US Dollar Eases for Now but Key Support Test Still Likely: Pairs, Levels to Trade

The retreated for a second day in early European trade as risk appetite improved further. But it remained to be seen whether the weakness will last, given the ongoing bullish trend amid strong data and a hawkish Fed.

Following Tuesday’s hotter-than-expected data, the focus will turn to more data as we approach the latter half of the week, with , and among the data highlights in the next couple of days.

If this week’s upcoming data, especially retail sales, continue to showcase economic resilience in the US, it is likely to bolster the US dollar further.

Apart from profit-taking after solid post-CPI gains, one other factor that helped to weigh on the dollar over the past day and a half has been the improvement in risk appetite insofar as the global equity market is concerned.

This morning saw Germany’s index hit a fresh record high, despite cautious comments from ECB President Christine Lagarde, and mixed earnings.

Sentiment improved after US tech megacaps rebounded on Wednesday, following the CPI-related sell-off the day before. The speedy improvement in sentiment helped to lift some of the risk-sensitive commodity dollars against the greenback.

The recovered a tad after Lagarde said rising wages are increasingly becoming a pivotal consideration for policymakers as they evaluate the timing for initiating interest rate reductions.

Weak data in the UK kept the dollar’s losses in check, however.

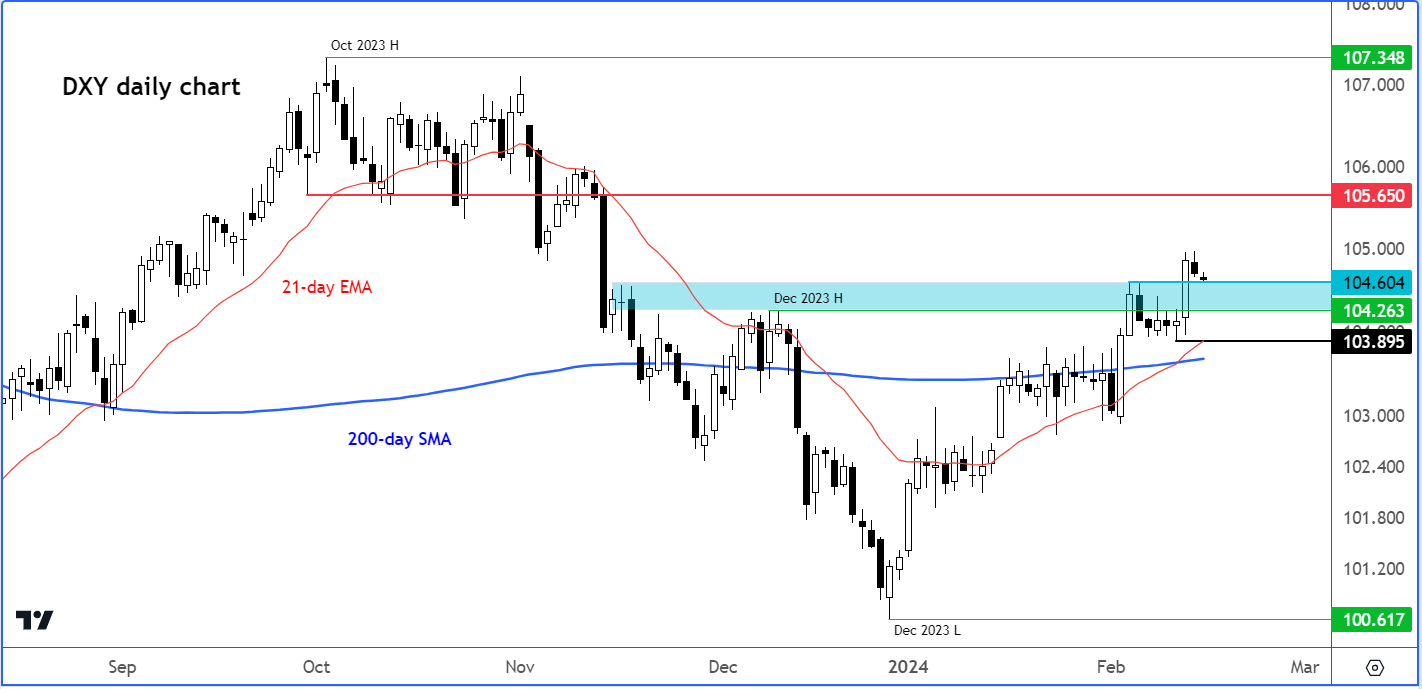

Dollar Index testing key support

Ahead of the above-mentioned data releases, the has now reached the top of a key support area between 104.26 to 104.60.

The upper end of this range was resistance from last week, while the lower end converges with the high from December.

The DXY will need to stay above this pivotal area to maintain its bullish bias. Failure to do so would be a bearish outlook, particularly when you consider how strong the inflation data was on Tuesday.

The line in the sand for me is at 103.90, the low of this week. Any move below that would invalidate the short-term bullish technical picture as it will create a lower low.

Assuming that the above support area will continue to hold, the Dollar Index may rise above 105.00 initially ahead of 105.65 next, with the latter being an old support area.

USD/JPY probing 150.00 – here’s how to trade it

Among the dollar pairs to watch is the , which is potentially setting up interesting trading opportunities, as it trades near the pivotal 150.00 mark.

The USD/JPY has had difficulty sustaining a breakout above the 150.00 handle in the past couple of years as you can see on the weekly chart:

But a cup-and-handle continuation formation here is pointing to an eventual breakout.

In the short term, support around the 150.00 to 149.50 area needs to hold. The lower end of this range was the point of origin of this week’s breakout, as you can see from the daily chart:

Tuesday’s large thrust candle suggests more gains could be on the way. A quick recovery is now needed, for if that doesn’t happen then it will raise the risk of price losing momentum.

The line in the sand for me now is at 149.21 in the short-term outlook. This level was the low from Tuesday. A potential move below that level could lead to a sharp sell-off as stops resting below get tripped.

But if my base case scenario plays out and we see more gains, a rise back above Wednesday’s low is what I would be eying first, at 150.35.

Thereafter, liquidity above this week’s high at 150.89 could be the next target for the bulls, ahead of a potential run on the double top high of 181.90-181.95 area, where the USD/JPY had peaked in the last two years.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it’s crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

Subscribe Now!

Don’t forget your free gift! Use coupon code OAPRO1 at checkout for a 10% discount on the Pro yearly plan, and OAPRO2 for an extra 10% discount on the bi-yearly plan.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Source link