Dollar Slides as Trade-War Risk Drives Investors to Other Havens

(Bloomberg) — The dollar slid Tuesday as concerns about the economic fallout of the US-sparked trade war pulled down Treasury yields and sent stock prices tumbling, driving investors into overseas havens.

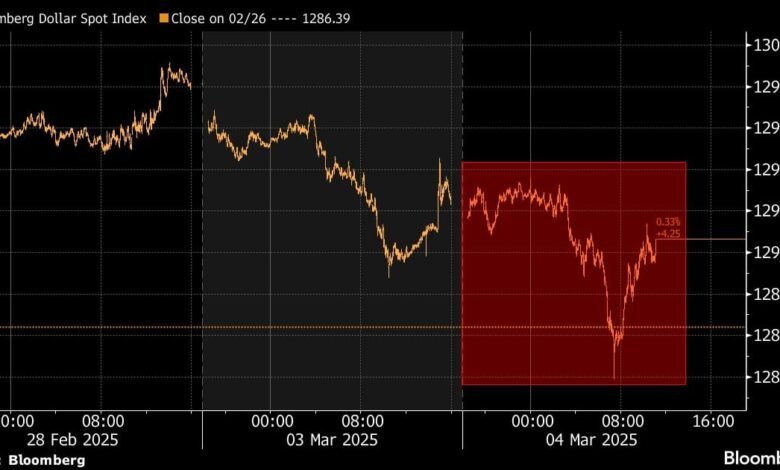

The Bloomberg Dollar Spot Index weakened as much as 0.7% to hit the lowest in a week before paring the drop. Stocks got hit across the board as concerns about global economy spurred a flight to gold and haven currencies, including the Swiss franc and Japanese yen.

“The market is thinking about the negative impacts of tariff uncertainty to the US economy, and the traditional haven bid on the dollar is being questioned,” said Sarah Ying, head of FX strategy at CIBC Capital Markets. “We are in between a thematic shift: the market is pivoting from being systematically bullish to bearish US dollars.”

President Donald Trump made good on his vows to hit Canada and Mexico with sweeping import levies and doubled an existing tariff on China, prompting swift retaliation.

The prospect of an escalating trade war is coming just as the US economy is losing steam. That’s driven a growing number of investors to bet that the dollar will weaken as the Fed resumes cutting interest rates within the next few months.

The Swiss franc rose 0.8% and the yen advanced 0.5% against the dollar, leading advances among peers in the Group of 10. The Canadian dollar weakened slightly, down about 0.1% against its US counterpart.

The false start on Canada and Mexico tariffs last month, however, have cast some doubts on whether the levies will remain in place — or be rolled back after negotiations.

“The initial market moves suggest that investors are not convinced that the tariffs on Mexico and Canada will be durable, or the start of more significant trade disruptions,” Goldman Sachs Group Inc. strategists including Michael Cahill and Stuart Jenkins wrote in a note. “As a result, investors have instead seen initial moves as a way to position for what has been the main market narrative in recent weeks—US underperformance.”

Still, the uncertainty has stoked worries among consumers that inflation will remain elevated, or even rise further, surveys show. US consumer confidence fell in February by the most since August 2021 on concerns about the outlook for the broader economy.

“The economy is much less exceptional today than it was a year ago,” said Ed Al-Hussainy, global rates strategist at Columbia Threadneedle Investments.

To Deutsche Bank AG, the events of the past days point to a risk that the US currency is losing its traditional safe-haven status. Strategists at the bank cite “the speed and scale of global shifts” as well as “broader US uncertainty” for the move in this direction.

The “market is starting to believe that US exceptionalism is over,” said Brent Donnelly, president of Spectra FX Solutions LLC. “The US role in the world is under threat.”

–With assistance from Greg Ritchie.

©2025 Bloomberg L.P.

Source link