DXY turns lower, US Nonfarm Payrolls eyed

Entering a consolidative phase?

The renewed upside momentum in the Greenback lifted the USD Index (DXY) back above the 105.00 barrier earlier in the week, although that move lacked follow-through as the week drew to a close, leaving the index navigating in the negative zone and fading the positive performance of the previous week.

Focus remains on data and Fedspeak

The Dollar’s weekly developments transited a bumpy road after collapsing to the 104.00 neighbourhood in the first half of the week, only to bounce markedly afterwards and eventually return to the bearish trend in the last couple of sessions, despite reclaiming the area beyond the 105.00 hurdle.

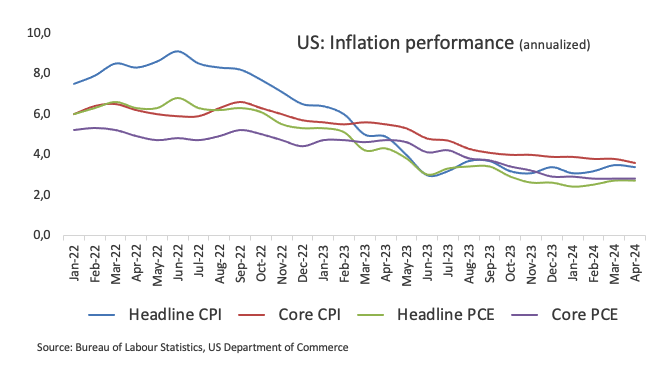

Although a rate hike by the Federal Reserve (Fed) in the next three meetings is seen with marginal probability, it still remains on the table, bolstered by hawkish Fedspeak, sticky inflation, and unabated tightness in the labour market. The release of another revision of Q1 GDP figures showed some loss of momentum in US economic activity, although nothing that was not anticipated.

Back to inflation, it is worth noting that the headline Personal Consumption Expenditure (PCE) Price Index matched estimates in April, rising by 2.7% over the last twelve months and by 2.8% YoY when it came to the Core PCE.

Overall, the CME Group’s FedWatch Tool now predicts a roughly 50% chance of lower rates in September, influenced by the hawkish tilt from the FOMC Minutes and the tighter-for-longer narrative around the Federal Reserve. Additionally, nearly 15 bps of easing are expected at the September 18 meeting, compared to about 35 bps in December.

Fed officials remained cautious

Bolstering the prospects of a resilient Dollar in the next few months, Fed policymakers maintained their prudent stance throughout the week: Minneapolis Federal Reserve Bank President Neel Kashkari suggested that the Fed should wait for significant inflation progress before considering interest rate cuts. He even suggested raising rates if inflation doesn’t decrease further. Additionally, Federal Reserve Bank of New York President John Williams stated there’s no immediate need to cut interest rates, stating the Fed has the flexibility to gather more data before making policy changes. Furthermore, Chicago Fed President Austan Goolsbee said further inflation improvement might lead to higher unemployment, while Dallas Federal Reserve Bank President Lorie Logan believes inflation is on track to reach the Fed’s 2% target.

US yields regain upward trend

The USD’s weekly performance aligned with a rangebound theme in US yields across various timeframes, driven by a changing macroeconomic backdrop that diminished rate-cut bets for the September meeting. That said, yields maintained their price action around the upper end of the monthly range.

G10 Central Banks: Anticipated rate cuts and inflation dynamics

Looking at broader trends among G10 central banks, the European Central Bank (ECB) is expected to cut rates next week, although uncertainty keeps running high regarding subsequent rate cuts. The Bank of England (BoE) is likely to reduce rates in the last quarter, while the Fed and the Reserve Bank of Australia (RBA) are expected to start easing at some point by year-end.

Upcoming key events

Next week, the release of May’s Nonfarm Payrolls will take centre stage, followed by the ADP report and the ISM Manufacturing and Services PMIs.

Technical analysis of USD Index

The USD Index (DXY) appears somewhat consolidative between 104.00 and 105.00 for the time being. In case the index breaks above the weekly high of 105.74 (May 9), it could then attempt a move to the 2024 peak of 106.51 (April 16). Breaking this level might lead to the November high of 107.11 (November 1) and the 2023 top of 107.34 (October 3). Conversely, renewed selling pressure could bring the DXY back to the May low of 104.08 (May 16). Further declines could see the index test the weekly low of 103.88 (April 9) and the March bottom of 102.35 (March 8). A deeper retracement might target the December low of 100.61 (December 28), the psychological barrier at 100.00, and the 2023 low of 99.57 (July 14).

Looking at the broader picture, the overall bullish bias is expected to persist as long as DXY remains above the 200-day SMA at 104.42.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months’ reviews and the Unemployment Rate are as relevant as the headline figure. The market’s reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Source link