US retail sales ease recession fears – United States

Written by Convera’s Market Insights team

Yields up, dollar up, on soft landing narrative

George Vessey – Lead FX Strategist

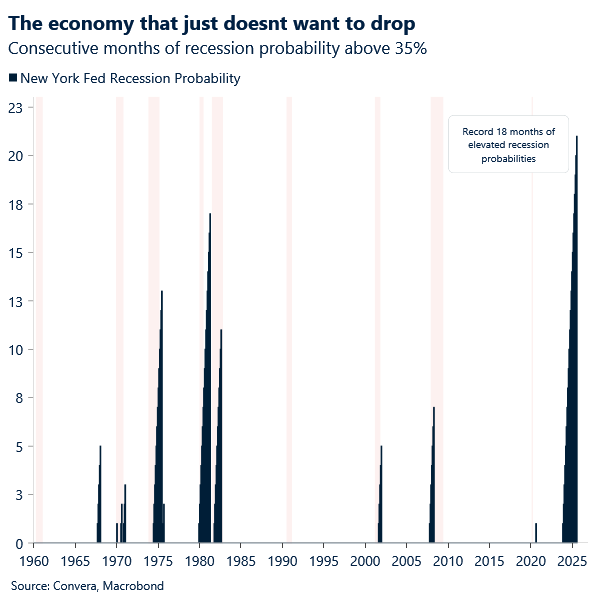

Stronger retail sales and jobless claims numbers signal the US soft landing is still intact, a positive catalyst for equities and broader investor sentiment. The renewed risk-on sentiment boosted US yields as rate cut bets for the Federal Reserve (Fed) were trimmed, in support for the US dollar.

As a whole, the current dynamic means the Fed is more likely to deliver a 25-basis point cut as opposed to 50-basis-point cut when it begins easing, likely in September. And while the prospect of fewer rate reductions had in the past weighed on stocks, this time it’s being driven by the notion that recession risks may be overstated. The labour market is cooling slowly, defying expectations of a sharper slowdown with initial jobless claims coming in lower-than-expected at 227k. Meanwhile, consumer spending continues to drive the narrative of US exceptionalism, with retail sales beating expectations with a 1% gain in July, the strongest reading since January of 2023. After declines seen following this week’s lower PPI and cooler CPI data, two-year yields have spiked back above 4%, as the data not only dispelled growth risks but put inflation back on the table as import prices also rose more than forecast.

Swaps tied to the Fed’s September meeting date show traders trimming their bets for a cut, with about 31 basis points priced in. They’re also back to pricing in less than 100 basis points of Fed cuts in 2024. The Jackson Hole Economic Policy Symposium next week will provide more clues on the economic and monetary outlook, to further steer market trends.

Pound holds gains after UK retail data

George Vessey – Lead FX Strategist

Rate differentials had indicated that sterling was overvalued against the euro, hence GBP/EUR’s adjustment to a more balanced level around €1.16-€1.17 from over 2-year highs above €1.19. The correction lower has seen the pair fall for five weeks, its worst stretch since Q3 2022. Further fuelling the decline was the softer-than-expected UK services inflation print, boosting BoE easing bets and dragging the UK-German 2-year yield spread to its lowest in over a year.

The 200-week moving average looks like a strong support at €1.1609 though, and whilst the 200-day MA was proving a tough short-term resistance barrier at €1.1692, the pair reclaimed €1.17 yesterday thanks to EUR/USD dropping back under $1.10. Despite sterling’s struggles in August, the 1-year UK-US rate differential suggests GBP/USD’s circa 3% drop since mid-July may have been overdone though. Indeed, downward momentum slowed near the 100- and 200-day MAs, allowing cable to snap a 4-week losing streak and rebound over 1.5% from last week’s lows, back above its 5-year average of $1.28. The pair is flirting with the 200-week MA resistance obstacle, but a convincing close above it could support further gains in the short-term. Stable equity markets and a sustained global easing bias should remain supportive for the pro-cyclical currency, particularly against its safe haven peers. But sterling needs a new positive catalyst to strengthen its upward trajectory from the first half of 2024.

