USD recovers from one-year lows after Fed shock – United States

Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

Greenback rebounds

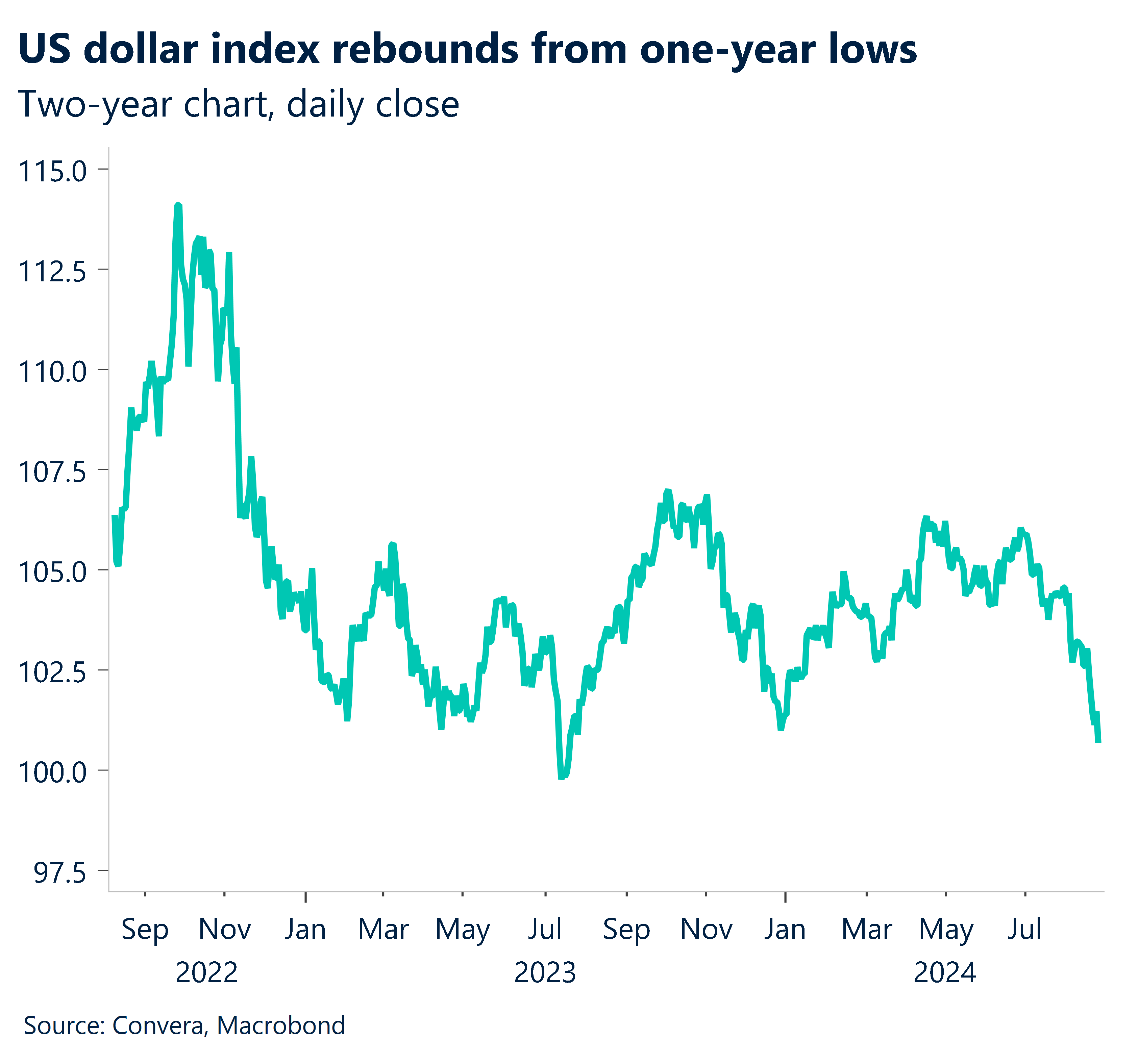

The US dollar was higher on Monday as it recovered from Friday’s major selldown that saw the USD index hit one-year lows.

On Friday, Federal Reserve chair Jerome Powell used his keenly-watch Jackson Hole speech to say a Fed rate cut was likely in September. The talk sent US bond yields and the greenback sharply lower.

On Monday, however, markets recovered, with the USD inching higher from the lows.

