Dollar-Yen Can Hit 160 if the Ascent is Slow

Image © Adobe Stock

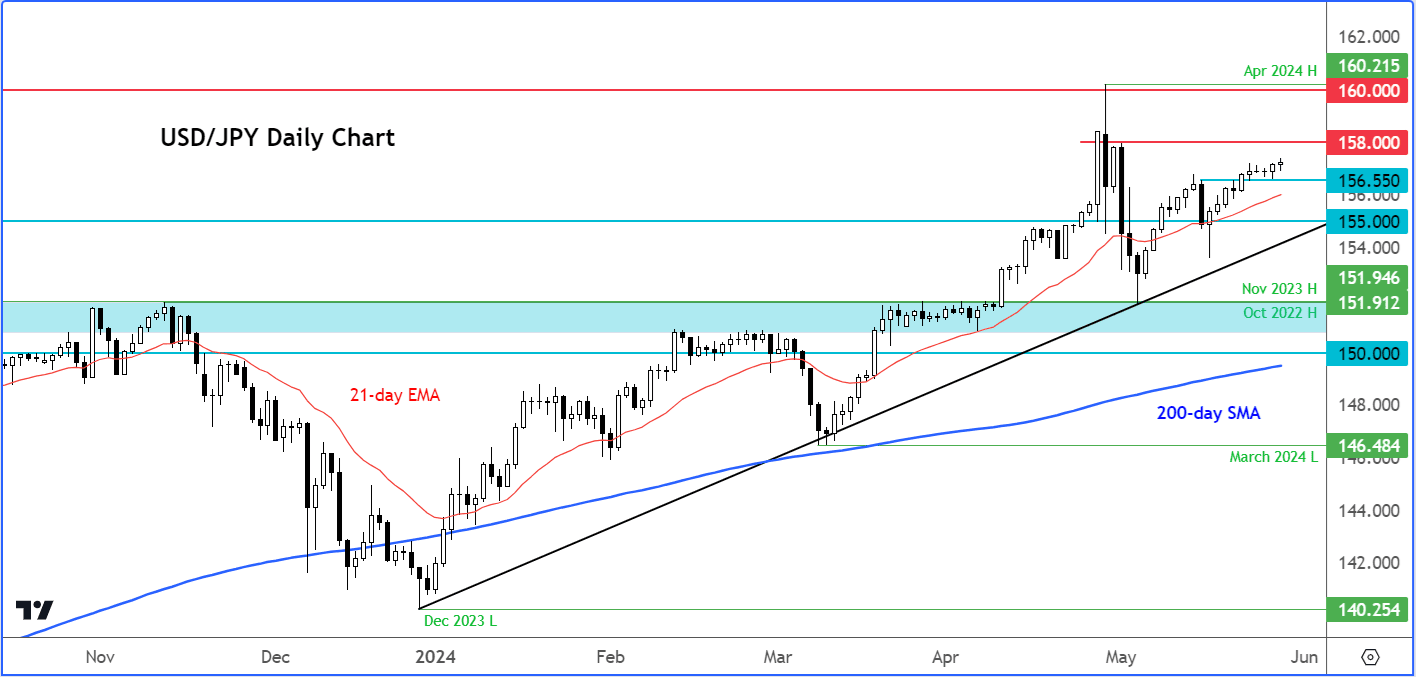

The USD/JPY is nearing intervention territory as it climbs above 157.00. Are we going to see a re-test of 160.00? asks Fawad Razaqzada, Market Analyst at City Index and FOREX.com.

The US dollar has been strengthening again, following a surprise rise in US consumer confidence for May, strengthening bond yields, and ongoing Fed hawkishness. Our short-term USD/JPY forecast remains bullish amid the BoJ’s current policy stance, the USD/JPY strong bullish trend and the US dollar’s overall robustness.

At north of 157.00 handle, the USD/JPY has now entered FX intervention zone, although the slow grind argues against such a move given that Japan has made it clear that it is more concerned with the speed of the yen’s depreciation rather than the specific level at which it trades.

Therefore, we might not see any action until the USD/JPY potentially reaches 160.00. The faster it potentially gets there, the more likely we will see an intervention.

At the end of last month, we saw the USD/JPY plunge by 5 big figures after Japan’s Ministry of Finance with the help of Bank of Japan evidently sold billions of dollars from its reserves. Then, the high was just above the 160.00 handle, too.

The USD/JPY remains a strong bullish trend as indicated for example by price remaining comfortably above the 21-day exponential moving average.

What’s more, the USD/JPY has been making interim higher highs and higher lows ever since it fell from that 160.00 handle following the Bank of Japan’s suspected intervention at end of April.

In terms of support levels to watch, the first one is seen at around 156.55 which was resistance before. Below that, 156.00 comes into focus where the 21-day exponential moving average comes into play. Then, it is the 155 handle, which is the last major key support which also ties in with the bullish trend line.

On the upside, there’s not much resistance seen until 158.00, which was the high from 1st of May when the dollar-yen dropped evidently on the back of the second round and intervention from the Bank of Japan.

Above this level, 160.00 comes into focus, which is just below the April’s high of 160.21.

Source link