Digitalisation opportunities to hasten internationalisation of rupee | Finance News

The report noted that though the US dollar remains the dominant currency for international payment transactions

)

Manojit Saha Mumbai

Digitalisation, which is set to break the iron laws of cross-border trade by enabling its emergence as a preferred currency for cross-border payments, presents opportunities for hastening the internationalisation of the rupee, the Reserve Bank of India’s currency and finance report for 2023-24 said.

The report, the theme of which is ‘India’s Digital Revolution’, said there is enormous potential to leverage India’s Digital Public Infrastructure (DPI) in an open economy setting to expand and diversify digital merchandise and services trade, promote cost-effective remittances, and increase foreign direct investment (FDI) into digital sectors.

“The internationalisation of the INR is benefitting from the comprehensive and integrated approach and would impart vibrancy to India’s external sector,” it said.

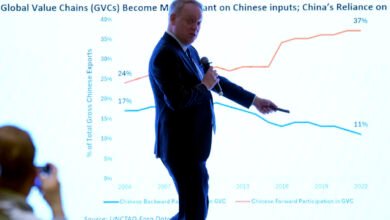

The report noted that though the US dollar remains the dominant currency for international payment transactions, there has been a fall in its share in total allocated reserves from around 71 per cent in 2000 to around 58 per cent in 2023.

Citing the International Monetary Fund, the report said the Indian rupee, alongside the Brazilian real, the Chinese renminbi, the Russian ruble, and the South African rand, has gained significant regional importance and has also shown a marked increase in their usage in international transactions, thus exhibiting their potential to internationalise, while highlighting that full capital account convertibility may not be a necessary prerequisite for internationalisation.

The report said anecdotal evidence suggests that the rupee is accepted in Bhutan, Nepal, Singapore, Malaysia, Indonesia, Hong Kong, Sri Lanka, the UAE, Kuwait, Oman, Qatar, and the UK, among others.

The report mentions several facilitative environments – inclusion of Indian bonds in global indices, settlement of rupee derivatives in foreign currency in GIFT city – and said with such facilitative environments in place, there are multiple ways for internationalisation of the INR as a currency for cross-border payments.

“Going forward, the goal is to globalise the UPI such that every other country will have some fast payment system (FPS), either its own or the UPI,” it said.

The report also said initiatives such as interlinkage of fast payment systems (FPSs) across economies and central bank digital currencies (CBDCs) are expected to support seamless international transactions, reduce foreign exchange risks, and effectively manage global liquidity.

“There exists immense potential in building cross-border interoperable fast payment systems and CBDCs to leverage open economy digitalisation,” it said.

The report said India’s state-of-the-art DPI has enormous potential for enhancing cross-border trade across sectors like finance, health, education, agriculture, and MSMEs, while adding that, to fully harness the potential of India’s DPI, there is a need to leverage the framework of One Future Alliance, wherein emerging market economies can share their best practices to hasten the process of digitalisation, and gain from its benefits.

Source link