Markets turn calm, but tests ahead with RBNZ, US CPI

Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

FX markets turn calm after volatile week

Financial markets turned calm by Friday – after the most volatile week since 2020 as measured by the VIX volatility index – but FX markets face further tests this week with US inflation and a potential rate cut from the Reserve Bank of New Zealand.

After a market-wide sell-off on Monday, which saw Japanese stocks suffer their biggest one-day loss since 1987, markets mostly recovered through the week with moderate gains seen on Friday.

The US’s S&P 500 and tech-focused Nasdaq both gained 0.5%.

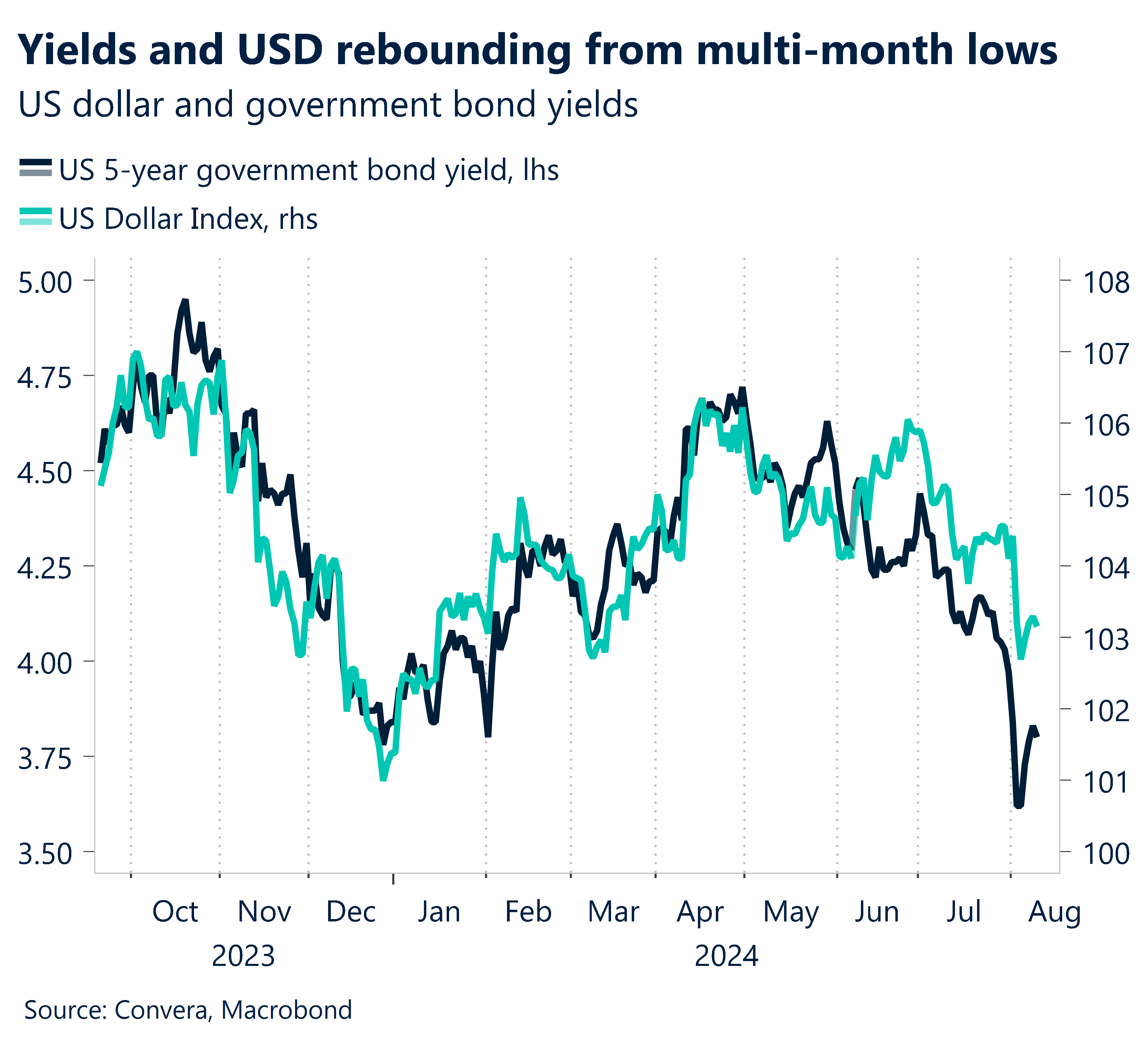

In FX markets, the US dollar mostly eased lower on Friday, after rebounding for most of last week, led by further losses in the USD/JPY, down 0.3%.

