US Dollar Wobbles as Markets Await Powell; Setups on EUR/USD, GBP/USD, USD/CAD

US DOLLAR OUTLOOK – EUR/USD, GBP/USD, USDCAD

- The US dollar (DXY) lacks directional conviction ahead of key events on the US calendar

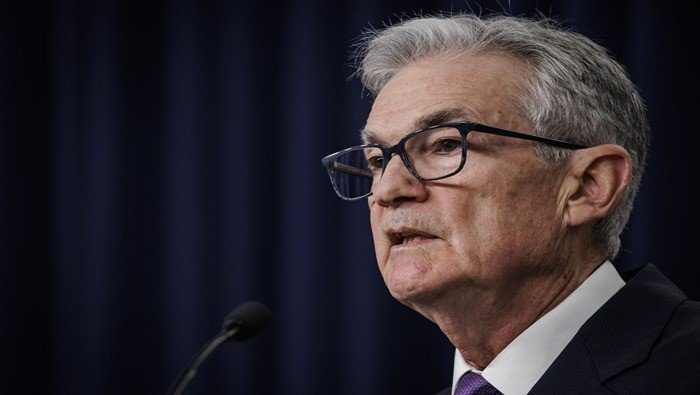

- Fed Chair Powell’s testimony before Congress later in the week will be a source of volatility to watch

- This article explores the technical outlook for EUR/USD, GBP/USD and USD/CAD

Most Read: USD/JPY Starts Week Strong; Tokyo Inflation, ISM Services, Powell & NFP in Focus

The U.S. dollar drifted aimlessly at the start of the new week, exhibiting a mixed performance against its major counterparts. Despite gains against some currencies, it softened against others, even with the support of rising U.S. Treasury rates. Typically, higher bond yields boost the greenback’s appeal, but today the relationship did not work quite well.

Traders were hesitant to take on much directional exposure, fearful of getting caught on the wrong side of the trade in light of a packed economic calendar that could bring increased market volatility. High-impact events pile up in the coming days, starting with Tuesday’s ISM services data, Powell’s appearance before Congress on Wednesday/Thursday and the highly anticipated U.S. NFP report on Friday.

Focusing on Powell’s testimony, the FOMC chief is likely to reiterate his message that there is little urgency to start easing, especially after recent CPI, PPI and PCE data showed stagnating progress on disinflation. If Powell surprises on the hawkish side and signals rate cuts are not coming until late in the year, yields are likely to push higher, creating a friendly environment for the U.S. dollar.

Transitioning our focus away from fundamentals, the next section of this article will concentrate on evaluating the technical outlook for three major FX pairs: EUR/USD, GBP/USD and USD/CAD. Our analysis will center on interpreting price action dynamics and identifying critical levels that could act as support or resistance in the upcoming trading sessions.

Curious about the euro’s near-term prospects? Explore all the insights available in our quarterly forecast. Request your complimentary guide today!

Recommended by Diego Colman

Get Your Free EUR Forecast

EUR/USD FORECAST – TECHNICAL ANALYSIS

EUR/USD edged higher on Monday, approaching its 50-day simple moving average at 1.0860. Bears must fiercely defend this level; failure to do so could spark a rally towards February’s high, just below the psychological 1.0900 mark. On further strength, all eyes will be on 1.0950.

Conversely, if sellers mount a counterattack and trigger a bearish reversal, initial support emerges at 1.0835, where trendline support and the 200-day SMA converge. A breach of this area could shift attention to 1.0800, followed by 1.0725.

EUR/USD PRICE ACTION CHART

EUR/USD Chart Created Using TradingView

Want to stay ahead of the pound’s next major move? Access our quarterly forecast for comprehensive insights. Request your complimentary guide now to stay informed on market trends!

Recommended by Diego Colman

Get Your Free GBP Forecast

GBP/USD FORECAST – TECHNICAL ANALYSIS

GBP/USD climbed on Monday, breaking above its 50-day simple moving average at 1.2675. If bulls maintain control of the market and push prices even higher in the coming days, trendline resistance is positioned at 1.2710. Further progress beyond this barrier will shine a light on 1.2830.

Alternatively, if sentiment shifts back towards the bears and cable turns downwards unexpectedly, support is located at 1.2675 and 1.2615 subsequently. A more significant decline beneath these levels might bring attention to the 200-day simple moving average around 1.2575.

GBP/USD PRICE ACTION CHART

GBP/USD Chart Created Using TradingView

Interested in understanding how FX retail positioning may influence USD/CAD price movements? Discover key insights in our sentiment guide. Download it now!

| Change in | Longs | Shorts | OI |

| Daily | 0% | 15% | 8% |

| Weekly | -15% | 31% | 7% |

USD/CAD FORECAST – TECHNICAL ANALYSIS

USD/CAD consolidated to the upside on Monday after bouncing off support at 1.3545 late last week. If gains pick up traction over the next few sessions, overhead resistance looms at 1.3620, the 61.8% Fib retracement of the November/December 2023 slump. Further up, attention turns towards 1.3700.

On the other hand, if prices take a turn to the downside, support stretches from 1.3545 to 1.3535. While this floor is expected to provide stability for the pair during a bearish assault, a breakdown could lead to a rapid descent toward the 200-day simple moving average at 1.3475.

USD/CAD PRICE ACTION CHART

Source link