Euro Weakens against Pound on Dollar on ECB Inflation Forecast Cuts

Above: File image of ECB President Lagarde © Angela Morant/ECB.

The ECB will soon run out of road to argue interest rates must stay at current levels for an extended period.

Euro exchange rates have come under pressure after the European Central Bank released forecasts that show it is on target to bring inflation down to the 2.0% target in timely fashion.

The ECB kept interest rates and official communications unchanged but released new economic projections that included cuts to previous inflation forecasts.

There was a “dovish shift in the staff projections,” says Claus Vistesen, an economist at Pantheon Macroeconomics. “They’re basically reaching target, so why not cut now?”

Cuts to the inflation forecasts mainly reflect a lower contribution from energy prices, said the ECB. It now projects inflation to average 2.3% in 2024, 2.0% in 2025 and 1.9% in 2026. The projections for core inflation (excluding energy and food) have also been revised down and average 2.6% for 2024, 2.1% for 2025 and 2.0% for 2026.

The softer Euro suggests the market interprets the data as confirmation the ECB will soon run out of road to argue interest rates must stay at current levels for an extended period.

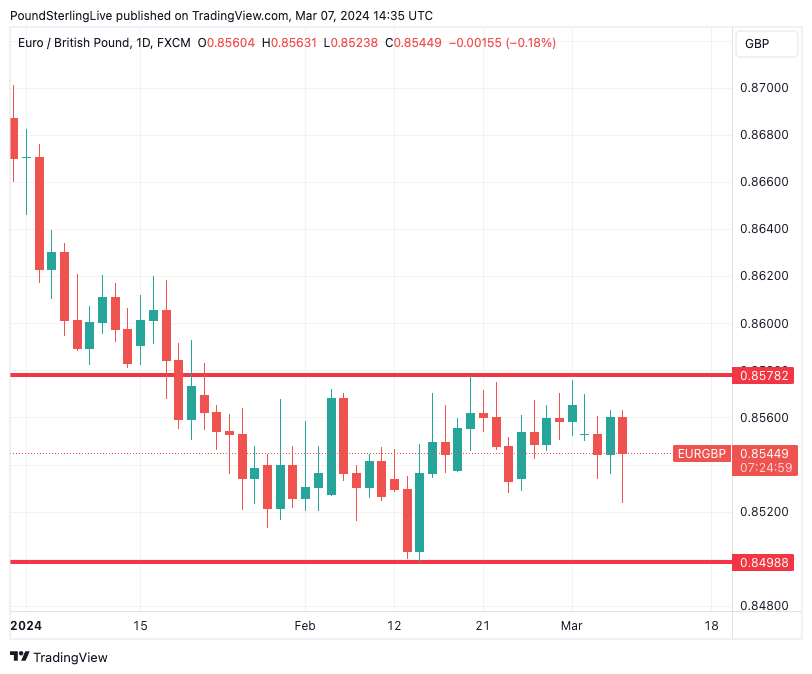

The Euro to Pound Sterling exchange rate slid 0.40% in the early European session to 0.8527 (GBP to EUR @ 1.1727). The Euro to Dollar exchange rate, having breached 1.09 earlier in the day, was back at 1.0890 (down 0.30%).

The ECB does not want the market to raise expectations for a cut, judging that this will work against its efforts to bring inflation down. (Market-implied expectations have an impact on real-world interest rates, meaning lending rates fall when the market ‘prices in’ future rate cuts).

The ECB said in a statement that “most measures of underlying inflation have eased further, domestic price pressures remain high”. It said the 2.0% target would only be achieved if interest rates were “maintained for a sufficiently long duration”.

Above: EUR/GBP ultimately continues to oscillate in the middle of the January-March range. Track GBP and EUR with your own custom rate alerts. Set Up Here

“The ECB’s general economic assessment has not changed, but the latest round of staff projections brought the expected downward revision to growth and inflation forecasts,” says Carsten Brzeski, Global Head of Macro at ING Bank in Germany.

However, the ECB risks its credibility by saying one thing while releasing inflation forecasts that contradict it. In short, the market is calling the central bank’s bluff that it will continue to hold rates at these levels for an extended period when it is clear the inflation battle is being won.

This is all the more pertinent when considering the central bank downgraded its growth forecasts; the Eurozone economy will soon need rates to be cut if it is to recover.

“Given the revisions to the staff forecasts and the modestly changed wording to the statement, the ECB is inching closer to the first rate cut. It won’t surprise the market that the ECB is taking a meeting-by-meeting, data-dependent approach,” says Mark Wall, Chief European Economist at Deutsche Bank.

Source link