When Is The Best Time To Buy JPY From GBP?

The pound-to-Japanese Yen forecast is an indication of where technical and fundamental analysts think the GBPJPY price may be in the future. You can use these exchange rate forecasts to help you decide if now is the right time to buy Japanese Yen, or if you should wait until the price improves further.

Highlights

- Bank of Japan struggles to overturn Japanese Yen’s persistent weakness

- GBPJPY testing psychological 200; an upside breakout (GBP stronger) looms

- Use GBP strength to buy more Yen

How has the Pound performed against the Japanese Yen recently?

The Japanese Yen has been stuck in a negative trend for the past few years.

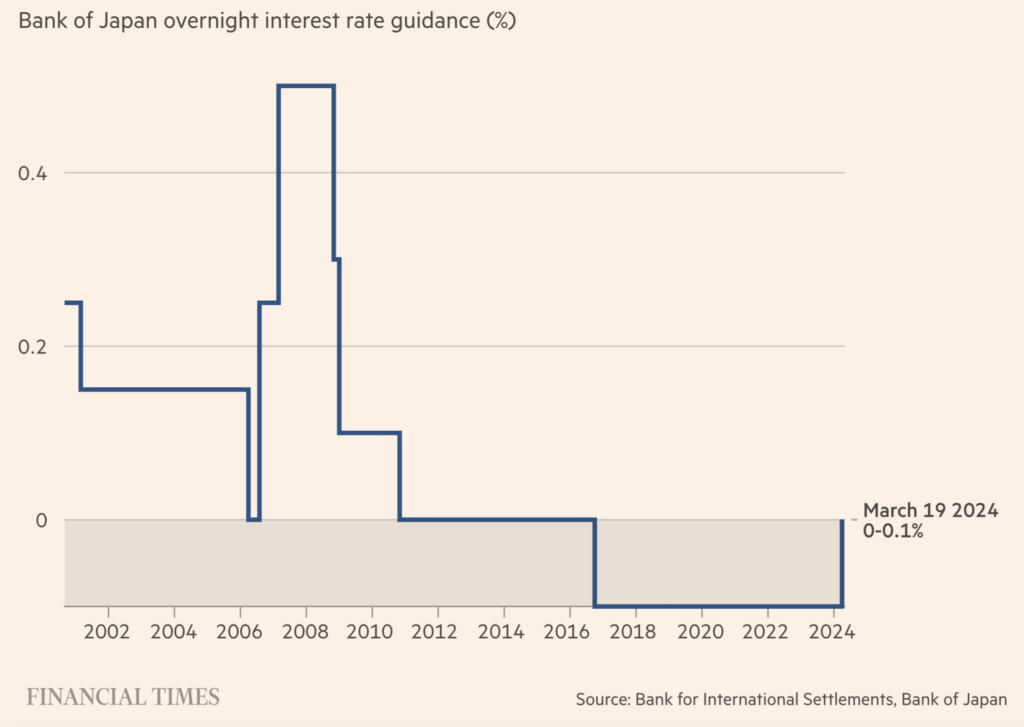

One main reason the Bank of Japan’s negative interest rate policy persistently pulls JPY’s value down is that it was only in March this year that the Japanese central bank overturned its extremely accommodative monetary policy. Inflation, not deflation, was BoJ’s ultimate objective. But even this simple objective is hard to attain.

In 2022, for example, tight international crude supplies and soaring natural gas prices sent the Japanese inflation rate to a 40-year high. The peak inflation rate? Just 4.3 percent. And as soon as energy prices came down from the peak, inflation promptly dropped below 3 percent again. That’s how difficult it is to engineer sustained inflation in Japan. Until the inflation objective is reached, the BoJ simply refuses to tighten.

Source: Financial Times (paywall)

In contrast, the Bank of England hiked the Base Rate multiple times in 2022 and 2023. Currently, the UK Base Rate is at 5.25 percent. In contrast, the Japanese policy is zero. And in the past 25 years, the highest Japanese policy rate was a meagre 0.5 percent. More importantly, the BoJ is still buying Japanese government bonds (JGBs) at the tune of $38 billion per month (6 trillion yen). That’s QE.

This monetary policy divergence is promptly reflected in the GBPJPY exchange rate. From 140 at the start of 2021, the rate gained sixty points to reach the 200 milestone. This level surpasses the 2015/6 peak (see below). With no resistance above until the 2008 peak, the path is clear for a further rally, albeit with overbought momentum.

Is it a good time to buy Japanese Yen in pounds?

Sterling has been strengthening against the Japanese Yen for some time.

Based on this ongoing long-term trend, it is perhaps not out of the norm to predict further gains for GBP.

Therefore, I would not buy all my Yen in one transaction. Perhaps a better strategy is to buy some on further JPY weakness and when the rate touches major round number levels, like 210, 220 etc.

Of course, while the outlook is negative on JPY, Yen bulls will highlight that the FX rate’s rally is near-term overbought and due for a correction. True, although a fall below 190 is needed to signal that the multi-year uptrend has paused for now.

Will the pound get stronger against the JPY in the second half of 2024?

The Japanese Yen has weakened dramatically over the past 2-3 years. But is this trend set to continue?

If we take a 6-month view on the rate, there are a few factors worth watching. The first is that UK monetary policy may no longer be as restrictive as before. One or two rate cuts may be in the pipeline given other G7 central banks have started the easing process. This may narrow the monetary divergence between the two countries.

The second factor is that the Japanese monetary policy may no longer be that loose. No doubt, the BoJ wishes to foster a higher-inflation environment, but this stance comes at an increasing cost. In particular, the propensity for the JPY to weaken has started to unease some policymakers. The downtrend for JPY is becoming too frantic and violent.

In May, for example, the Japanese central bank acted to limit the downside. Specifically, as soon as USDJPY hit 160 – the highest level in decades – the bank bought up to $60 billion worth JPY in a matter of days to prevent a ‘one-way’ bet on the Yen.

Against this backdrop, it is possible that GBPJPY may still weaken, although the outlook is not as clear as before.

But the bottom line is this: until the BoJ starts to become more hawkish, traders generally assume the JPY will only weaken in the months ahead despite the multiple currency intervention.

What is the GBPJPY forecast in weeks, months, and years?

In light of the above-mentioned economic trends, the market consensus is that GBPJPY will stay where it is now for the time being.

A pullback is envisaged given GBPJPY’s overbought momentum. Many expect the rate to return near 190 in the next few weeks (see below).

However, these are just expectations, which can change quickly given a new set of economic data. Therefore GBPJPY may range in between 200-190 for the time being.

Source: fxstreet.com (June 2024)

Source link