How Does a UK Recession Affect the Pound’s Fate?

- BoE maintains more hawkish stance than Fed, ECB

- Despite recession in H2 2023, rate cut bets were not altered

- January data suggests the economy may have turned a corner

- With general elections looming, what’s next for the pound?

UK enters recession in H2 2023

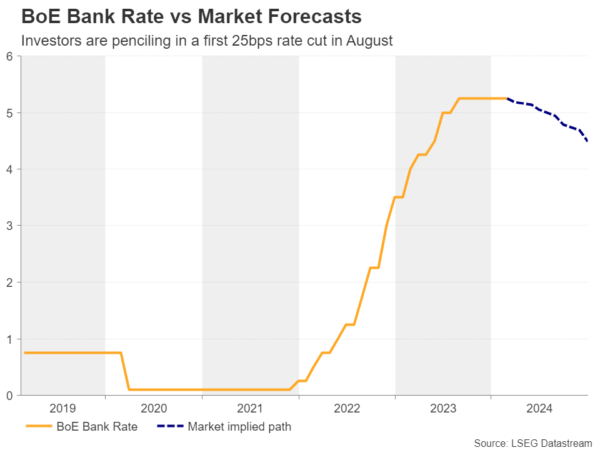

Despite dropping its tightening bias at its February gathering, the Bank of England (BoE) maintained a more hawkish stance than the Fed and the ECB, pushing back against interest rate cuts. At the press conference following the latest decision, Governor Bailey said they are not yet at a point where they can lower borrowing costs, adding that policy needs to stay sufficiently restrictive for sufficiently long.

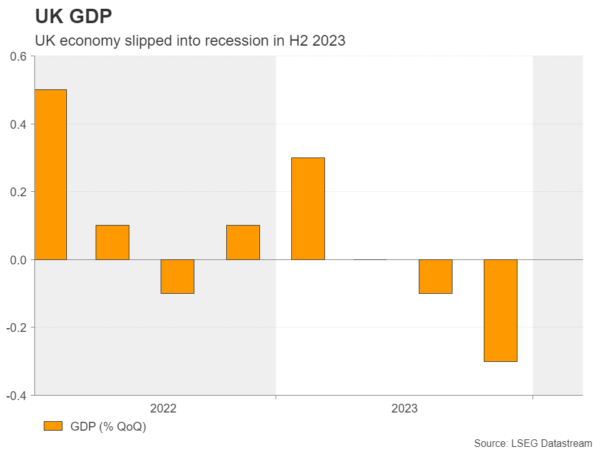

However, this was before last week’s barrage of economic data, with the highlight being the preliminary GDP numbers for Q4, which revealed that the economy contracted by more than anticipated, officially entering a technical recession. This weighed on the British pound, which had already been hurt the day before, after the CPI figures suggested that inflation held steady in January, confounding expectations of a small acceleration.

However, the market’s BoE implied path was not lowered. In other words, investors did not bring forward their rate cut bets. Currently, they are pricing in around 70bps worth of reductions by the end of the year, with the first quarter-point cut penciled in for August. Even after the notable upward adjustment to its interest rate projections regarding the Fed, the market still holds a more hawkish – or less dovish – view about the BoE.

Has the UK economy turned a corner in 2024?

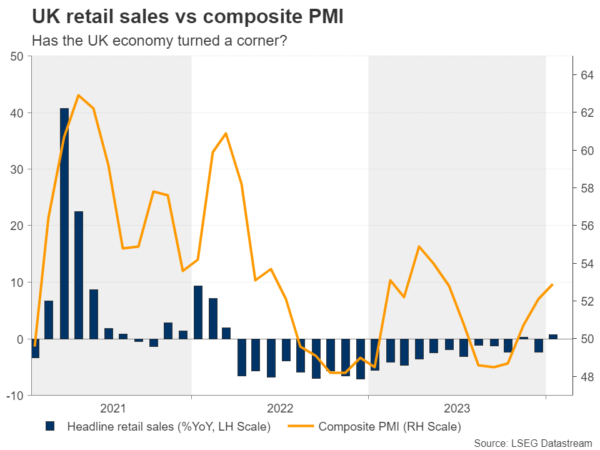

But why is that? One reason may be that, despite the latest slowdown, inflation in the UK remains stickier than other major economies, with the core rate at 5.1%, more than 2.5 times the BoE’s objective of 2%. On top of that, wages have slowed by less than expected, with the rate of average weekly earnings excluding bonuses coming in at 6.2% y/y in December, well above the CPI rates. This still presents some upside risks to the inflation outlook for the months to come. Last but not least, retail sales for January accelerated to their fastest pace in nearly three years, which combined with the improvement in the PMIs for the month, adds to hopes that the economy may have started turning the corner.

The confirmation of a recession in the second half of last year seems to be having more political than economic importance, as it’s a heavy blow to Rishi Sunak’s popularity ahead of an expected general election later this year. Voters appear to have not been convinced that his plan of cutting taxes is working, shifting their trust of the economy to the Labour Party, according to opinion polls.

Just after the GDP data, finance minister Jeremy Hunt said that there were signs the economy is turning a corner and that they must stick to their plan. This means that at least until the election, the fiscal mentality of the government may continue to work against the BoE’s efforts to tackle elevated inflation, thereby prompting the central bank to keep interest rates higher for longer, as officials have been already communicating. Just last Wednesday, BoE Governor Bailey said that he still wanted more evidence that inflation pressures were abating, corroborating the notion that the Bank’s focus remains on price data.

Heading into elections, what’s next for the pound?

With all that in mind, should upcoming data confirm the narrative that the UK economy is growing again, investors are likely to further push back their rate cut bets, which could prove supportive for the pound. Considering also that due to the UK’s twin deficit, the currency has developed a correlation with risk-sentiment, further advances in the equity world could offer an extra help. The opposite may be true if the economy continues to struggle, even with the government abiding by its tax-cut plan.

Having said all that, closer to the elections, which need to be held before January, the uncertainty about the change in fiscal attitude may have a negative impact on sterling. The leading Labour party has been portraying itself as the party of fiscal responsibility and thus, scrapping the Conservative’s agenda may prompt the BoE to start loosening monetary policy sooner.

From a technical standpoint, pound/yen has been trading in a steep uptrend since March 2020. Last week, the pair confirmed a higher high, entering territories last tested back in the summer of 2015, suggesting that the bulls may be willing to continue marching north.

The pair may correct lower should the Japanese authorities step in to support the yen, but the retreat may remain limited and short-lived if the BoJ keeps pushing against speculation of a rate hike soon and if data continues to suggest that the UK economy has turned the corner. The next area to consider as a potential resistance may be at around 195.00, near the highs of July and August 2015. For the outlook of this pair to change, a dive all the way below 178.50 may be needed.

Source link