Pound to Dollar Rate Spikes on Service PMI Surprise

Image: Photo by Anthony Quintano. Licensing: CC 2.0. Sourced: Flickr.

The Dollar fell across the board after the ISM PMI survey of the services industry showed a slowing in momentum that raised hopes the Federal Reserve could cut interest rates for the first time in June.

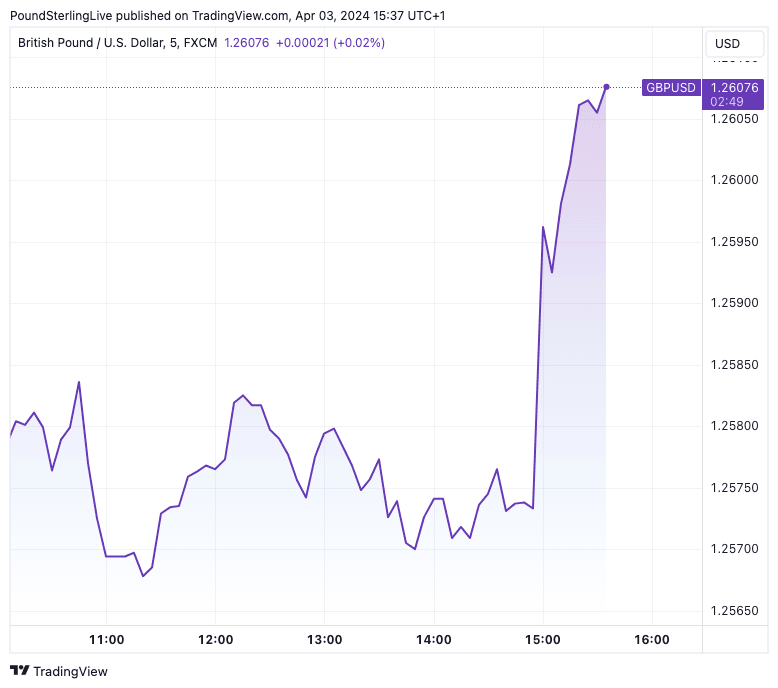

The Pound to Dollar exchange rate rallied a third of a per cent to 1.2606 in the minutes after ISM said its services PMI read at 51.4% in March, notably lower than the 52.6% printed in February and below expectations for an increase to 52.7%.

“The Dollar is softer following the services PMI release suggesting hopes for a June rate cut have risen again,” says Kevin Watts at forexbrokers.net. However, it was the Services Paid component – which provides a decent indicator of inflationary pressures in the sector – that raised eyebrows, falling from 58.6% to 53.4%.

This was a four-year low for this subindex.

Above: GBP/USD at five-minute intervals showing the post-PMI reaction. Track GBP/USD with your own custom rate alerts. Set Up Here

“The prices subindex has generally had a good leading relationship with core services inflation in the past and is now consistent with underlying services inflation dropping to around pre-COVID rates before long,” says Oliver Allen, Senior U.S. Economist at Pantheon Macroeconomics.

The Employment Index, meanwhile, contracted for the third time in four months, reading 48.5%, a 0.5-percentage point increase from the 48% recorded in February.

Allen says the overall message from the report is that services inflation is much more likely to drop back than reaccelerate from here.

These data are at odds with other recent surveys showing a pickup in activity; earlier in the day, the ADP payroll report showed a solid gain that pushed back expectations for a June Fed rate cut.

These findings from ISM reverse expectations once more, providing a little turbulence in the Dollar.

“While employment was virtually stable, the sharp fall in the prices paid component from its height in January supports our conviction that some softer inflation prints are on the way. This should provide the entry point that policymakers are looking for to initiate rate cuts this summer. We expect that the Fed will err on the side of caution at the April – and likely June – meetings, but the data continues to point towards two to three cuts this year,” says Kyle Chapman, Markets Analyst at Ballinger Group.

James Knightley, Chief International Economist at ING Bank, warns that the more timely ISM reports have become less useful at signalling trends in the official data.

“With both the manufacturing and the services ISM employment components coming in below 50 – indicating falling employment levels – this should in theory mean a soft payrolls print on Friday (the consensus is 213k), but the report has a mind of its own and doesn’t correlate with anything right now,” he says.

Knightley explains the relationship between the PMI surveys and the official data has broken down since the pandemic. “The ISMs are at levels historically consistent with the economy expanding at a rate below 1% year-on-year, not the 3%+ figure that official data tells us.”

This could limit any Dollar weakness as investors prefer to sit on their hands and await the conclusive details of the official releases.

Source link