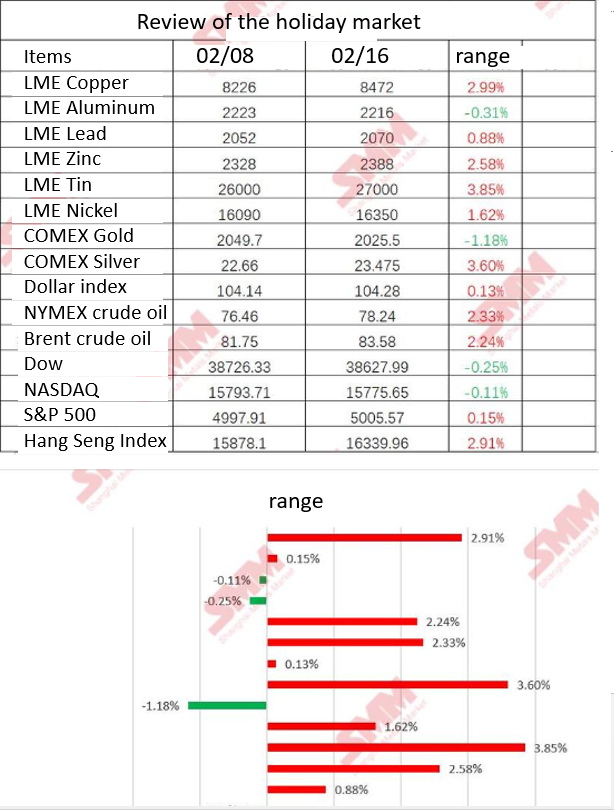

Spring Festival holiday market review and outlook: the US dollar and crude oil both rose, LME metals rose almost across the board, and Hong Kong stocks performed well

During the Spring Festival holiday, the LME metal on the outer disk “rose”. London Xi led the way with a 3.85% increase, London copper rose 2.99%, London zinc rose 2.58%, London nickel rose 1.62%, London lead rose 0.88%, and London aluminum fell 0.31%.

Precious metals: COMEX precious metals trend divergence during the Spring Festival holiday, among them, COMEX gold fell 1.18% to $2025.5 / ounce, it is worth noting that during the Spring Festival holiday, COMEX gold once fell below $2000 / ounce intraday, the lowest fell to $1996.4 / ounce; COMEX silver rose 3.6% to $23.475 an ounce

On the US dollar: The US dollar index rose slightly during the Spring Festival holiday, and as of the close of trading on February 16, the US dollar index had risen by 0.13% in six trading days. The release of higher-than-expected producer inflation data raised expectations that the Fed will not cut interest rates at least until the middle of this year, which in turn raised concerns about the shape of the US economy. The U.S. Department of Labor reported the largest increase in producer prices in five months in January, while the January consumer price increase on Tuesday was also higher than expected. But Thursday’s release of U.S. retail sales for January was the biggest drop in 10 months, and the November and December data were also revised downward, giving some in the market a breather as the report showed that consumer spending momentum was slowing. According to CME Group’s FedWatch tool, Fed funds futures expect just a 10.5% chance of a rate cut in March and a 33.7% chance of a rate cut in May. At the beginning of the year, the expectation was that there was a 79% probability of a rate cut in March. Fed’s Daly said that the median forecast for three rate cuts this year is reasonable, and that interest rates cannot be cut until inflation reaches 2%. The neutral rate is now estimated to be between 0.5 and 1, and the nominal rate is between 2.5 and 3. In terms of data: [Financial data is off to a good start! ] China’s increase in the scale of social financing and credit growth in January both exceeded market expectations and soared to record highs. Data released on February 9 showed that in January 2024, the scale of social financing increased by 6.5 trillion yuan, compared with 1.94 trillion yuan in December and 6 trillion yuan in the same period last year. RMB loans increased by 4.92 trillion yuan in January, an increase of 16.2 billion yuan year-on-year. At the end of January, the balance of broad money (M2) was 297.63 trillion yuan, up 8.7% year-on-year. The balance of narrow money (M1) was 69.42 trillion yuan, a year-on-year increase of 5.9%. The balance of money in circulation (M0) was 12.14 trillion yuan, a year-on-year increase of 5.9%. The net cash injection in the month was 795.4 billion yuan. RMB deposits increased by 5.48 trillion yuan in January, a year-on-year decrease of 1.39 trillion yuan.

【PBOC Regulatory Media: There is Still Downward Space for Loan Rates】

The China Financial Times reported that on February 18, the People’s Bank of China (PBOC) released information on its Medium-Term Lending Facility (MLF) operations for February. Combining signals previously released by the PBOC, market analysts believe that with consecutive excess MLF operations and reasonable liquidity in the banking system, the Loan Prime Rate (LPR) in the loan market may decrease in the coming days, with a greater possibility of a decrease in LPR for terms over 5 years. MLF has become an important tool for the PBOC to provide liquidity to the banking system, with excess operations conducted monthly for over a year, effectively providing liquidity support to financial institutions. China’s interest rate policy adheres to self-reliance, and will continue to guide the stable and downward trend of the overall social financing cost, further stimulating effective demand in the real economy, and consolidating and enhancing the positive trend of economic recovery.