The USD/CNH and USD/SGD both fell 0.1%.

Aussie, kiwi’s rallies might be short lived

The Australian and NZ dollars were both lower on Friday after the currencies had staged a mid-week rebound in line with gains in equity markets.

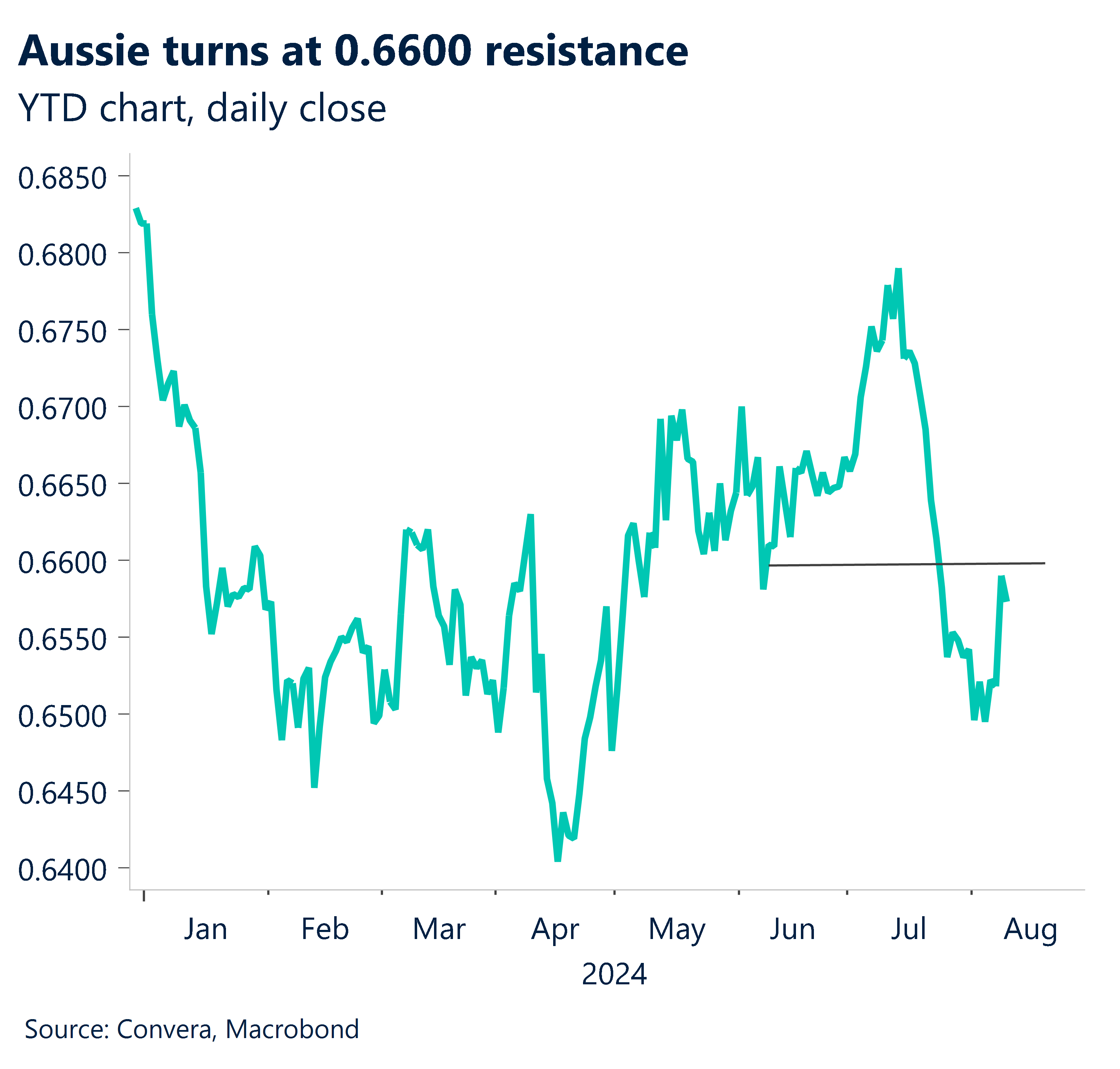

The AUD/USD rebounded from below 0.6400 (on an intra-day basis) to two-week highs at 0.6600 – a more than 4.0% rally over the week. However, the 0.6600 level, which aligns with the 200-day exponential moving average, caused the market to reverse and the pair now faces risk for further losses this week with the AUD/USD below the key 200-day EMA.

