Pound to Dollar Rebounds After Fed Put to Bed Rate Hike Speculation

Image © Federal Reserve

Dollar exchange rates fell after the Federal Reserve put to bed speculation that it might be opened to another interest rate hike.

The Pound to Dollar exchange rate rose to a high of 1.2550 after Federal Reserve Chair Jerome Powell stated that he expects inflation to fall over the course of the year and that a further rate hike is “unlikely”.

Ahead of this week’s Federal Reserve Open Market Committee (FOMC) decision, investors had raised expectations that the Fed’s next move could be a hike, with options markets showing this to be a 20% probability.

“I think it’s unlikely that the next policy rate move will be a hike. I’d say it’s unlikely,” Powell said, which erased these expectations and took some heat out of U.S. bond markets, as well as the Dollar.

Nevertheless, expect USD losses to be contained as the Fed still looks willing to maintain interest rates at 20-year highs for an extended period in response to a series of above-consensus inflation prints that reveal inflationary pressures were building again in early 2024.

“The pound has capitalised on the weaker US dollar following the Fed’s statement and presser yesterday. GBP/USD is trading back above $1.25, a whisker away from its 200-day moving average resistance level, which needs to be overcome for scope at further upside,” says George Vessey, Lead FX Strategist at Convera.

The base case market assumption heading into the FOMC was that the Fed would likely cut interest rates for the first time in December, and this expectation is relatively unchanged after midweek events, paring the excesses of post-Fed FX moves.

“The May FOMC meeting was mostly uneventful but dovish overall. While the Committee added a hawkish acknowledgement of the ‘lack of further progress’ on inflation so far this year to its statement, Chair Powell offered a dovish message in his press conference,” says David Mericle, an economist at Goldman Sachs.

Goldman Sachs leaves its forecast unchanged and expects two rate cuts this year, in July and November. Should this outcome be realised, a significant repricing in U.S. interest rates is in store, which can lead to more durable weakness in the Dollar.

But such a turn in events will require upcoming data to print on the soft side and verify Powell’s expectation that Q1’s inflation uptick is not the start of a renewed spike in price pressures.

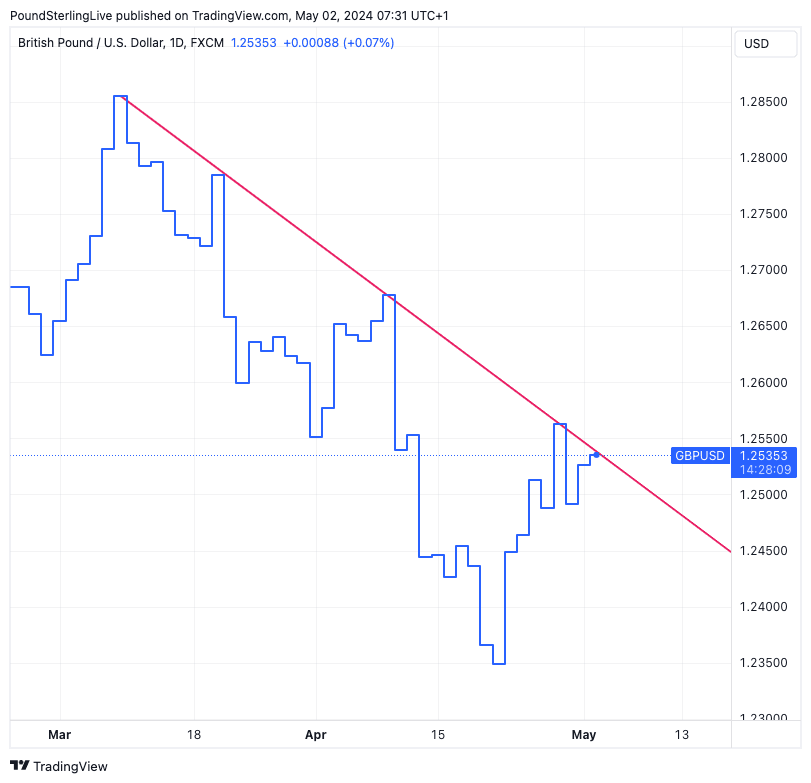

Despite the Dollar’s setback, it remains in a trend of appreciation against most G10 currencies. Regarding the Pound-Dollar exchange rate specifically, we can see the recent recovery brings it to the downtrend line that has been in place for much of this year:

Above: GBP/USD at daily intervals, showing the 2024 downtrend line. Track GBP/USD with your own custom rate alerts. Set Up Here

“It is quite possible that there could be more downside in cable if speculators build short positions, but the 1.22 level will likely be a near-term floor,” says Chester Notifor, a foreign exchange strategist at BCA Research.

Another failure at the downtrend line is possible, particularly if Friday’s U.S. job report prints stronger than expected, resulting in another leg lower in Pound-Dollar.

But a softer-than-expected job print could provide a first signal that the U.S. dinsinflation process is still underway, and more than one rate cut in 2024 becomes a probability once more.

This would lead to further USD weakness and allow Pound-Dollar to breach its downtrend, thereby turning the outlook more constructive.

Source link