On macro front, the July retail sales rose 0.5% month-over-month, in line with market expectations. Sales at non-food stores increased by 1.4%, particularly in department stores and sports equipment stores, attributed to summer discounting and sporting events. Excluding fuel, retail sales rose 0.7%, which was stronger than the 0.6% rate economists had expected. The proportion of sales made online also edged up to 27.8% from 27.4% the month before.

Euro tumbles as US defies expectations

Ruta Prieskienyte – Lead FX Strategist

European stocks rallied and bonds sold off as further encouraging data from the US eased investors’ concerns about a rapidly deteriorating US economic outlook. The STOXX 50 is up nearly 1.6% week-to-date and has recovered close to 90% of the losses incurred in August. The two-year German bond yield rose to a two-week high of 2.45%, following the upward movement in US Treasury yields. The front-end spread widened to 165 basis points but remains structurally narrower compared to pre-NFP prints at the end of July. Nevertheless, the move sent EUR/USD to a session low of $1.095 before the pair recouped some of the losses.

No macroeconomic reports were released today in the Eurozone, but there was still plenty of excitement as the Norges Bank held its monetary policy meeting. The committee decided to keep its key policy rate steady at a sixteen-year high of 4.5% for the fifth consecutive meeting. The Bank warned that the interest rate would likely remain at the current level for some time, as policymakers are concerned about a weaker krone and its potential implications for inflation. On the other hand, overly tight monetary policy could restrain the economy more than necessary, which is already showing signs of slowing, with unemployment edging higher. Given the largely unsurprising outcome of the monetary policy meeting, EUR/NOK closed only 0.05% lower on the day.

The prospect of the US economy and interest rates converging toward lower levels similar to the rest of the world, along with restored risk-on sentiment, is proving supportive for EUR/USD. The pair continues to be driven almost exclusively by US macroeconomic data and Fed rate cut expectations, as investors continue to shrug off mounting evidence of greater risks to the Eurozone outlook. Regarding the Fed, yesterday’s partial pricing out of near-term Fed easing expectations was welcome news given the pricing appeared to be stretched. With 90bps still baked into the OIS curve, there appears to be more room for further scaling back of expectations. However, it is unclear if we will reach that point this week, given the lack of market-moving data on today’s agenda. Next week’s Jackson Hole symposium, which has historically been a hawkish event for the dollar, may be the next catalyst.

JPY extends losses as US beats expectations

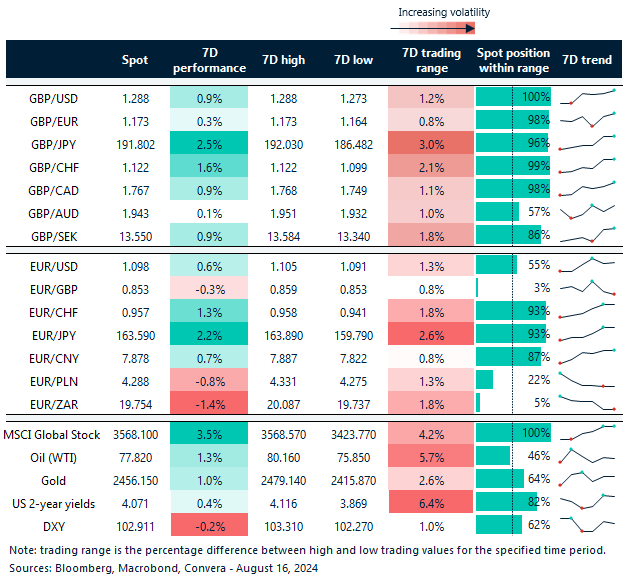

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: August 12-16

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Source link