Pound Sterling Struggles Amidst ‘Risk Off’ Market Sentiment

Image © Bank of England

The British Pound is under pressure amidst deteriorating investor sentiment towards Europe and caution ahead of next week’s inflation data release and Bank of England decision.

The Pound to Dollar exchange rate dropped to 1.2713 in sympathy with Euro-Dollar losses linked to French financial and economic uncertainties.

A look at the stock markets shows U.S. indices are in the red, but only marginally, with the marquee S&P 500 within touching distance of record highs.

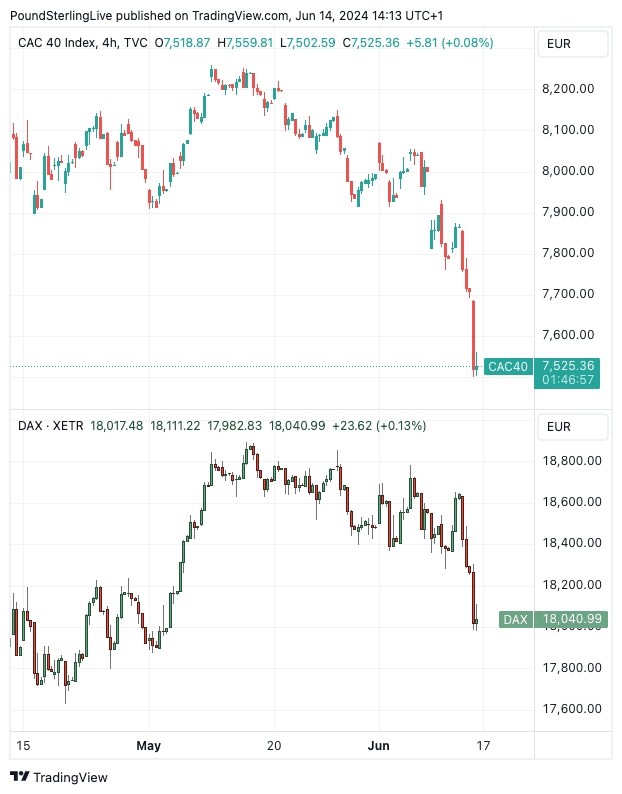

Scanning markets across the Atlantic shows the selloff is deepening, with French (-2.2%) and German stocks (-1.0%) extending recent losses. French bonds have taken a significant hit this week as markets factor in political and fiscal uncertainty.

But it is instructive to note that UK bonds are also selling off, alongside the bonds of other non-German EU nations. Jeremy Stretch, an analyst at CIBC Capital Markets, notes that investors continue to prefer the safety of German bonds to UK ones. “Gilt-Bund spreads have widened around 8bps over the last couple of sessions,” he says.

This is a European-centric risk-off market, i.e. all things Europe appear risky, particularly relative to the U.S., which is keeping the Dollar at the top of the pile while not playing in Sterling’s favour.

Above: German and French markets are taking a hammering.

Other safe havens, such as the Franc and Yen, are also in demand. But we’re also seeing the Pound record losses against commodity currencies such as the Australian, New Zealand and Canadian Dollars, which is not what would see in a typical ‘risk off’ market.

Again, geography is important, and this confirms the Pound is in a neighbourhood that doesn’t look very appealing at present.

It is also important to remember that next week is an important one for the UK, with inflation data and a Bank of England decision due.

“Whilst external factors have been more influential in moving GBP than domestic data and UK election developments, we think markets are underpricing the chance of a Bank of England rate cut this summer,” says George Vessey, Senior FX Strategist at Convera.

The Pound’s strong run thus far in 2024 could be stifled by a softer-than-forecast inflation print and any signal from the Bank of England that it is ready to cut interest rates.

Such developments would result in selling pressure. Investors will ask whether they should risk waiting for the outcome or lock in recent gains.

Source link