound to arise from so many policy shocks to the economy. The question is whether or not the measures will be enough to avoid a full-blown hyperinflationary collapse like what happened to the peso in 1989-1990. The country has seen a dramatic fall from its reign as one of the world’s most prosperous economies during the late 19th and early 20th centuries.

GDP per capita of Argentina, % of US

A similar fall may eventually become an economic reality in the United States if we continue on our current path. As Peter Schiff said on his podcast late last year,

“The laws of physics work in America the same way they work in Argentina. Economics are laws. We have the same consequences.”

Now let’s look at the Russian ruble, an interesting case in the context of its renewed war with Ukraine and a time of increased general tensions with NATO. Since 2022 when war broke out, the ruble had an initial crash and recovery and has since been on a downward trend.

Russian Ruble/USD Since the Start of the Ukraine War

In response, Moscow imposed capital controls and the central bank has been raising rates to tame inflation amidst Western sanctions, increased military spending, domestic demand for goods outpacing production, and a shortage of workers as young men are sent to fight. Moscow has a major challenge on its hands trying to finance a continuing war effort without letting inflation get even more out of hand.

However, being slapped with sanctions has motivated Russia to ramp up trade with Asia — especially China. Economic sanctions provide further motivation for Russia to continue to reduce its dollar dependence along with other BRICS nations. As de-dollarization trends continue, it contributes to downward pressure for the USD on foreign exchange markets and accelerating inflation in the US. If freshly printed dollars have fewer places to flow around the world, more of them will be left to slosh around in the domestic economy and erode their purchasing power.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!