The kiwi’s rebound last week was also dramatic – 3.2% from the lows – but the NZD/USD also looks to have formed a short-term top at 0.6035, near the three-week highs and also below the 200-day EMA.

RBNZ, US CPI key

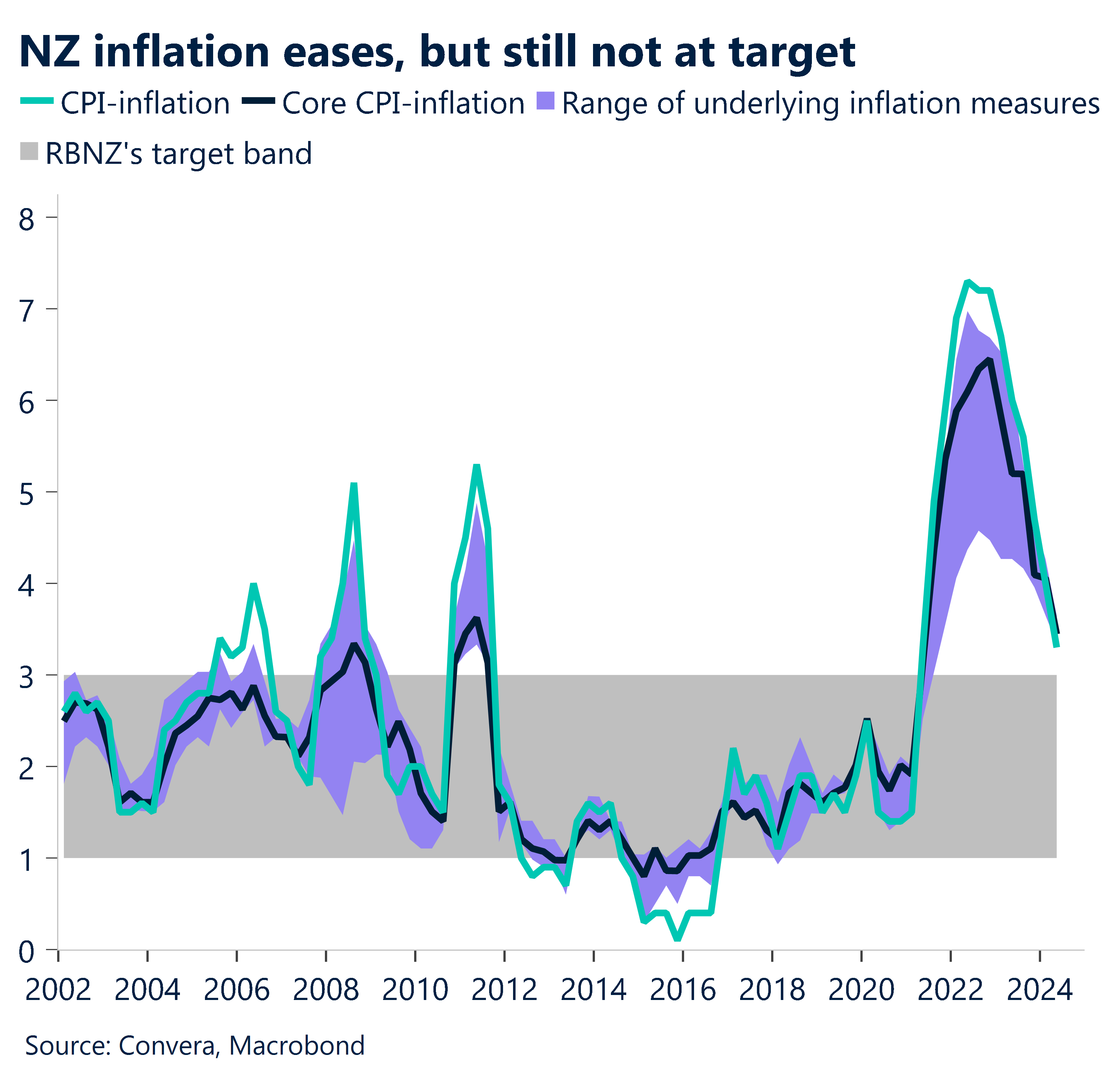

Financial markets face a massive week with the Reserve Bank of New Zealand decision and US CPI as the highlights.

