A Mixed Financial Performance with …

-

Revenue: Reported Q1 revenue of $9,958 million, falling short of estimates of $10,230.83 million.

-

Net Loss: Q1 net loss stood at $966 million, an improvement from the previous year but higher than the estimated net loss of $631.37 million.

-

Earnings Per Share: Recorded a loss per share of $0.40, compared to an estimated loss per share of $0.24.

-

Free Cash Flow: Demonstrated a significant improvement with free cash flow of $390 million, compared to a negative $930 million in the prior year quarter.

-

Debt Repayment: Successfully repaid $1.1 billion of debt during Q1, contributing to a robust balance sheet with $3.4 billion cash on hand.

-

Global DTC Subscribers: Grew to 99.6 million, an increase of 2.0 million subscribers from the previous quarter, with a 4% ex-FX increase in ARPU to $7.83.

-

Major Releases: Highlighted by the success of ‘Dune: Part Two’, which grossed over $700 million globally, becoming the highest-grossing movie of 2024 to date.

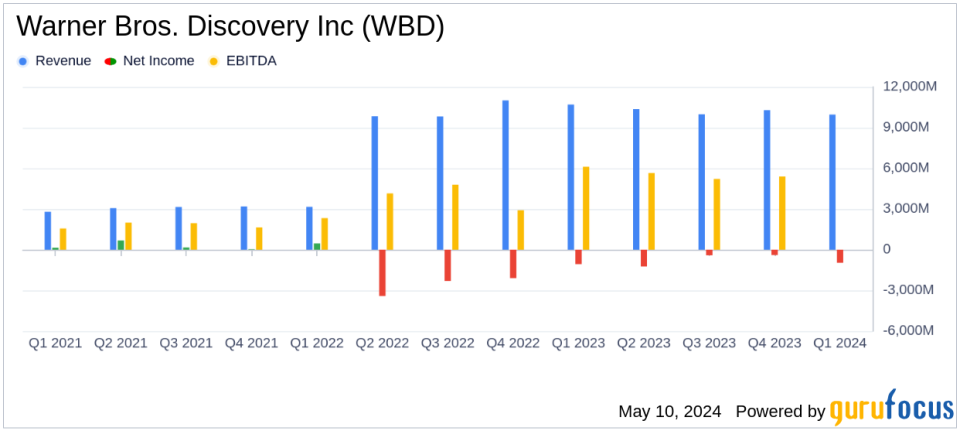

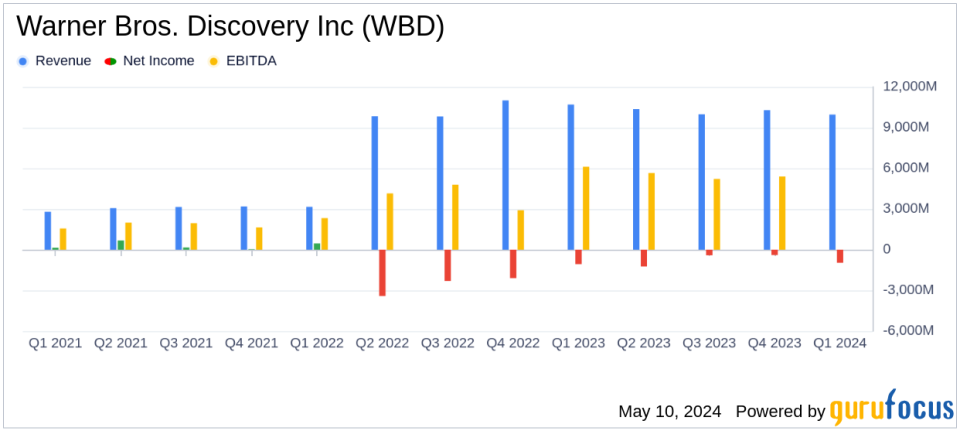

On May 9, 2024, Warner Bros. Discovery Inc (NASDAQ:WBD) disclosed its first-quarter financial results through an 8-K filing. The company, a global leader in media and entertainment formed through the merger of WarnerMedia and Discovery Communications, reported a mixed financial performance with total revenues of $9,958 million, a 7% decrease compared to the previous year. This result was below the estimated revenue of $10,230.83 million.

Financial Highlights and Challenges

The net loss for the quarter stood at $966 million, an improvement from a net loss of $1,069 million in the prior year. This loss includes significant pre-tax acquisition-related amortization and restructuring expenses totaling $1,879 million. Despite these challenges, Warner Bros. Discovery has shown resilience by repaying $1.1 billion of debt and ending the quarter with $3.4 billion in cash on hand.

Segment Performance

The Studios segment faced a 13% revenue decline, primarily due to lower games revenue and TV production delays. However, theatrical revenues saw a significant boost, driven by the success of ‘Dune: Part Two’ and ‘Godzilla x Kong: The New Empire’, which collectively grossed over $1.2 billion globally. The Networks segment also experienced an 8% revenue decline, affected by the exit from the AT&T SportsNet business and a challenging advertising market.

Direct-to-Consumer Growth

Warner Bros. Discovery reported a growth in global Direct-to-Consumer (DTC) subscribers, reaching 99.6 million, a 2 million increase from the previous quarter. The DTC segment’s revenue saw modest growth, with significant contributions from increased advertising revenue, which surged by 70% due to higher engagement on Max.

Strategic Moves and Future Outlook

The company’s CEO, David Zaslav, highlighted the strategic progress, including the successful launch and migration of subscribers to the new Max platform in Latin America and the planned expansion into 29 European countries. Zaslav also noted the strong content lineup scheduled for the coming year and emphasized the importance of strong free cash flow, which saw a significant improvement to $390 million from a negative $930 million in the prior year.

Analysis of Financial Health

Warner Bros. Discovery’s efforts to streamline operations and reduce debt are evident in its financial activities, including the significant repayment of debt and the management of operating expenses. The increase in cash provided by operating activities to $585 million from a negative $631 million in the previous year quarter demonstrates a disciplined approach to content investment and production timing.

Conclusion

While Warner Bros. Discovery faces ongoing challenges such as revenue declines in key segments and a complex post-merger integration landscape, the strategic initiatives underway and the resilience in improving operational efficiencies paint a cautiously optimistic future. Investors and stakeholders will be watching closely as the company continues to navigate its transformational journey in the dynamic media landscape.

Explore the complete 8-K earnings release (here) from Warner Bros. Discovery Inc for further details.

This article first appeared on GuruFocus.

Source link