Euro-Dollar Rebounds to 1.09 After Fed Sets Sights on June Rate Cut

Image © Adobe Images

The Dollar fell after the Federal Reserve delivered what markets interpreted as a ‘dovish’ policy update midweek that raised the odds of a June interest rate cut.

The Euro to Dollar exchange rate rose by half a per cent on the day and extended gains into Thursday to quote at 1.0925 at the time of writing.

“The FOMC surprised us with an overall dovish meeting that lowered the bar for a first cut despite ongoing macro resilience,” says Evelyne Gomez-Liechti, Rates Strategist at Mizuho. “Powell clearly said that the Fed may cut earlier if the labour market eases.”

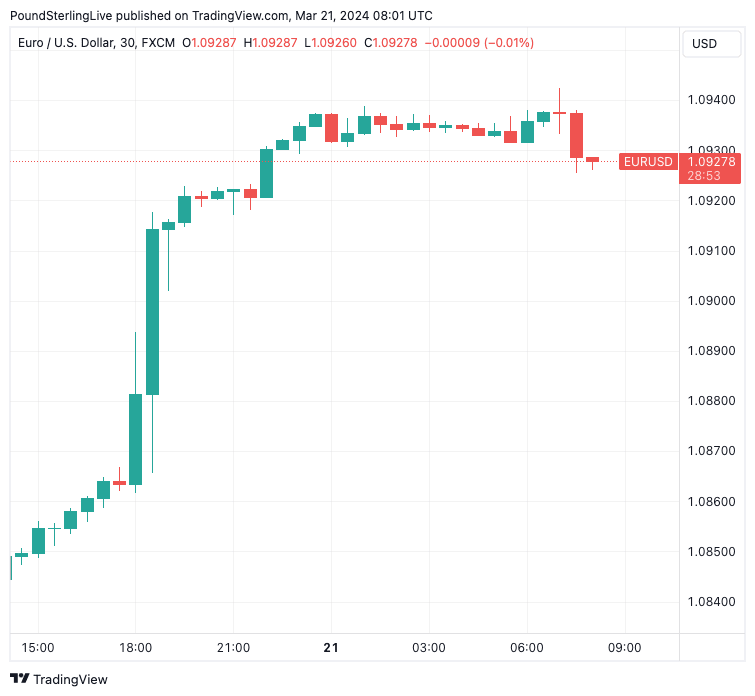

Above: EUR/USD at 30-minute intervals. Track EUR/USD with your own custom rate alerts. Set Up Here

Euro-Dollar had lost value heading into the midweek Fed update, weighed by earlier comments from ECB President Lagarde that confirmed the Eurozone’s central bank was also honing in on a June rate cut.

But the market was clearly nervous that the Fed might turn more ‘hawkish’ and signal it might be in a position to lower rates on just two occassions in 2024, owing to the strong economy and persistent inflation.

This nervousness manifested in the Dollar’s rebound through mid-March and into the runup of the Wednesday event.

“Our reading of dollar price action yesterday was a market positioned for just two Fed cuts in 2024,” says Chris Turner, head of FX research at ING Bank. “Risk assets are bid and the dollar is softer as last night’s FOMC meeting revealed a Fed firmly minded to cut rates even as growth forecasts were revised higher.”

The Federal Reserve left the Fed funds target rate range unchanged and continues to indicate three 25bp rate cuts are the most likely path ahead for 2024. Crucially, its statement was left largely unchanged.

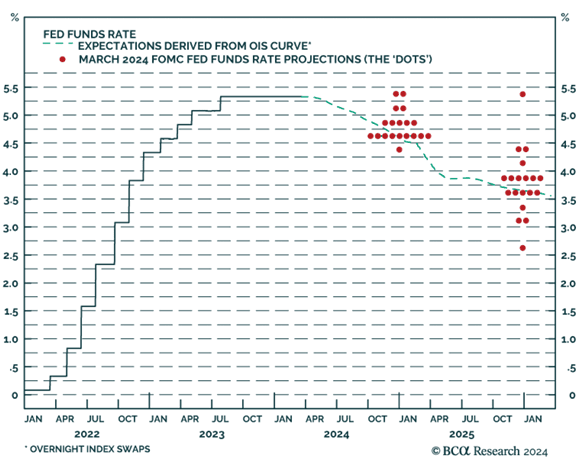

The crucial dot plot chart – which shows individual predictions for the future level of interest rates made by policymakers – shows three rate cuts are still considered appropriate this year.

Above: The market is no longer at odds with the Fed’s own expectations for the future of U.S. interest rates. Image courtesy of BCA Research.

The interest rate projections were largely unchanged despite surprisingly firm U.S. inflation figures in January and February and broader economic resilience elsewhere. The Fed acknowledged this and upgraded its GDP prints and PCE inflation prints.

But Fed Chair Jerome Powell says the policy rate is likely at its peak and that it would be appropriate to begin easing policy back towards a more neutral level “at some point this year”.

Powell also commented that seasonality issues potentially impacted the strong January and February inflation prints, while strong labour data is not seen as a barrier to rate cuts.

Money market pricing shows investors have raised the odds of a June rate cut, with 21 basis points of hikes priced for June, up from 18bp heading into the meeting.

“EUR/USD looks as though it can drift up to the 1.0980/1000 region as European equities also enjoy prospects of a lower trajectory for global policy rates,” says ING’s Turner.

Source link