The China Association of Small and Medium Enterprises released on February 14 that the China Small and Medium Enterprises Development Index for January was 89.2, an increase of 0.2 points from the previous month, higher than the same period in 2023. Both sub-indexes and sub-industry indexes showed more gains than losses. For more holiday news details, please click: “Spring Festival Holiday News Overview: Financial Data ‘Opens the Red Carpet’ “The ‘Hottest’ Spring Festival Draws to a Close! U.S. Inflation Rebounds, Japan’s GDP Overtaken by Germany Next Week’s Macro Aspects: Next week will see the release of China’s one-year and five-year loan market quoted interest rates for February, Canada’s January non-seasonally adjusted CPI annual rate, Canada’s January core CPI-common annual rate, Japan’s January commodity exports, the euro zone’s February preliminary consumer confidence index, France’s fourth-quarter GDP annual rate final value, France, Germany, the euro zone, the UK, and the U.S. February Markit manufacturing PMI preliminary values, the euro zone’s January core harmonized CPI annual rate-unadjusted final value, U.S. initial jobless claims for the week ending February 17, U.S. continued jobless claims for the week ending February 17, U.S. January existing home sales annualized total, Germany’s fourth-quarter seasonally adjusted GDP quarterly rate revised value, Germany’s February IFO business climate index, and other data. It is noteworthy that in 2024, FOMC voters and Atlanta Fed President Bostick will deliver welcoming remarks at an event; the Fed will release the minutes of its monetary policy meeting; the European Central Bank will release the minutes of its January monetary policy meeting; Fed Governor Jefferson will deliver a speech; Fed Governor Bowman will deliver a speech; Fed Governor Lisa Cook will deliver a speech; Fed Governor Waller will deliver a speech; and the National Bureau of Statistics will release the monthly report on residential sales prices in 71 large and medium-sized cities. February 19 is Presidents’ Day in the United States, and the New York Stock Exchange will be closed for one day, while trading in precious metals and U.S. crude oil futures contracts under the Chicago Mercantile Exchange will end at 03:30 Beijing time on February 20, and trading in stock index futures contracts will end at 02:00 Beijing time on February 20. Regarding crude oil: During the Spring Festival holiday, both crude oil futures rose more than fell for 6 trading days. As of the close on February 16, WTI crude oil rose by 2.33% and Brent crude oil rose by 2.24%. The tension in the Middle East geopolitical situation overshadowed the impact of the International Energy Agency’s (IEA) forecast of slowing demand, supporting oil prices. Giovanni Staunovo, an analyst at UBS Group, stated that the oil market’s response to Middle Eastern news has been mild. He said, “The market believes that oil is still flowing, and the disruption is minimal.” Despite this, the significant increase in service costs in January caused U.S. producer prices to rise more than expected, which may exacerbate concerns about inflation. Nevertheless, the decline in retail sales has prompted hopes that the Fed will soon begin cutting interest rates, which may support oil demand. On Thursday, the International Energy Agency (IEA) said that global oil demand growth is losing momentum and lowered its forecast for global oil production in 2024. The IEA said on Thursday that global oil demand growth is losing momentum and lowered its forecast for growth in 2024. The agency expects global oil demand growth to slow to 1.22 million barrels per day in 2024, about half the increase last year, partly due to a sharp slowdown in Chinese consumption. The agency had previously forecast demand growth of 1.24 million barrels per day in 2024. The Organization of the Petroleum Exporting Countries (OPEC) expects oil consumption to continue to grow over the next two decades. Baker Hughes, an energy services company, said in its closely watched report on Friday that the number of active oil and gas drilling rigs in the United States decreased this week for the second time in three weeks. NYMEX New York crude oil March futures will complete their final trading session at 03:30 on February 21 due to the rollover. The final electronic trading session will end at 6:00 am. Please pay attention to the expiration and rollover announcements of trading venues to control risks. In addition, the expiration time of some trading platforms’ U.S. oil contracts is usually one day earlier than that of NYMEX official announcement, please pay more attention. Hong Kong stocks: During the Spring Festival holiday, the Hong Kong Stock Exchange was closed on February 12 and 13, and opened as usual at other times. During the Spring Festival period, Hong Kong stocks performed well, with the Hang Seng Index closing up 2.91% during the Spring Festival period as of the close on February 16. U.S. stocks: During the Spring Festival holiday, the U.S. stock market saw intraday records for the Dow Jones Industrial Average and the S&P 500, with the Nasdaq Composite Index breaking through record closing highs. The final trends of the three major U.S. stock indexes were mixed. As of the close on February 16, the Dow Jones Industrial Average fell 0.25% during the Spring Festival period, the Nasdaq Composite Index fell 0.11%, and the S&P 500 Index rose 0.15%. It is worth noting that on Friday (February 16, Eastern Time), as U.S. January PPI data exceeded expectations across the board, once again suppressing market expectations of a Fed rate cut, the three major indexes collectively fell, ending five consecutive weeks of gains. As of the close of the day, the Dow Jones Industrial Average fell 0.37% to 38,825.03 points; the S&P 500 Index fell 0.48% to 5,038.70 points; and the Nasdaq Composite Index fell 0.82% to 15,917.41 points.

For more information, please contact account manager: E-mail: lifan@smm.cn/ whatsapp: +86 13207180321

Source link