Pound to Dollar Rate Ends Week on Sour Note

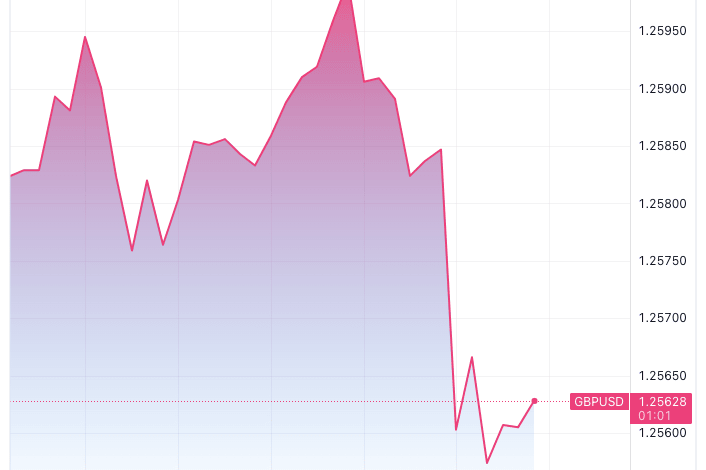

Above: GBP/USD at five-minute intervals.

The Pound to Dollar exchange rate was set to end the week on a sour note following a fresh U.S. inflation reading that pointed to persistent price pressures.

Tuesday saw headline CPI inflation surprise to the upside and it was the turn of the PPI (Producer Price Index) print to surprise in a similar fashion on Friday.

The Pound-Dollar exchange rate was softer by two-thirds of a per cent, as was the Euro to Dollar rate, after headline PPI read at 0.3% year-on-year in January, which was above the 0.1% expected and December’s -0.1%.

“The January 2024 PPI inflation result adds to the angst resulting from January’s upside shock in CPI inflation that pricing pressures pose a comeback threat,” says a note from PNC Bank.

Year-on-year, PPI stood at 0.9% in January, above the 0.6% expected by the market. Excluding food and energy gave a core reading of 2.0%, ahead of the 1.6% expected and 1.7% from December.

“The headline was constrained by a steep drop in energy prices and a modest 0.3% dip in food prices, but all the attention will be on the overshoot in the core,” says Ian Shepherdson, Chief Economist at Pantheon Macroeconomics.

Above image courtesy of Pantheon Macroeconomics.

“To be clear, this is not a story of goods prices being driven up by the problems in the Red Sea; core goods prices rose by only 0.3%, a bit above the trend but well inside the range of the past year. Most of the core overshoot is in domestic services,” he adds.

The market has pushed back the expected timing of the first Federal Reserve interest rate cut to June, but these data threaten to push the data back further, which is supportive of the Dollar.

“PPI inflation for January 2024 posted its first significant increase since September 2023,” says PNC Bank. “Ongoing wage pressures and seemingly insatiable consumer demand on the services side of the economy at least prevent the January 2024 PPI bounce from being dismissed as an outlier out of hand.”

PNC expects the Fed to cut rates this year by a full percentage point in four 25 basis point increments, beginning in May. But economists warn that if January’s inflation results prove more than isolated incidents, that already tame – by market standards – forecast could itself could prove to be too dovish.

As long as market expectations continue to be confounded by the data, the Dollar will likely remain bid.

Source link