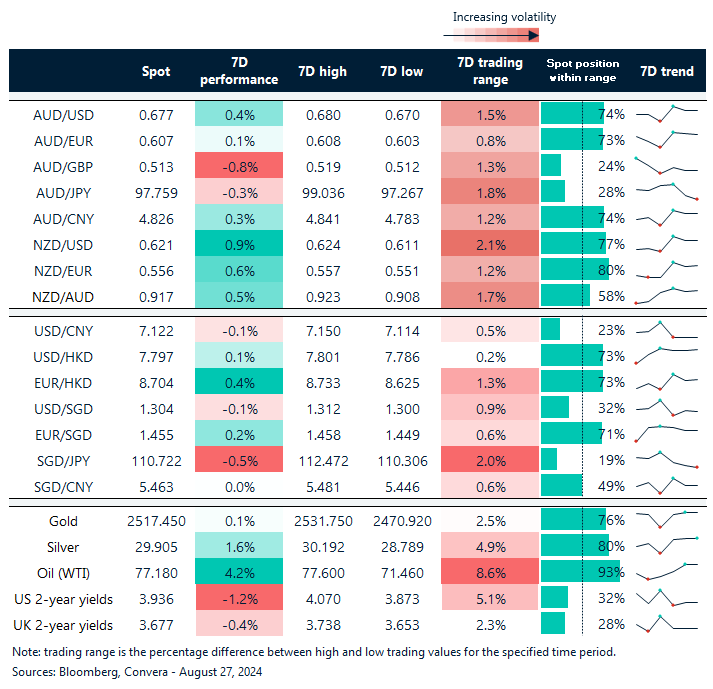

Most key FX markets reversed. The AUD/USD fell 0.3% from seven-month highs while the NZD/USD dropped 0.4%, also falling from seven-month highs.

The USD/SGD gained 0.3%, climbing from ten-year lows, while the USD/CNH was broadly steady.

Consumer confidence eyed amid USD consolidation

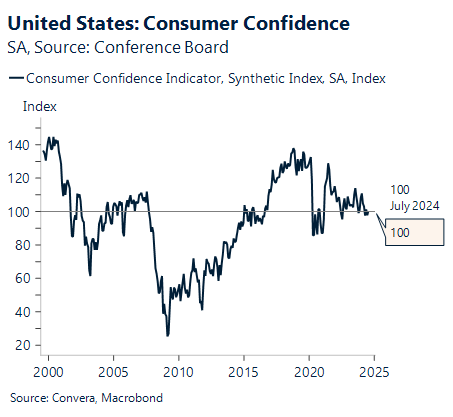

The US dollar’s next test is tonight’s US consumer confidence numbers.

In August, consumer confidence probably rose by 1.7 points to 102.0. Preliminary University of Michigan consumer sentiment increased throughout the month. August saw a decrease in gasoline prices as equities prices recovered from their early losses.

From a tactical perspective, after such significant rate fluctuations, the USD usually consolidates, with the potential for a USD recovery from here.

UK retail outlook in focus as GBP flags

The British pound has been an outperformer over the last month with markets seeing less chance of rate cuts from the Bank of England compared with the European Central Bank or Federal Reserve.

The next key release is the BRC shop price index. In August, prices have consistently increased by % month-over-month, as per this non-seasonally adjusted poll. Prices increased by 0.4% m-o-m (headline) and 0.5% m-o-m (non-food) on average between 2015 and 2019.

In August of this year, such increases would imply that the non-food inflation rate would stay at -0.9% y-o-y and the annual headline rate would drop to 0.1% y-o-y.

The resistance levels in the range of 1.3143–1.3174 have been breached by the GPB/USD’s rise, but the market may stall here and maybe reverse, with the daily price action and momentum indicators like the relative strength index signaling a shift in momentum.

Greenback recovers from one-year lows

Table: seven-day rolling currency trends and trading ranges

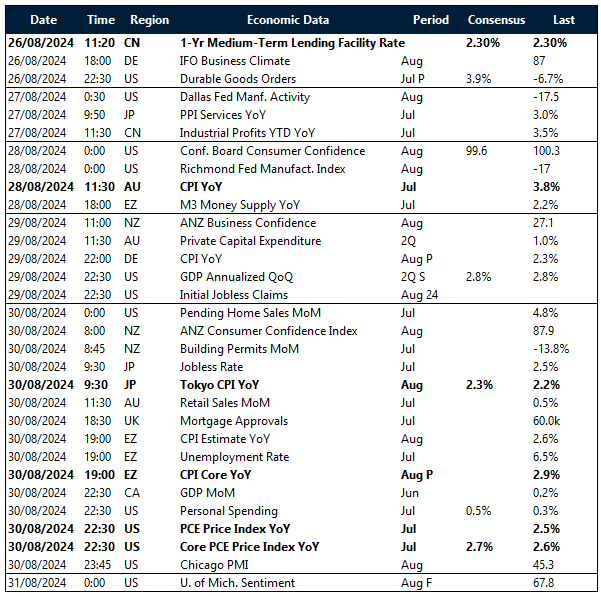

Key global risk events

Calendar: 26 – 31 August

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]

Source link