Still Pointed Higher Says City Index

Image © Adobe Images

The Pound to Dollar exchange rate’s recent setback has been shallow and the broader backdrop remains supportive, says Fawad Razaqzada, an analyst at City Index.

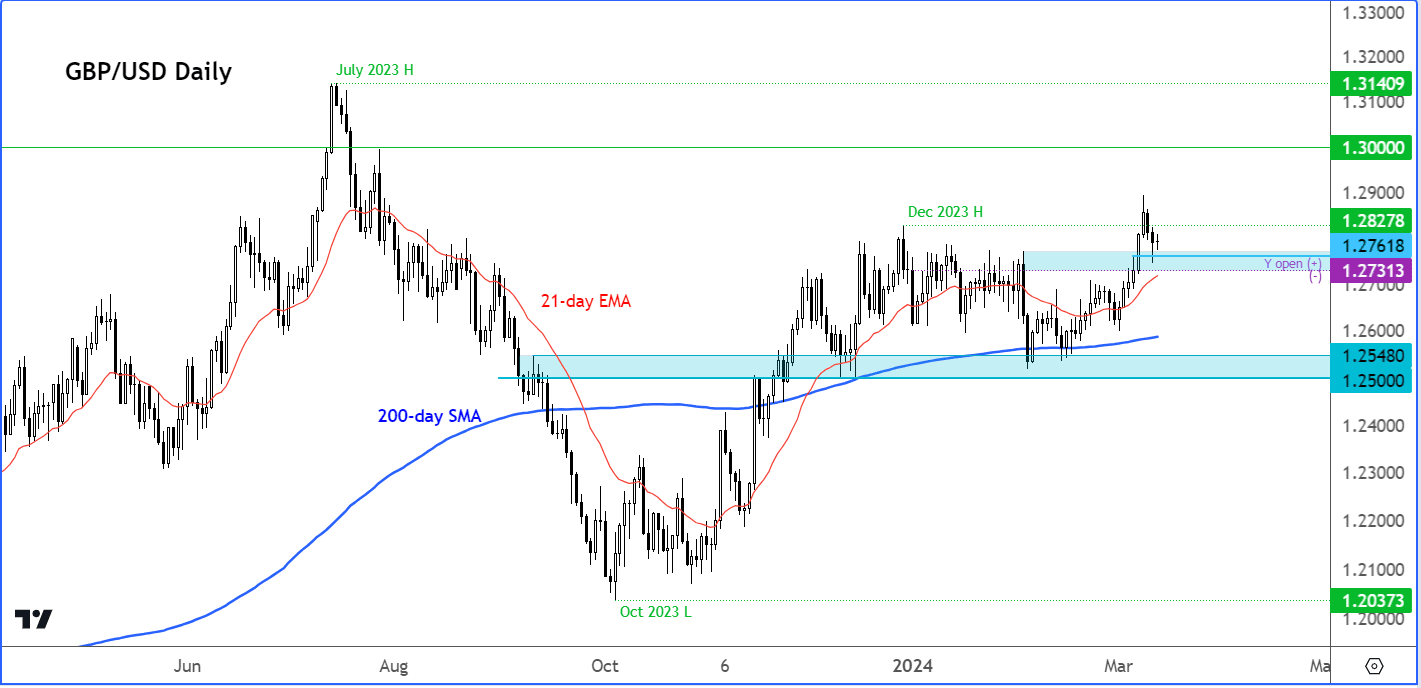

With Pound-Dollar making higher highs and higher lows of late, the path of least resistance is clearly to the upside, despite the weakness observed this week.

In this regard, the 1.2750/60 area is very important, given that this was the last resistance area before rates broke out last week.

If this 1.2750/60 support level fails, then 1.2700 could be the next downside target for the bears. However, the bulls will be looking to defend 1.2750/60 area and eye a daily close above 1.2800.

Image courtesy of City Index.

Should Pound-Dollar break through 1.2800, the levels to watch on the upside include 1.2828, the December high, followed by 1.2900 and 1.3000 round handles, and finally the July high of 1.3140.

The pound is gradually climbing back, buoyed by slightly positive news from the UK, where the economy grew in January, sparking optimism that the recession was brief.

In January, the UK’s GDP increased by 0.2%, meeting expectations and bouncing back from the previous month’s +0.1% decline.

Delving into the details, the construction (+1.1%) sector saw the biggest improvement, counterbalancing a decrease in industrial production (-0.2%). These figures indicate that the UK is poised for growth in the first quarter of 2024, marking the end of last year’s economic downturn.

Part of the reason Pound-Dollar has rebounded has to do with the US dollar.

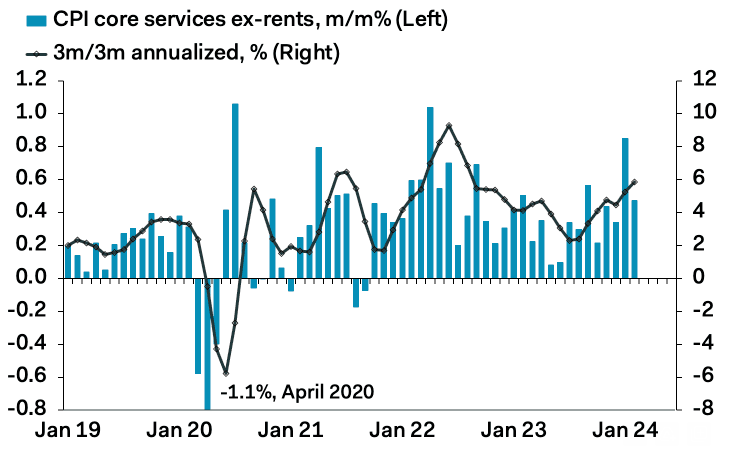

Federal Reserve Chair Jerome Powell’s sunny take on inflation is still music to traders’ ears, even though the core CPI nudged up by 0.4% in February, a smidge higher than expected. But the market’s reaction? Not quite as wild as before when faced with similar surprises in inflation.

Above: Core inflation in the U.S is heading in the wrong direction again. Image courtesy of Pantheon Macroeconomics.

Traders are still hanging onto Powell’s less than hawkish vibe, which has everyone thinking about potential rate cuts in June and keeping the market response in check.

In the rates futures market, there has only been a slight adjustment downwards since the week began, suggesting expectations of easing haven’t changed much despite the stronger inflation data.

Right now, traders are pencilling in 19 basis points for the June rate decision and 85 basis points by December.

Even though payrolls and inflation were a bit perkier than forecast, the market didn’t bat an eyelid much. It seems like the market’s feeling pretty steady, all thanks to Powell’s laid-back stance.

Unless there’s a big shake-up in risk-taking by the end of the week, the GBP/USD could make back some or all of its lost ground as we head towards the end of the week.

Looking ahead, we have more inflation data coming up with PPI on Thursday and UoM Inflation Expectations survey on Friday.

We also have retail sales coming up on Thursday, with headline sale seen rising 0.8% and core sales 0.5% month-over-month. Last month, both headline and core retail sales data disappointed expectations, and this contributed to the weakness we have seen in the dollar of late, with a few other macro pointers also pointing to a slowdown in economic activity.

If further evidence emerges of a struggling consumer, then we could see the dollar weaken. A very strong report is what the dollar bulls will be eying.

But CPI was the main data highlight this week and it didn’t disappoint those who were calling for a stronger print. However, the reaction was less than what the dollar bulls would have liked to see.

Source link