While a small majority of economists expect the RBNZ to remain on hold on Wednesday – 12 out of 21 according to Bloomberg – financial markets are looking for a rate cut with a 73% chance of decrease priced in (source: Bloomberg).

From the US, Wednesday’s inflation number will be key ahead of the Federal Reserve’s September meeting. A higher number might mean the Fed is unable to cut in September and could unsettle markets.

Otherwise, Australian employment, Chinese industrial production and retail sales, and US retail sales, all due Thursday, will also be closely watched.

Aussie, kiwi turn from highs

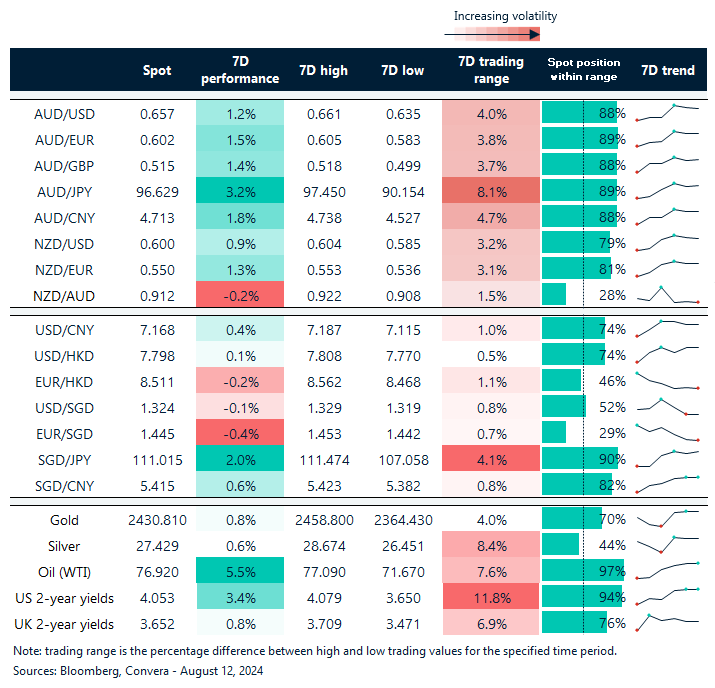

Table: seven-day rolling currency trends and trading ranges

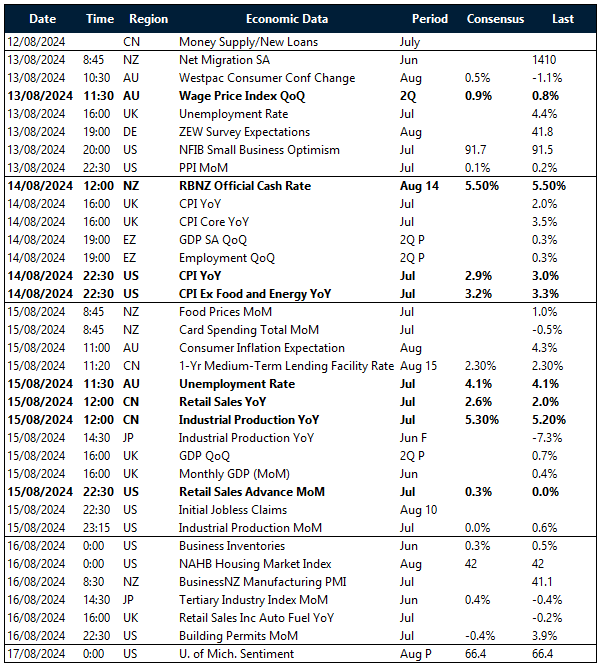

Key global risk events

Calendar: 12 – 17 August

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]

Source link