Pound Appears Vulnerable to a Correction: Convera

Image © Adobe Images

Analyst George Vessey at Convera writes the Pound looks vulnerable to a bigger corrective dip lower.

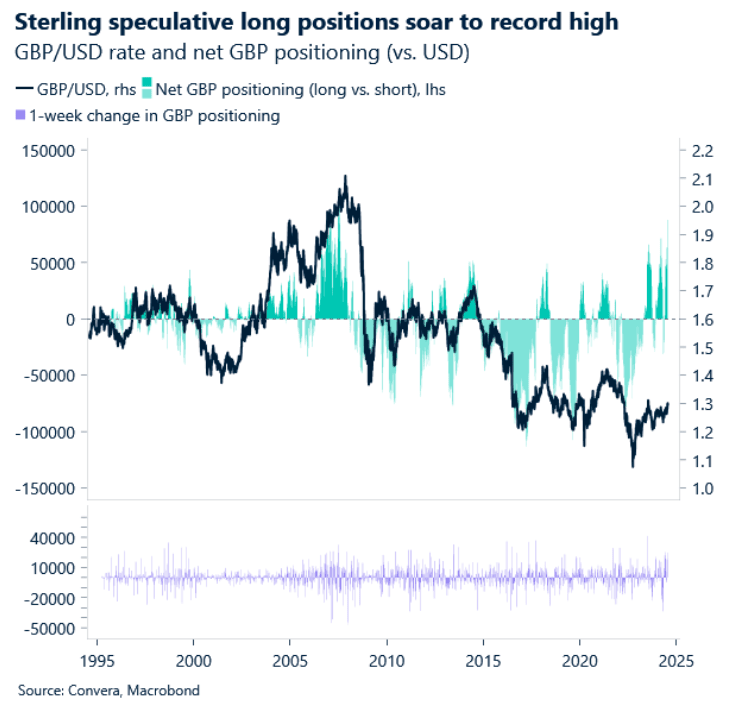

In parallel with GBP/USD stretching to a fresh 1-year high above $1.30 last week, bullish bets in the British currency climbed to a record high last week.

Already we’ve seen a minor correction lower in sterling, but amid the overcrowded GBP speculative positioning leading into the Bank of England’s (BoE) rate decision next week, sterling appears vulnerable at these levels.

Non-commercial traders, i.e. hedge funds, asset managers and other speculative market players, increased their net long position on the pound to an all-time high last week, according to Commodity Futures Trading Commission data.

The positioning reflects the optimism around the UK’s better-than-expected economic performance so far this year, relative political stability with a majority Labour government and the currency’s appeal to carry traders as the BoE has delayed cutting interest rates.

It’s the latter – carry trades – based on the pound’s high yields relative to other currencies, that could be set to uncoil as a period of ambiguous monetary policy beckons in conjunction with the eagerly-watched US presidential election.

Track GBP/USD with your custom alerts; find out more here

FX volatility has been in the doldrums for some time, promoting the carry trade strategy, but if the risk of bigger price swings starts unnerving investors, high yielding currencies with greater sensitivity to risk sentiment – like GBP – will likely feel the pain.

Indeed, with the Fed and BoE meetings due next week, the 2-week implied volatility gauge has jumped to its highest in a month.

Meanwhile, money markets assign a 40% probability of a BoE quarter-point interest rate cut in August, which is another reason for bullish GBP traders to be wary.

Because if the BoE does catch markets off guard with a cut, sterling could weaken sharply. The 200-week moving average at $1.2850 is our first key support level in focus.

Source link