Pound to New Zealand Dollar Week Ahead Forecast: Spectacularly Overbought

Image © Adobe Images

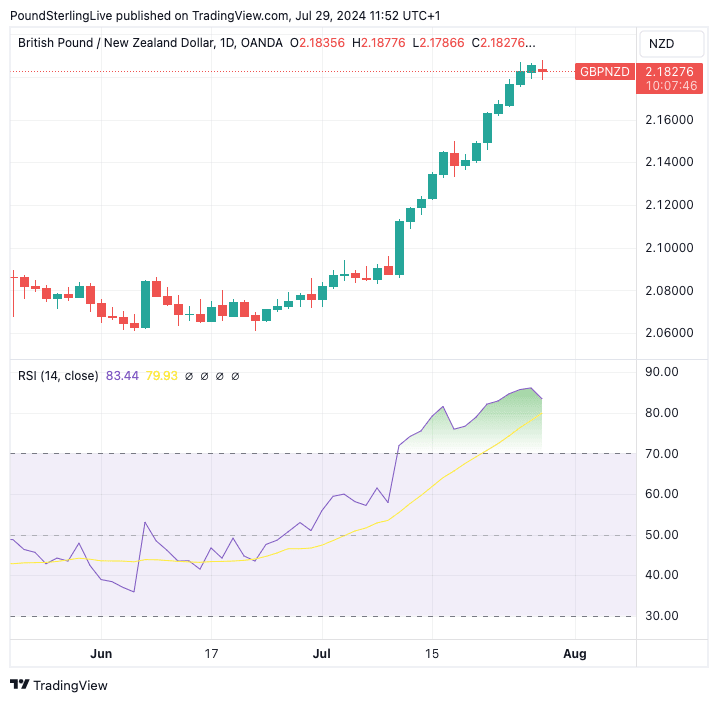

In our previous edition of the Week Ahead Forecast, we opined that the Pound to the New Zealand Dollar was due to a pullback from notably overbought conditions.

Yet, the exchange rate just kept rising and those overbought conditions became even more extreme.

Here we are at the start of another new week, and overbought conditions remain notable. In fact, we have rarely seen any exchange rate sit at such extremely overbought levels for this period of time.

So, we are seeing something relatively remarkable, but we are also chastened by last week’s example that overbought conditions can persist for days and even weeks.

Above: GBP/AUD at daily intervals with RSI in lower panel. Track GBP/NZD with your custom alerts; find out more here

The pair will ultimately pull back and consolidate at some point, and we are confident we can see this happening in the coming days.

That said, the GBP/NZD’s retreat to 2.1821 on Monday is hardly convincing (GBP/AUD is much lower, and we would like to see the NZ Dollar putting in some decent strength here alongside AUD).

The NZ Dollar is being weighed down by growing expectations of a potential interest rate cut at the Reserve Bank of New Zealand in August. The Kiwi economy is slowing, as we noted here last week, and the market appears to be gearing up for a generous cutting cycle.

This can keep NZD under pressure.

Also, recall that the NZD was identified as one of the big victims of the global FX carry unwind that is underway.

A surge in the Japanese Yen corresponds with the dumping of the NZD, AUD, and other currencies. “The carry unwind continues,” says Max Lin, an economist at CIBC Capital Markets: “The weakness in carry currencies (AUD, NZD, SEK, NOK), and strength in the funders (JPY, CHF) has been the theme.”

The carry trade sees investors borrow money where interest rates are low and invest where they are high.

Because Japan has the lowest base rates in the G10, it is considered an attractive “funder”. New Zealand has the highest base rate, so the returns of borrowing from Yen-based lenders and buying New Zealand Dollar-based assets are highly attractive.

This creates demand for the New Zealand Dollar. But when the trade reverses, the payback can be impressive. As we have noted, the NZD/JPY selloff has a mechanical impact on cross-currency pairs, such as GBP/NZD.

The Yen is surging as investors anticipate a potential rate rise at the Bank of Japan on Tuesday, which comes amidst talk of further currency intervention by the Bank. Demand for the Yen has also increased as investors bet on the prospect of interest rate cuts at the Federal Reserve, which lowers the attractiveness of the Yen as a funding currency.

Should the JPY retreat this week (which can happen if the Bank of Japan disappoints), the NZD can rebound. But should further JPY strength be seen, we might have to delay the GBP/NZD correction from overbought.

UK Rate Cut

The Pound is coming off the boil against a number of currencies as investors become increasingly wary that the Bank of England will cut interest rates on Thursday.

The odds of such a move have been rising over recent days, with economists saying the Bank could proceed with a cut by saying it can begin to start adjusting Bank Rate without risking stoking inflation.

Much will also depend on the tone of the guidance and the state of the new economic forecasts: anything that points to further rate cuts will likely weigh on the Pound.

That said, the Pound is 2024’s best-performing major currency and it is unlikely the Bank will deliver any kind of guidance that would terminally kill the rally.

The UK economy is growing, the labour market remains healthy and capable of generating inflation, meaning we are likely looking at a shallow interest rate cutting cycle.

If so, then the Pound can continue to benefit from one of the higher interest rates in the G10 world over the coming months.

Source link